URD 2023

-

-

Presentation of the Group

-

1.1History

OVHcloud’s position as the leading European cloud provider traces its roots to its founding in 1999 as an internet hosting company in France. Over the past 20 years, OVHcloud has expanded significantly, initially by developing its infrastructure and growing its presence within Europe, and then by diversifying its cloud offerings and expanding its operations globally.

Key developments

1999

OVH was founded by Octave Klaba as one of Europe’s first internet hosting companies.

2000

First top-level .fr and .be domain accreditations.

2002

OVH begins manufacturing its own servers.

2003

First use of proprietary water-cooling technology for servers.

2004

Initial geographical expansion into Poland and Spain.

2005

Opening of first datacenter, in Roubaix, France.

2006

Opening of a datacenter in Germany. Deployment of proprietary fibre optic network.

2008

Expansion of offering to include telecommunications and internet access. Expansion into Italy, Portugal and the United Kingdom. Additional datacenter opened in Roubaix, France.

2009

Continued expansion in Europe, including the Netherlands, Ireland, Finland, Lithuania and the Czech Republic. OVH launches 10 Gbps Bare Metal servers.

2010

Expansion into cloud services. Opening of third datacenter in Roubaix, France.

2011

OVH becomes Europe’s No. 1 web hosting service. Fourth datacenter opened in Roubaix, France. Launch of Public Cloud offering.

2012-2015

Expansion outside of Europe, including in the United States and Canada. Opening of three new datacenters in France and one in Beauharnois, Canada.

2014

Launch of OpenStack Project for Public Cloud and vRack (a private network on dedicated servers).

2016

Additional datacenters in Roubaix, France and Beauharnois, Canada. OVH raises €250 million in capital when KKR and TowerBrook Capital Partners become shareholders.

2017

Acquisition of vCloudAir, VMware’s former cloud offering. From 2017-2020, continued geographical expansion with the opening of datacenters in the United States, the United Kingdom, Germany, Poland, Singapore, Australia, France and Canada.

2018

“OVHcloud” is adopted as the Group’s new name, emphasising its positioning as a cloud service provider. Michel Paulin is appointed Chief Executive Officer. Opening of office in India. Launch of Gscan (monitoring and alerting at scale).

2019

OVHcloud introduces Kubernetes technology into its Public Cloud solutions as well as a range of high-performance processing units. It expands its partnerships internationally. OVHcloud receives its Hébergeur de Données de Santé (HDS) health data hosting security certification.

2020

Acquisition of OpenIO and Exten. OVHcloud becomes a founding member of the GAIA-X initiative.

2021

OVHcloud continues to expand its partnerships, announcing collaborations with IBM and Atempo, Atos, Orange Business Services, Capgemini, mongoDB and Thales. OVHcloud receives its SecNumCloud security certification.

On 15 October 2021, OVHcloud is listed in compartment A of the Euronext Paris regulated market to finance its growth strategy, including the financing of its geographical expansion, the construction of datacenters, the development of new products and, where applicable, external growth transactions.

2022

Acquisition of ForePaaS. OVHcloud reaches more than 80 available IaaS and PaaS solutions.

2023

Opening of new datacenters in France and India. S&P Global ratings awards OVHcloud a score of 71/100, reflecting the Group's commitment to leading the data revolution for a responsible future. OVHcloud strengthens its range of PaaS solutions, in particular for artificial intelligence.

-

1.2The cloud computing market

1.2.1Cloud computing

Cloud computing means providing users with storage, computing and network resources on demand. Cloud resources are located in datacenters that house servers and equipment used to process, store and transmit data. Users of cloud computing services can access stored data and instruct processing units to perform computing functions automatically, without the need for human interaction, minimising the computing and storage capacities needed on their devices (such as personal computers, tablets and mobile phones). Wherever they are located, as long as they have an internet connection, users are able to access IT services through the cloud.

Businesses can establish and operate their own datacenters using internal IT staff, or they can outsource some or all functions to cloud service providers such as OVHcloud. For many businesses, the time and financial investment required makes proprietary cloud computing less attractive than outsourcing, which means paying only for the resources they actually use. Additionally, it can be difficult for businesses that are not specialised in IT services to innovate at the requisite levels in order to ensure that their cloud infrastructure provides them with adequate services and protections, such as data security. Internal IT systems also might not be sufficiently scalable to meet peak-load demands (unless businesses maintain costly excess capacity).

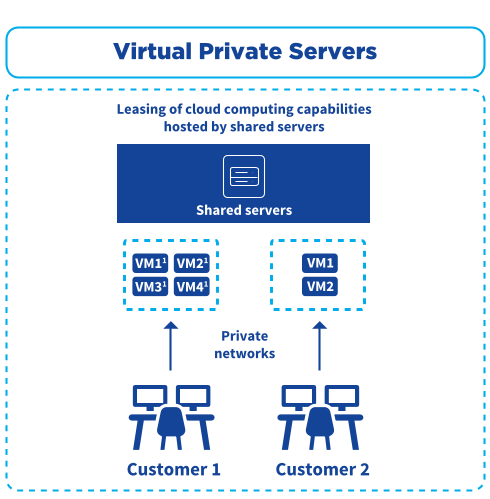

Servers maintained in datacenters can be used for multiple functions, each of which is accessed through a “virtual machine” created on the server. The virtual machines are operated and separated from one another through a software platform known as a “virtualisation stack.” Each virtual machine can have its own operating system that permits users to develop and run applications. Through a function known as a “hypervisor,” the server’s capacity is allocated to the virtual machines in accordance with the demands of users. More recently, software applications have been written to be bundled in “containers” that run directly on the operating system of the server itself, coordinated through platforms known as “orchestration” systems, which generally take up less space and can provide better performance than hypervisor-based virtualisation stacks.

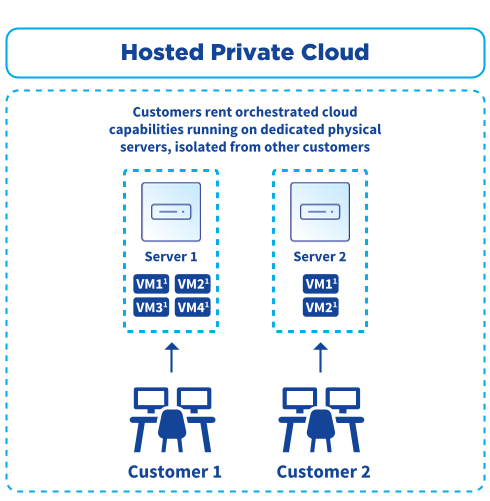

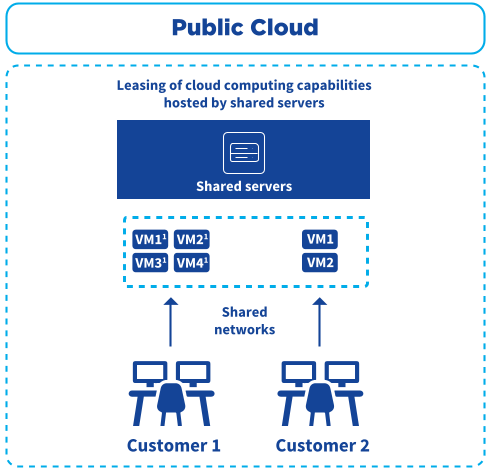

The ability to create multiple virtual machines in each server or to deploy container-based systems allows a cloud service provider to allocate its capacity among multiple user groups or customers in a secure manner. Service providers can dedicate a server to a single customer (a “Private Cloud” system), allocating the server’s capacity among user groups authorised by the customer. Alternatively, a server can be shared among multiple customers (a “Public Cloud” system). Private Cloud customers generally pay monthly charges for dedicated capacity, whether or not they use that capacity. Public Cloud customers generally pay for the capacity they actually use.

In order to optimise the cost of cloud services, many businesses are deploying “hybrid cloud” strategies, in which they combine on-premises or outsourced Private Cloud capacity for their most sensitive functions and data, with Public Cloud capacity for their less sensitive needs. Customers are also deploying “multi-cloud” strategies, purchasing cloud services from several providers. To meet the growing demand for hybrid cloud and multi-cloud services, a cloud provider must offer packages that allow the various solutions to function as an integrated whole.

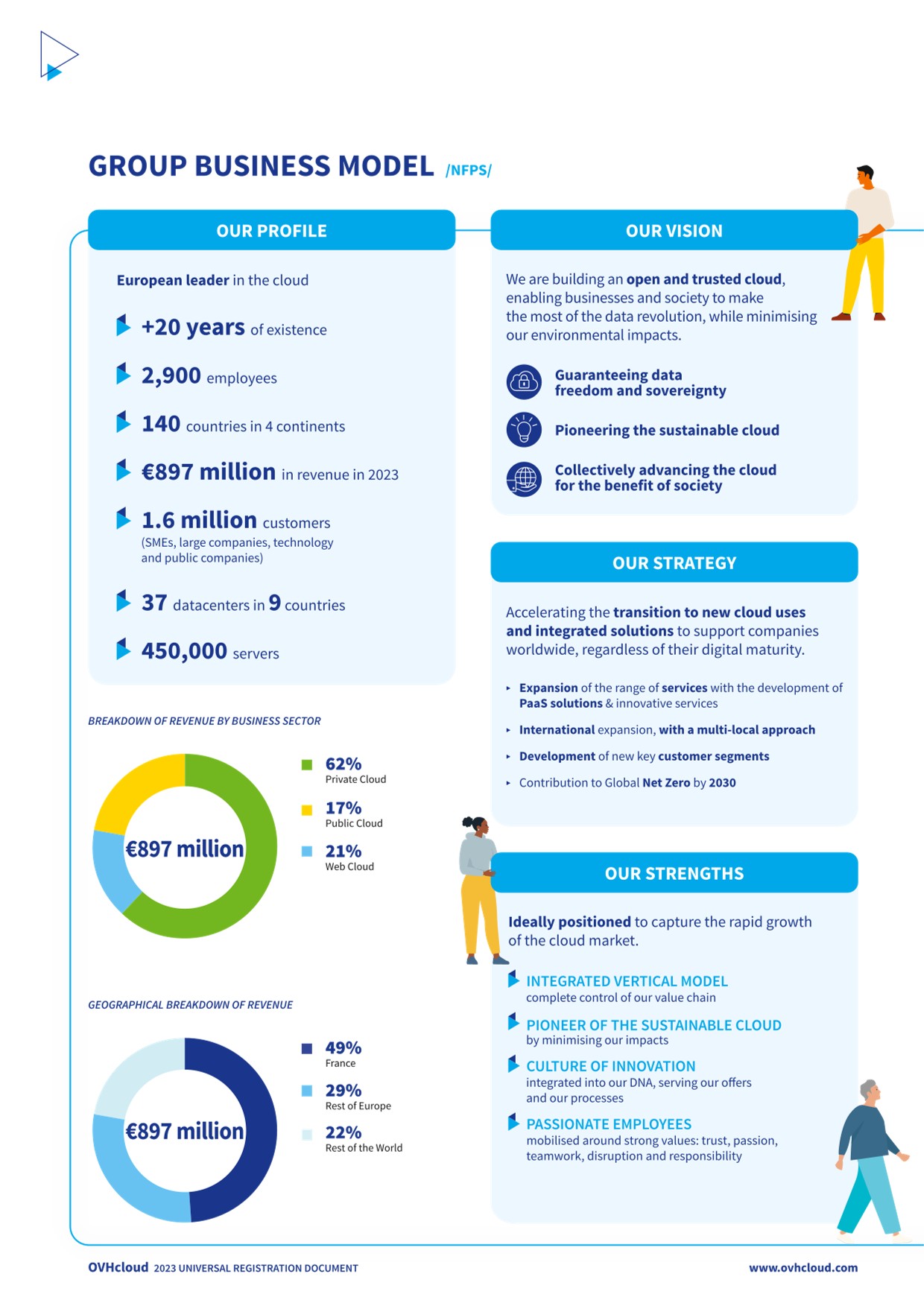

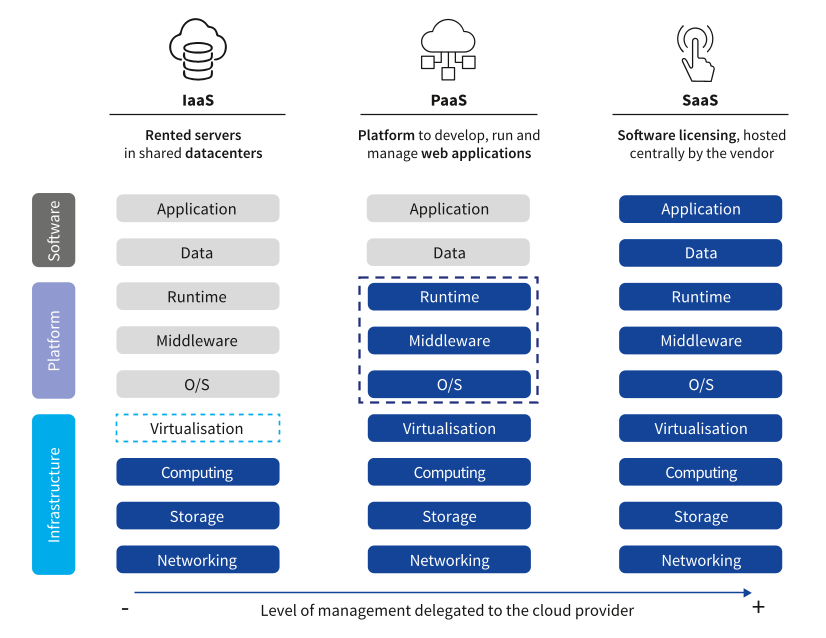

Cloud computing encompasses a range of services that include providing access to infrastructure (Infrastructure-as-a-Service or “IaaS”), selecting and operating platforms such as operating systems, virtualisation stacks and security systems (Platform-as-a-Service or “PaaS”), and offering applications that are developed and can function on cloud platforms (Software-as-a-Service or “SaaS”). These features are illustrated in the following graphic:

The cloud solutions market also includes Web services targeted mainly at individuals and small and medium-sized businesses. The web cloud market largely consists of web and domain hosting, including leasing servers for websites, selling secondary services (such as software packages) and domain name registration, renewal and transfer services.

-

1.3Business

1.3.1A comprehensive range of solutions

1.3.1.1Private Cloud

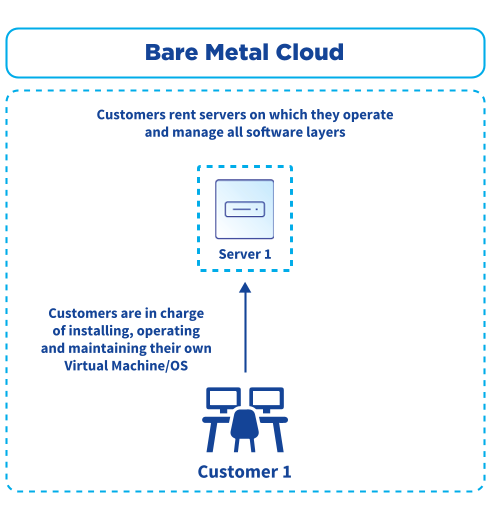

Bare Metal Cloud

OVHcloud’s Bare Metal Cloud service provides dedicated physical servers to customers, who have full control over the server, including the choice of operating system. The Bare Metal Cloud allows them to have a similar experience to the one they would have with on-premises solutions managed by their internal teams, while taking advantage of the benefits offered by outsourcing.

OVHcloud’s main Bare Metal Cloud offering consists of high-end servers and mid-to-high-level services. OVHcloud also has a lower-priced offering marketed as part of the “Eco” range, which uses refurbished servers that provide quality services at a reduced cost, while improving environmental efficiency.

Bare Metal Cloud services provide business customers with high-level computing power and strict service level agreements in a secure environment appropriate for sensitive data applications. The server can be customised to meet customer requirements and can be operated without allocating the server’s capacity to virtual machines through a hypervisor, allowing the customer to use the server’s full capacity. Any unused capacity can be deployed within minutes, although the total capacity is limited by that of the dedicated server.

Bare Metal Cloud customers pay monthly fees that depend on the performance levels they select. They may also choose options (such as server customisation or data backup) for additional fees.

The main uses of Bare Metal Cloud services include the computation of complex data, low latency operations, streaming, online gaming and critical business applications such as ERP and CRM.

Hosted Private Cloud

OVHcloud offers Hosted Private Cloud services to its business customers, providing servers fully managed by OVHcloud, including the operating system and the virtualisation layer, in partnership with VMware or Nutanix offerings.

Within its Hosted Private Cloud service, OVHcloud has two main offerings: (i) Essential and (ii) Premier.

- ▶Essential allows customers to benefit from dedicated and virtualised servers, fully managed by OVHcloud, with a 99.9% service level. Essential customers are mainly medium-sized companies.

- ▶Premier provides high-end dedicated virtualised servers, and includes virtual storage and backup management as well as 24/7 support, with a 99.9% service level. The servers are certified to host information from customers in a variety of sensitive sectors, including healthcare in France (HDS certification), Germany, the United Kingdom and Poland, and finance, including credit card payments (PCI DSS certification). Premier customers are primarily large companies and public sector players looking to move to a cloud service provider.

OVHcloud’s Hosted Private Cloud services provide customers with private access to servers that can be customised to meet their specific requirements. They meet the needs of customers seeking isolation and security, scalable resources and resilience.

The main uses for Hosted Private Cloud services include deployment in hybrid cloud strategies, media encoding, big data analytics and disaster recovery, as well as the storage and processing of sensitive data in key sectors such as healthcare, finance and the public sector.

1.3.1.2Public Cloud

OVHcloud offers Public Cloud solutions based on open source technologies such as OpenStack (a platform for deploying processing, storage and networking resources) and Kubernetes (a container orchestration platform that has become a market benchmark). The use of these standard platforms provides customers with easy data transfer capability and deliberately transparent access to source code, facilitating reversibility and eliminating “vendor lock-in”. This feature of the OVHcloud offering is particularly attractive for customers looking to deploy multi-cloud strategies.

Public Cloud solutions provide users with virtually unlimited computing capacity, with the only constraint being the demands of other users and the total installed capacity of the cloud provider. It is possible to deploy new Public Cloud instances automatically and in seconds. As the Public Cloud service is based on shared servers, customisation options are defined by OVHcloud. The flexibility of the hardware architecture offers high service levels.

Public Cloud customers pay usage fees for the capacity they actually use. The OVHcloud model offers much more predictability than models used by hyperscalers and many other competitors. In particular, unlike hyperscalers, OVHcloud does not charge additional fees for outgoing data transfers or API calls, except for block and archive storage, and for services located in Asia-Pacific.

The Group’s Public Cloud offering provides three core cloud computing services: computer performance, storage and network capabilities.

Customers of OVHcloud's Public Cloud solutions can choose fully scalable Public Cloud services on virtual machines that are hosted on shared servers and networks.

OVHcloud’s Public Cloud service is attractive for customers seeking highly scalable resources, with significant peak management demands across multiple access locations, and a high degree of resilience. This service is used for applications with high-demand bursts and services that use large volumes of data, such as video and music streaming.

OVHcloud's Public Cloud customers can also choose from a number of on-demand (SaaS) software running on OVHcloud's Public Cloud servers. In particular, OVHcloud offers its customers access to Microsoft Exchange messaging and calendar solutions, SharePoint data storage and management solutions, and the Office365 business software suite.

Virtual private servers

OVHcloud also offers a virtual private server option, providing IT capabilities located on shared servers, but with virtual machines isolated through the use of virtual private networks.

The virtual private server option is attractive to customers seeking tailored resources, particularly for short-term operations with volatile workloads and server demand. Virtual private server solutions are used primarily for applications testing and other one-time projects, the management of short-term peak loads and backup functions.

Platform-as-a-Service (PaaS)

As part of its growth strategy, OVHcloud is developing and implementing a comprehensive PaaS offering, overlaying its Private Cloud and Public Cloud IaaS products. In addition to developing products in-house, OVHcloud has announced several partnerships and acquisitions, in order to accelerate its development plan, enabling it to offer more than 80 IaaS and PaaS solutions to its customers by the end of the 2023 financial year, mainly in the following areas:

- ▶Storage. OVHcloud now offers its customers a comprehensive portfolio of storage solutions such as Object Storage S3 (High Performance and Standard), Block Storage, File Storage, Snapshot & Backup and Archive;

- ▶Database-as-a-Service. Data management software allows users to manage their databases to enable queries and updates. It includes programmes that execute queries on data and provide visual representation of the data in formats such as spreadsheets, enabling users to build applications faster and automate database management. OVHcloud announced a partnership with MongoDB in April 2021 and a partnership with Aiven in July 2021 to make several types of database available on the OVHcloud infrastructure;

- ▶AI, Machine Learning & Analytics. Artificial intelligence and analytics solutions include tools and services that support data analysis and presentation. OVHcloud is particularly advanced in high-performance computing solutions for artificial intelligence and machine learning, and intends to continue its development in this area. In April 2022, OVHcloud announced the acquisition of ForePaaS, a company specialising in analytics. Throughout 2023, OVHcloud strengthened its artificial intelligence product offering, such as AI Notebook, AI Deploy, AI Training, AI App Builder and AI Endpoint;

- ▶Security & Encryption. OVHcloud is expanding its offering of identity access management and encryption solutions, including end-to-end encryption that secures customer data in all states. In July 2021, OVHcloud announced the acquisition of BuyDRM, a US company specialising in this area;

- ▶Application platforms. Application platforms are back-end server software solutions that provide developers with a runtime and development environment.

1.3.1.3Web Cloud and Other

OVHcloud has offered Web Cloud services since its founding in 1999. With its leading position in the French market and strong positions elsewhere in Europe, the Web Cloud offering provides a stable, recurring revenue base and regular growth.

- ▶Web hosting and domain names. This includes the leasing of hosting capacity on servers, allowing customers to connect their websites to the internet, as well as domain name registration, renewal and transfers. Customers can choose basic packages offering just one or a few websites, or packages targeted at professionals and developers that wish to host multiple websites, together with email addresses and storage options. OVHcloud offers its customers additional services, such as Secure Socket Layer (SSL) certificates, which enable secure connections between a web server and a browser;

- ▶Telephony and connectivity. Customers can purchase VoIP (Voice over IP) systems for use as switchboards and interactive voice response systems. OVHcloud also offers customers internet access through ADSL and fibre networks, with basic and professional packages;

- ▶Support and services. OVHcloud offers its customers additional levels of support and services, including a range of support, expertise and online services. There are two levels of support offering: i) Business, which corresponds to the level suitable for production environments, or ii) Enterprise, which offers a key account experience for critical production environments. Additional services are proposed in the Professional Services offering, which provides access to technical support and advice during infrastructure migration or IT architecture changes.

OVHcloud’s main customers in the Web Cloud segment are small and medium-sized businesses, as well as certain individual customers and entrepreneurs. Web Cloud customers generally seek secure and reliable web and communications services, to establish their web presence, and to digitise business functions.

-

1.4Strategy and targets

1.4.1Develop key customer segments

OVHcloud pursues a growth strategy adapted to its three main customer segments: (i) technology and software companies, (ii) large corporates, SMEs and public entities, as well as (iii) white labellers, resellers and private individuals.

Technology and software companies (digital natives)

This customer segment is historically favourable for OVHcloud. In order to extend its growth in this segment, OVHcloud has implemented an enhanced digital marketing strategy, including an improved customer experience on the Group’s websites with a customer-centric interface, focused on usage and products, a prospect relationship management programme, online support such as chatbots and training materials such as webinars and technical documentation.

- ▶the Startup Program helps startups grow and develop by providing them with technology credits, resources, training and advice. This programme is particularly useful for startups still in the idea-forming stage. The 12-month programme allows the use of up to €10,000 in technology credits and several hours of technical support. Since 2015, more than 1,800 startups and scale-ups from all over the world have joined the programme and the ecosystem;

- ▶the Market Place brings together innovative and trusted technology and software companies as part of a SaaS (Software-as-a-Service) marketplace hosted by OVHcloud.

Large corporates, SMEs and public entities

OVHcloud is implementing a three-part strategy to achieve growth with large corporates, SMEs, and public entities. As part of this strategy, OVHcloud is addressing the needs of these customers for transformation and support as they consider migrating to the cloud.

- ▶OVHcloud is leveraging its position as a European “trusted cloud” provider, meeting the security and data sovereignty needs of European companies and public sector entities handling highly sensitive or strategic data. OVHcloud does not use or sell its customers' data, which is stored in the datacenters chosen by its customers. It offers the highest level of security with numerous recognised certifications, including SecNumCloud certification from the French National Cybersecurity Agency (ANSSI), attesting to Europe's highest level of IT security for the hosting of sensitive and strategic data in the cloud. OVHcloud has also launched the Trusted Zone sovereign solution, which is designed to meet the highest security standards of public sector and critical services operators. It is also one of the founding members of the Gaia-X initiative, helping to promote a European sovereign cloud. OVHcloud is constantly improving its offers by investing in security and encryption solutions.

- ▶OVHcloud is strengthening its marketing channels to enhance its position with large corporate customers and public entities. As part of this strategy, OVHcloud has strengthened its relationships with its network of almost 1,000 IT partners, reinforcing its position with large system integrators such as Accenture, Capgemini, Sopra Steria and Deloitte and specialised system integrators such as Neurones IT, providing OVHcloud with a strong platform to capture a broader share of the IT spending of their corporate customer base. At the same time, OVHcloud has substantially increased its direct sales force that serves the needs of its large corporate customers, as well as providing enhanced customer support and services to guide corporate customers in their cloud migration projects.

- ▶OVHcloud has developed specific offerings for small and medium-sized businesses. For this segment, OVHcloud is leveraging its strong relationships with IT advisors and web agencies, while offering maximum flexibility through an automated self-service channel that can be used by customers directly or through their IT advisors. OVHcloud is also enhancing its multi-location, multi-language support offering for small businesses.

White labellers, resellers and individuals

OVHcloud has a long history of commercial success through web agencies that resell OVHcloud solutions, sometimes under their own brand names. For individuals in particular, significant work has been ongoing for several years to offer an optimised digital sales channel, new and improved product offerings, and improved support. This continuous improvement aims to promote the acquisition of new customers along with cross-selling opportunities to existing customers. OVHcloud is also developing a “DataCenter-as-a-Service (DCaaS)” offering for corporates to deliver high performance and data sovereignty for their on-premises resources.

-

1.5OVHcloud’s competitive advantages

1.5.1The only European player of this size

It is one of the two main providers of Private Cloud services in Europe. Additionally, as a Europe-based cloud provider, the Group is able to meet the requirements of European customers for data sovereignty and security.

OVHcloud has a growing presence in the Public Cloud market, which is dominated globally by the American “hyperscalers” (Amazon Web Services, Google Cloud Platform and Microsoft Azure). It is the only European provider of Public Cloud infrastructure services that was positioned as a major player in the IDC MarketScape (IDC – September 2022), based on its infrastructure offering.

-

1.6Legislative and regulatory environment

1.6.1Legislation and regulations in the European Union

As a French cloud service provider, OVHcloud is subject to European regulations across a wide number of areas, including information technology (“IT”) services, cybersecurity, online content moderation and data protection. OVHcloud may also be subject to sectoral regulatory regimes applicable to certain customers and generally applicable regulations such as contract laws and consumer protection policies.

1.6.1.1Cybersecurity

OVHcloud is subject to European regulations aimed at strengthening cybersecurity across the European Union (the “EU”). Transposed into French law on 26 February 2018, Directive (EU) 2016/1148 of 9 July 2016 established requirements for cloud service providers with respect to network and information systems security. The French law(2) transposing Directive (EU) 2016/1148 classifies cloud service providers as digital service providers. As a digital service provider, OVHcloud must guarantee a level of information security adapted to the relevant risks and adopt appropriate organisational and technical measures. Any security incident having a significant impact on the provision of services must be declared to the French National Cybersecurity Agency (“ANSSI”). The French Prime Minister may also open investigations upon receiving information of non-compliance by the digital service provider with security obligations. Fines for non-compliance with security obligations range from €50,000 to €100,000.

The ANSSI has adopted security standards for cloud service providers(3). In particular, cloud companies must set up a security policy for information relating to the service and carry out a risk assessment covering the entire service. If applicable security standards are met, the ANSSI grants the “SecNumCloud” label certifying an enhanced level of security for the storage of sensitive information. In October 2022, the ANSSI extended OVHcloud's “SecNumCloud” security visa for its Hosted Private Cloud until December 2023. For the protection of critical information systems, the ANSSI recommends that operators of essential services (e.g., gas supply companies, airline carriers, health institutions, banks) use security products and services with an ANSSI security visa.

The role of the European Union Agency for Cybersecurity (the “ENISA”) was strengthened by Regulation (EU) 2019/881 of 17 April 2019 (the “Cybersecurity Act”). The ENISA is tasked with establishing and maintaining a European-wide cybersecurity certification scheme applicable to cloud service providers, including a comprehensive set of rules, technical requirements, standards and procedures. In July 2020, the ENISA published a proposal that would enable cloud service providers to obtain certifications across the EU attesting to the level of security of their services.

In September 2022, the European Commission unveiled its proposed Cyber Resilience Act (“CRA”). This proposal fixes a series of general and organisational cybersecurity requirements for products containing digital elements (for example: software, hardware products, data processing). It aims to adopt a common base within the European Union to limit cyberattacks. The CRA applies differently to supply chain players: manufacturers, importers and distributors. The text is awaiting examination by the European Parliament and then by the Council of the European Union; during this procedure, which may take up to two years, the current text will most likely undergo certain changes. It is therefore still too early to comment on the impacts this text may have on OVHcloud.

1.6.1.2Data protection

As a provider of cloud and telecommunications services, OVHcloud processes, stores and transmits a substantial amount of personal data. As a result, OVHcloud must comply with a number of European regulations and national laws relating to personal data protection.

European Union – The General Data Protection Regulation (GDPR)

A cornerstone of personal data protection in the European Union since it came into force in May 2018, the GDPR has three main objectives: (i) to establish rules relating to the protection of individuals with regard to the processing of their personal data as well as rules relating to the free movement of such data, (ii) to strengthen the application of the regulation by providing a unified legal framework for organisations processing personal data, and finally (iii) to strengthen the responsibility of parties processing personal data (data controllers and processors) by requiring that processing and the tools/applications used be documented.

The GDPR places organisations under strict obligations in terms of information and transparency with regard to the personal data processing they carry out on their own behalf or on behalf of others.

It also confers a number of rights on data subjects with regard to the processing of their personal data, such as the right of access, the right to rectification and the right to erasure ("right to be forgotten"), giving them greater control over the use of their personal data.

The GDPR also requires organisations to implement appropriate technical and organisational security measures for the processing of personal data as soon as a new product or service is designed, in order to ensure that personal data security and confidentiality requirements are met ("Privacy by design").

Lastly, the GDPR requires organisations responsible for processing personal data to notify the supervisory authority of any breach that is likely to result in a risk to the rights and freedoms of natural persons and data subjects.

Canada, Province of Quebec – An Act to modernise legislative provisions as regards the protection of personal information

Passed on 22 September 2021, the Act to modernise legislative provisions as regards the protection of personal information, known as "Law 25", makes major changes to the Act respecting the protection of personal information in the private sector ("ARPPIPS"), giving citizens greater control over their personal data and making organisations more accountable for the way they manage this information. This law establishes new obligations and transparency rules for Quebec companies, such as the appointment of a Data Protection Officer, in order to establish governance policies and practices regarding personal information, and conducting privacy impact assessments (PIAs), respecting the new rights granted to individuals with regard to their personal data, in particular the right to require that such information cease to be disseminated, or that it be re-indexed or de-indexed (the right to be forgotten) before being communicated outside Quebec, and ensuring that technological products and services offered to the public have settings that provide the highest level of confidentiality by default.

The new responsibilities and requirements applicable to organisations processing personal data are coming into force progressively in September 2022, 2023 and 2024.

Compliance tools

In order to ensure compliance with applicable data protection regulations, OVHcloud has implemented a personal data management system based on the ISO 27701 standard.

OVHcloud also relies on the Cloud Infrastructure Service Providers in Europe (CISPE) Code of Conduct, with its certified Bare Metal Cloud and Hosted Private Cloud powered by VMWare offerings, to ensure and demonstrate the compliance of its IaaS activities.

1.6.1.3Free movement of non-personal data

Regulation (EU) 2018/1807 of 14 November 2018 (“Regulation on the free flow of non-personal data”) aims to ensure the free flow of non-personal data between EU Member States (the “Member States”) and IT systems in the EU. Non-personal data is either (i) data not linked to identified or identifiable natural persons, or (ii) anonymised personal data. This regulation enables the storage and processing of non-personal data anywhere in the EU, prohibits data localisation and ensures the availability of data for regulatory control.

The Regulation on the free flow of non-personal data also provides that the European Commission must encourage the development of self-regulatory codes of conduct to facilitate portability between service providers. To that end, OVHcloud participated in the drafting of two voluntary codes of conduct on switching cloud service providers and data portability through the working group on switching cloud providers and porting data (“SWIPO”). Published in July 2020, the codes of conduct for Infrastructure-as-a-Service (IaaS) and Software-as-a-Service (SaaS) provide guidance for cloud service providers and customers on switching cloud provider and porting non-personal data. The adoption of such codes of conduct aims to reduce the risks of vendor lock-in (i.e., situations where customers are dependent on a particular provider due to significant switching costs) by cloud service providers. It also provides guidance for customers on the transfer of non-personal data.

1.6.1.4Online content moderation

As a hosting service provider, OVHcloud must comply with a number of laws on content moderation, including those moderating terrorist content, child sexual abuse material and the infringement of intellectual property rights.

European legislation on digital services (Digital Services Act, “DSA”)

Regulation (EU) 2022/2065 of the European Parliament and of the Council of 19 October 2022 on a Single Market for Digital Services and amending Directive 2000/31/EC (“Digital Services Act”) entered into force on 18 November 2022. This new framework aims to harmonise the rules applicable in the different Member States of the European Union and replaces the framework adopted in 2000 with regard to liability of intermediaries in relation to illegal content while maintaining the fundamental principles of freedom of expression and freedom to provide services.

The regulation also establishes new obligations of due diligence and transparency for hosting services such as OVHcloud, both vis-à-vis the authorities and users, particularly on the processing of reports of illegal content. It also increases the level of penalties that can be imposed in the event of a breach of the obligations established by the regulation, with fines of up to 6% of the intermediary service provider’s global annual revenue. A certain number of measures are applicable on a deferred basis over the next two years and involve the adoption of texts at the national level. OVHcloud will carefully monitor their publication in order to comply with its obligations.

1.6.1.5Fight against anti-competitive practices on digital markets

European legislation on digital markets (Digital Markets Act, “DMA”)

Regulation (EU) 2022/1925 of the European Parliament and of the Council of 14 September 2022 on contestable and fair markets in the digital sector and amending Directives (EU) 2019/1937 and (EU) 2020/1828 (“Digital Markets Act”) aims to make the digital sector fairer and more competitive by introducing preventive measures for large digital companies as gatekeepers on the European market. In particular, the regulation provides for several obligations and prohibitions against gatekeeping online platforms and strengthens the sanctioning powers of the European Commission, which will be assisted by an advisory committee and a high-level group. So, for example, gatekeepers must allow users to easily uninstall pre-installed software on their devices and easily unsubscribe from an essential platform service such as a cloud service. Gatekeepers will no longer be able to impose software such as internet browsers or default search engines or reuse users' personal data for the purpose of targeted advertising without their explicit consent.

Applicable from 2 May 2023, the companies concerned must report to the European Commission and ensure that they are compliant by March 2024 at the latest. The legislation gives the Commission the exclusive power to monitor compliance with their obligations, and new sanctions, including a fine of up to 10% of the company's total global revenue from the previous financial year.

The adoption of this new legislation is a positive step towards regulating the practices of the dominant digital players on the European market. However, its effectiveness will depend on the means that the European Commission devotes to ensuring compliance with it. OVHcloud will pay particular attention to the forthcoming details regarding the teams tasked with monitoring gatekeepers' compliance.

1.6.1.6Other applicable regulations and initiatives

Telecommunications sector

OVHcloud entities are telecommunications operators in four (4) Member States: Belgium, France, Germany and Spain. OVHcloud is subject to specific obligations when providing telecommunications services. Because the EU and its Member States have been regulating the telecommunications sector for many years, there are a variety of different implementing measures, guidelines and authorities across the EU. OVHcloud entities are also telecommunications operators in the United Kingdom and Switzerland, which have their own telecommunications regulations. The United Kingdom also implemented the requirements of the European Electronic Communications Code into its national regulatory framework prior to Brexit.

The Directive (EU) 2018/1972 of 11 December 2018 established the European Electronic Communications Code. Although this directive has not yet been transposed in all Member States where OVHcloud acts as an operator, several other directives applicable in the telecommunications sectors, such as Directives 2002/19/EC, 2002/20/EC, 2002/21/EC and 2002/22/EC of the European Parliament and of the Council, have been substantially amended. Directive 2018/1972 was transposed into French law in May 2021(4). The key objective of this European Electronic Communications Code is to create a comprehensive set of updated rules to regulate electronic communications and protect EU citizens when they communicate through traditional or web-based services, encourage competition between telecommunications operators, and ensure that national regulatory authorities are protected against external intervention or political pressure.

Health sector

As a cloud service provider, OVHcloud is subject to obligations when providing services to organisations in the health sector. For example, French law requires health data hosting providers (i.e., any person hosting personal health data collected in the course of prevention, diagnosis, care or social and medical monitoring activities on behalf of natural or legal persons having produced or collected such data or on behalf of the patients themselves) to comply with specific obligations. Such obligations include obtaining proper certification or receiving prior approval from public authorities as per the French Public Health Code, and entering into an agreement with customers in the health sector, setting out the mandatory provisions prescribed by Article L. 1111-8 of the French Public Health Code. OVHcloud is also subject to the requirements of other jurisdictions in which it operates, such as Italy, Poland, Germany and the United Kingdom.

In 2016, OVHcloud obtained the “health data host” accreditation and, since 2018, the Group has operated a management system that allows several of its cloud offerings to comply with the requirements of this accreditation. In 2019, OVHcloud obtained the French HDS (Hébergeur de Données de Santé – health data host) certification for its Hosted Private Cloud offering. In 2020, this certification was extended to OVHcloud’s dedicated servers, and it was extended to OVHcloud’s Public Cloud offering and Trusted Exchange in 2021.

Financial sector

Companies in the financial sector (including credit institutions and investment firms) may also be subject to industry-specific obligations that may reflect on OVHcloud in the context of the provision of its services. In particular, in 2019, the European Banking Authority (“EBA”) issued “Recommendations on outsourcing to cloud service providers” applicable to outsourcing arrangements. These recommendations create obligations with respect to information systems security and audit rights for the outsourcing banks, which they must impose on their cloud service providers when using their services. OVHcloud aims to offer contractual conditions applicable to financial service operators that ensure that customers are able to implement an outsourcing policy which is compliant with the EBA’s recommendations and with local European regulations.

Financial service operators may also require OVHcloud to comply with specific national regulations. For instance, OVHcloud may have to comply with French regulations such as those of France's banking and insurance supervisor, Autorité de contrôle prudentiel et de résolution (“ACPR”) on critical outsourced services such as banking operations. Companies outsourcing critical services must ensure that service providers guarantee the protection of confidential information, implement back-up mechanisms in the event of significant difficulties affecting service continuity and provide the ACPR, in carrying out its duties, with access to critical outsourced information. With respect to internal procedures for managing information system security, the American Institute of Certified Public Accountants (“AICPA”) granted OVHcloud SOC I-II type 2 certifications.

With respect to hosting banking data and reducing card fraud, OVHcloud’s main Hosted Private Cloud offering is compliant with the Payment Card Industry Data Security Standard (“PCI DSS”). OVHcloud’s datacenters in France, Canada, the United Kingdom, Germany and Poland comply with PCI-DSS.

On 27 November 2022, the European Commission adopted a Regulation on Digital Operational Resilience for the Financial Sector (“DORA”). Following a proposal by the 2020 European Commission, this regulation imposes a number of requirements on cloud outsourcing arrangements in the financial sector. The proposed regulation covers a broad range of regulated financial entities, including credit institutions (such as banks), central securities depositaries, insurance companies and certain fund managers, among others. It imposes a number of information and communications technology risk management requirements on these financial entities, some of which apply directly to outsourced cloud activities.

In particular, financial sector entities covered by the proposed regulation are required to take a number of steps to address risks in their relationships with third parties, such as cloud service providers, including ensuring that their cloud services contracts provide a full description of the services proposed with qualitative and quantitative performance targets, and include provisions governing integrity, security, personal data protection, recovery in case of failure, rights of inspection and audit, and termination provisions with clear exit strategies. The regulation proposes the approval of standardised contractual terms by the European Commission.

In addition, the regulation imposes a new oversight framework on critical third-party service providers (including cloud service providers), subjecting them to individual oversight plans adopted by the European financial regulatory bodies responsible for supervising banks, securities markets or insurance companies, depending on the sector primarily using the services of the relevant provider. The determination of which services are critical depends on their potential systemic impact, the dependence of financial entities on them for critical functions and the availability of alternatives. The oversight plan can impose requirements in areas such as security and quality, contractual terms, and subcontracting, with financial penalties imposed in case of non-compliance, up to 1% of the service provider's global revenue in the most recent year. The oversight bodies have broad inspection and auditing rights and investigative powers. The adopted regulation also prohibits financial entities from using a service provider from a country outside the EU for critical cloud functions.

Environmental and industrial risks

Many of OVHcloud’s datacenters are located in former industrial buildings, some of which are classified as presenting environmental or other risks under applicable French legislation. OVHcloud’s datacenters outside of France may also be classified as presenting environmental risks under local regulations. In order to comply with the applicable regulations, OVHcloud is sometimes required to submit applications and obtain operating licenses. OVHcloud may be required to take certain remedial measures as part of the application process.

-

1.7Group organisation

1.7.1Simplified organisational chart

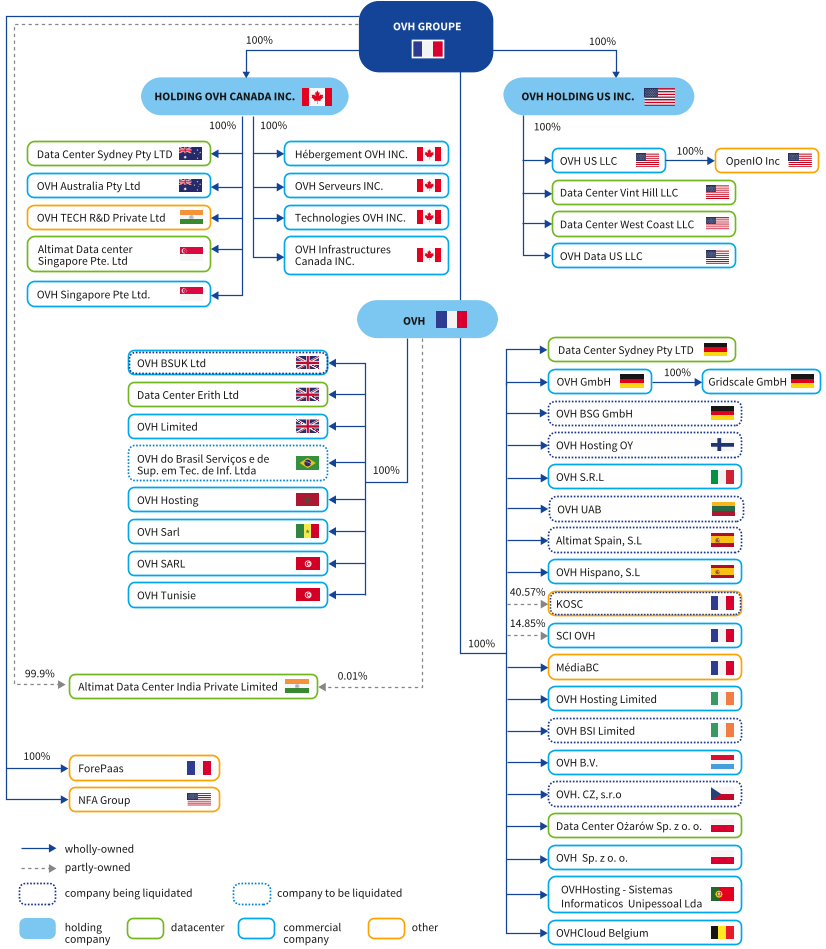

Simplified organisational chart as of the date of this Universal Registration Document

The simplified organisational chart below shows the Company's legal structure and its consolidated subsidiaries as of the date of this Universal Registration Document. The percentages indicated below represent the percentages of share capital. There has been no significant change in capital ownership since 31 August 2023.

-

Risk factors

and internal controlCentral to its governance mechanism, OVHcloud's risk management system helps the Group achieve its strategic objectives while protecting its assets and reputation. It also helps to mobilise employees around a common approach to risk. OVHcloud is committed to regularly assessing risks and implementing internal controls and action plans to mitigate them.

-

2.1Risk factors /AFR/

2.1.1Risk management system

Risk monitoring system

The risk management system aims to identify, analyse and manage the main risks to which the Group is exposed. It contributes to the control and security of its activities, the effectiveness of its operations and the efficient use of resources.

This system comprises a series of processes aiming to identify, assess and prioritise risks, prevent and control them, and monitor action plans to limit them. It relies on the Group's employees, particularly in internal control and compliance, and on external expertise where required. Group management, the Board of Directors and the Audit Committee closely monitor risk management and define the most appropriate strategy.

CSR risks are covered in Chapter 3 – Non-financial performance statement of this Universal Registration Document.

Risk mapping

Carried out with the support of an external specialised consultant and the involvement of top management from all the Group’s activities, the risk mapping process has made it possible to identify the main risks to which the Group is exposed and to assess their potential impact, taking into account their criticality and probability of occurrence.

The most significant risks have been grouped into different families (strategy and markets, operational, human resources, financial, regulatory and legal, information systems) and a description is provided of their causes and potential impact, as well as the actions taken to manage them.

One or more risk owners are appointed for each risk to complete the risk analysis, identify the actions and resources needed to mitigate the risk, and manage the corresponding action plans.

The relevance and progress of the action plans are monitored by members of the Group's Executive Committee, including the Chief Executive Officer, Chief Financial Officer and General Counsel, who review them on a quarterly basis. Risk mapping and action plans are presented annually to the Group’s Audit Committee, and more frequently upon request.

-

2.2Insurance and risk coverage

2.2.1Insurance policy and organisation

The Group's Legal Department negotiates all insurance contracts centrally for the entire Group, excluding subsidiaries in the United States, which determine their own insurance policy and take out their own insurance policies.

Insurance policies are either taken out by the Group, on its own behalf and on behalf of its subsidiaries, or directly by its subsidiaries, through brokers mandated to negotiate with the main insurance companies to set up or renew the most appropriate guarantees for risk coverage requirements.

Insurance companies are selected on the basis of criteria such as the amount of premiums, the scope of coverage offered, the ability to set up integrated programmes such as master policies, the duration of the commitment, their availability to insure the risks in question in light of all their other commitments in the segment and market in question, and the ability to offer qualitative support in order to better understand risk management.

- ▶adapt its insurance coverage each year, when renewing its policies, according to developments in the risks related to the growth of its usual activities and its steady increase in capital. To do so, the Group uses an external firm to appraise the assets of its largest sites;

- ▶pursue an active prevention and protection policy at its industrial sites, in particular through its HYR prevention plan, designed to protect them against accidental fire risks. The Group has most of its industrial sites audited annually by its brokers’ and insurers’ prevention engineers;

- ▶communicate to the insurance and reinsurance market at the roadshows organised by the Group, on the information detailed in the HYR prevention plan;

- ▶set up awareness-raising sessions on fire risk, with a technical and insurance-based approach, for a wide range of operational staff;

- ▶develop risk prevention, such as exposure to natural and environmental disasters, in order to enhance existing insurance coverage.

All insurance contracts were renewed at 1 January 2023, with the exception of a few contracts with expiry dates later in the year.

OVHcloud prefers to take out “master” policies in order to pool coverage within the Group. For regulatory or factual reasons, such as the size of a subsidiary, OVHcloud also uses local or “standalone” policies taken out directly by its subsidiaries.

The Group also has insurance policies taken out directly by the Group or through its subsidiaries, covering the liability of its executives, risks relating to all its offices, its car fleet, the use by its employees of their own vehicle for business trips, professional assignments, expatriate employees, construction work, installation of equipment or fittings in its datacenters or offices, the transportation of goods, rented accommodation made available to staff during occasional business trips to the head office, as well as the medical office of the doctor also working on behalf of OVHcloud.

-

2.3Internal control system

2.3.1General internal control framework

2.3.1.1Definition and objectives of the internal control system

Based on the AMF reference framework, OVHcloud has set up an internal control system comprising a set of resources, policies, behaviours, procedures and appropriate actions designed to ensure:

- ▶the application of instructions and guidelines set by management;

- ▶the operation of internal processes to ensure the effectiveness and control of activities;

- ▶the reliability of accounting and financial information;

- ▶compliance with laws and regulations;

- ▶the management of risks.

2.3.1.2Internal control governance

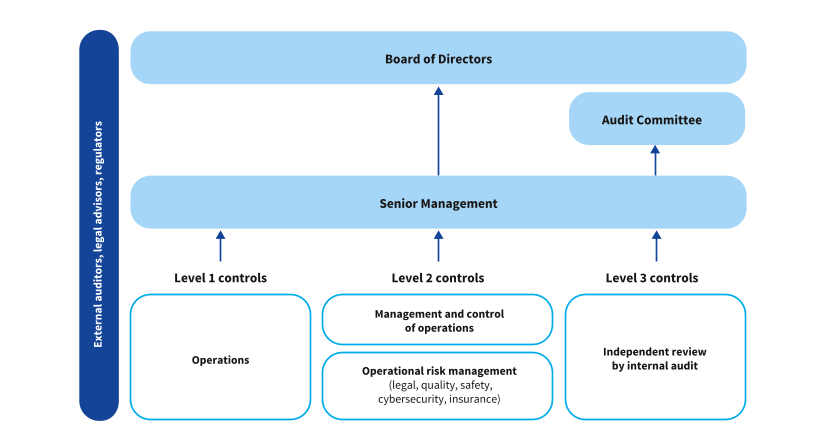

Board of Directors and Audit Committee

Delegated by the Board of Directors, the Audit Committee is responsible for monitoring the preparation of financial information and the effectiveness of internal control, risk management and internal audit systems.

See Chapter 4 – Corporate governance for a detailed description of the tasks of the Board of Directors and the Audit Committee.

Senior Management

Senior Management is responsible for deploying the internal control system and overseeing risk mapping. To achieve this, Senior Management relies on the support of the Finance Department and the Audit, Internal Control and Risk Department.

Level 1 controls

The first line of control is made up of operations that formalise and implement operational processes to ensure control of day-to-day operations and their internal control.

Level 2 controls

Internal control is an integral part of each operational department’s mission. The management of the operational departments is responsible for checking that the Level 1 procedures and controls are being properly applied by carrying out Level 2 controls, for example via sampling and by implementing application controls and validation circuits. The Management Control function may also be responsible for carrying out Level 2 controls.

Lastly, the functional departments are responsible for defining the guidelines and controls to be applied by all the commercial and industrial entities and for managing the operational risks in their respective areas: for example, the Legal, Quality, Standards, Safety and Working Environment, Cybersecurity, Human Resources, Finance and Insurance Departments. These functional departments may also be called upon to verify that Level 1 rules have been applied correctly through Level 2 control campaigns.

With a view to strengthening its internal control and improving coordination, OVHcloud has set up an Audit, Internal Control and Risk Department, which reports to the Group's Finance Department. This department assists the operational and functional departments in setting up their Level 1 and 2 control systems. The Audit, Internal Control and Risk Department also carries out internal control campaigns based on the operational departments’ self-assessment of whether controls have been applied correctly. The Audit Committee monitors the rollout of the internal control system.

Level 3 controls

The third line of control is the Audit, Internal Control and Risk Department. On the basis of an annual audit plan, approved by Senior Management and the Audit Committee, audits are carried out in a fully independent manner and are the subject of an audit report which identifies any risks and the action plans needed to mitigate them.

-

Non-financial performance statement /NFPS/ /AFR/

-

CSR approach

OVHcloud structured its CSR approach during the 2022 financial year. With nearly 2,900 employees and a global industrial and commercial footprint, the Group is fully aware of its responsibility in a world where data have a major impact on private, social and professional lives on an economic, geopolitical, ethical and environmental level. They impact relationships between people and their use reflects a vision of the world and the type of society in which everyone wants to live. Driven by its ambition, “Leading the data revolution for a responsible future”, OVHcloud’s mission is to build an open and trusted cloud, enabling businesses and society to make the most of the data revolution while minimising its environmental impacts.

This vision and the related mission are reflected in a CSR policy, which is closely integrated into the Group’s strategy. This policy is based on three pillars of commitment, each of which in turn breaks down into three areas of action:

OVHcloud is at the heart of the digital revolution, which opens the way to a multitude of opportunities in applications and technology. In this context, the Group offers its customers cloud solutions covering all their uses – supporting them in their digital transformation, enabling them to innovate by building cloud native applications or helping them leverage the power of data. In fulfilling this mission, the Group offers its customers the freedom to build their most ambitious projects, in a secure, compliant and sustainable cloud environment, according to three areas of action:

- •defending data sovereignty, security and privacy;

- •guaranteeing freedom of choice and reversibility;

- •offering predictable and transparent pricing.

At the forefront of the sustainable cloud, since its creation, OVHcloud has integrated sustainability at the heart of its business model, aiming to minimise its environmental impact at every stage. OVHcloud’s environmental action is structured around three priorities:

- •placing innovation at the heart of its industrial model;

- •contributing to global Net Zero by 2030;

- •raising awareness among stakeholders of all the impacts of the cloud, in order to initiate a collective approach to reducing the environmental footprint.

At OVHcloud, everything starts with people. Men and women are the Company's best assets: it is their talent that ensures its success. “Working together” is one of the Group's fundamental values. This collective aspect is extended to its ecosystem, and in the desire to see the European cloud segment progress. This third pillar of commitment breaks down into three areas of action:

- •attracting and developing skills in a collective adventure within a diverse and inclusive Company;

- •collaborating and developing coalitions with stakeholders in the European cloud ecosystem;

- •promoting local anchoring and societal commitment by working on digital inclusion.

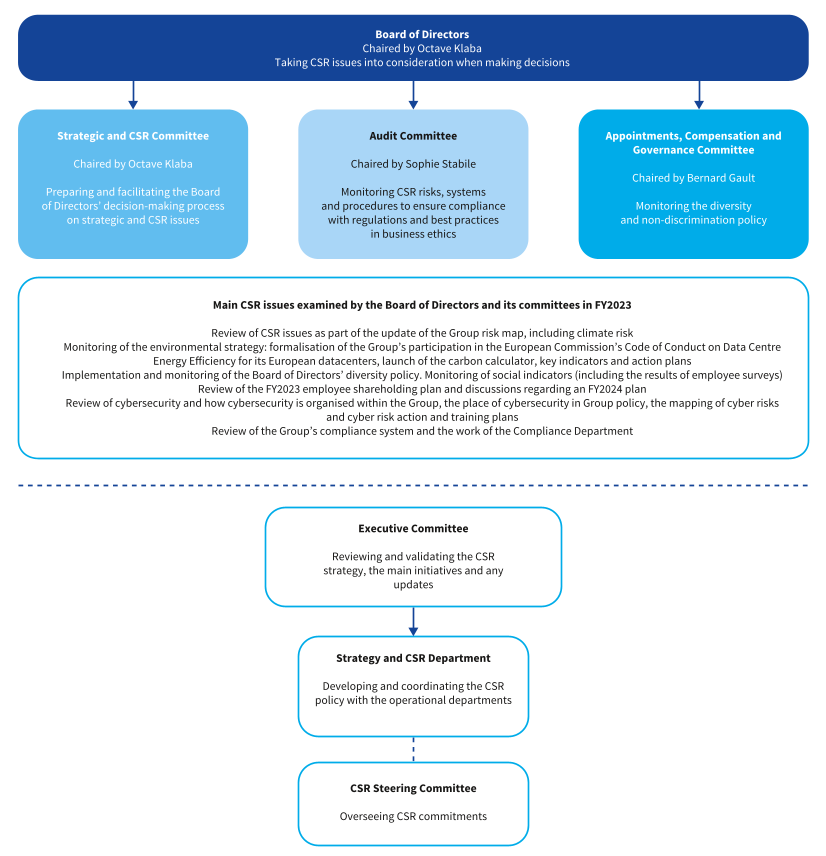

CSR governance

To manage its corporate social responsibility (CSR) ambitions, OVHcloud has set up a dedicated governance structure, closely associated with the management of the Group’s overall strategy.

The Board of Directors strives to promote the Company’s long-term value creation by considering the social and environmental challenges of its activities. In connection with the strategy defined, it regularly examines the opportunities and risks such as financial, legal, operational, social and environmental risks, including climate risk, as well as the measures taken as a result. The medium-term CSR priorities and targets were approved by the Board of Directors in 2022. They are monitored by building on the work of its committees.

Established after the Group’s IPO in 2021, the Strategy and CSR Committee has the task of preparing the work and facilitating the decision-making process of the Board of Directors on strategic and CSR issues. In terms of CSR, it is notably responsible for:

- ▶ensuring that matters relating to social and environmental responsibility (such as diversity and non-discrimination policies and compliance and ethics policies) are taken into account in the Group’s strategy and in its implementation;

- ▶reviewing the non-financial performance statement on social and environmental matters provided for in Article L. 22-10-36 of the French Commercial Code (Code de commerce);

- ▶examining the opinions expressed by investors, analysts and other third parties and, if applicable, the potential action plan drawn up by the Company to improve the points raised on social and environmental matters;

- ▶reviewing and assessing the relevance of the Group’s social and environmental commitments and strategic directions on social and environmental matters, in light of the challenges specific to its activity and objectives, and monitoring their implementation.

The Audit Committee ensures the effectiveness of the operational risk monitoring and internal control system, including CSR risks and climate change risk, as well as the review and monitoring of the systems and procedures in place to ensure the dissemination and the application of policies and rules of best practice in terms of ethics, competition, fraud and corruption and, more generally, compliance with regulations in force.

Lastly, the Appointments, Compensation and Governance Committee is responsible, among other duties, for the annual review of the Board of Directors’ diversity policy as well as monitoring the gender parity rate, age and diversity of skills.

The role and work of the Board of Directors and its committees are presented in Sections 4.1.5 and 4.1.6 of this Universal Registration Document.

The Strategy and CSR Department, which reports to the Chief Executive Officer, is responsible for the implementation of the Group’s major strategic directions, which it helps to define, as well as for the development and coordination of the CSR policy, with the aim of engaging the Company in a process of continuous improvement, of enhancing its commitments and of measuring the effects of the CSR programme. The Strategy and CSR Department reports to the Executive Committee on a regular basis on the progress of the CSR programme, its main initiatives and their updates.

The CSR programme commitments are drawn up and monitored by the CSR Steering Committee. Coordinated by the Strategy and CSR Department, it is composed of a central CSR team and operational department representatives involved in the implementation of the CSR action plan. The Committee meets weekly to define, monitor and adjust CSR action plans.

-

Open and regular exchanges with stakeholders

Stakeholders

Means of promoting dialogue

Customers

OVHcloud constantly strives to develop a relationship of trust with its major customers and maintains regular dialogue with them.

- ▶Once a month, the account managers and Technical Account Managers (TAM) organise an operational committee with each of the major customers for which they are responsible. Targets include reviewing the perception and measurement of the quality of the services provided, checking that the initial promise is kept and presenting the new features of the OVHcloud roadmap.

- ▶Once or twice a year, a strategic committee is organised, bringing together one or more members of OVHcloud's Executive Committee, sponsors of the Group’s main customers, as well as customer management representatives. These exchanges help ensure the alignment of OVHcloud's service proposal with its customers' strategic trajectory.

- ▶On an ad hoc basis, OVHcloud brings in experts to facilitate the understanding, adoption and improvement of solutions. For these targeted interventions, the Group relies on a team of Customer Success Managers and Solutions Architects providing high-level support services.

- ▶OVHcloud organises dedicated annual events such as OVHcloud Engage or Summit (formerly Ecosystem Experience), bringing together its network of technological, industrial and commercial partners, contributing to enriching the reflection of its customers on digital transformation and cloud migration.

Suppliers

OVHcloud works to establish a partnership of trust with its suppliers.

- ▶The OVHcloud purchasing teams are in daily contact with all supplier partners to discuss the performance, prices, quality of their products, delivery times as well as the carbon footprint of their products or services.

- ▶Every quarter, a multidisciplinary team of product, supply, quality and purchasing team representatives meets with strategic suppliers to carry out operational monitoring.

- ▶Every year, OVHcloud examines the Top 25 suppliers based on seven criteria (Security, Technology, Quality, Responsiveness, Delivery, Costs, Environment). An action plan is then jointly drafted with each supplier to improve overall performance. At the same time, in order to reward the best performing supplier, every year, OVHcloud organises an awards ceremony based on one or more of the seven criteria mentioned above.

- ▶Meetings between members of the Executive Committee, OVHcloud's Chief Procurement Officer and management representatives of the main suppliers (both active and potential) in Asia and the United States are organised twice a year in order to share targets, roadmaps and develop partnerships with key suppliers.

- ▶Key suppliers are invited to participate in the annual Summit (formerly Ecosystem Experience) event, an event dedicated to the Group’s customers and partners, offering them the opportunity to be fully involved in OVHcloud’s challenges.

Employees

- ▶The social partners are at the heart of the dialogue at OVHcloud thanks to regular, constructive and transparent exchanges.

- ▶In order to unite and engage employees more broadly, the Internal Communications and Human Resources Departments regularly organise events, based on the principle that every voice counts and must be heard. Whether on everyday issues or on the Company’s most strategic issues, employees are regularly consulted via:

- •engagement surveys twice a year;

- •workshops on key topics such as diversity & inclusion and management, in a consultative approach, open to dialogue for future decision-making;

- •a global programme to identify and prevent psychosocial risks;

- •a Company information-sharing platform accessible to all, where Company information is shared;

- •regular and interactive discussions with Senior Management (monthly videoconferencing, on-site visits at least once a year) to explain the Group’s projects and priorities.

- ▶OVHcloud is committed to gender equality in the workplace:

- •Since 2019, OVHcloud has published a report on the gender pay gap in France.

Shareholders/

investors- ▶OVHcloud aims to establish long-term trusted relationships with its financial community.

- ▶OVHcloud meets its reporting obligations to the financial community in compliance with best practices, in particular by issuing press releases for its revenue and results publications, in French and English, and by organising conference calls with its Chief Executive Officer and Chief Financial Officer.

- ▶OVHcloud's management and the investor relations team participate in several conferences and roadshows throughout the year, to meet regularly with investors and shareholders. During the 2023 financial year, for example, they met with more than 350 institutional investors

- ▶Dialogue with shareholders is also ensured during General Meetings.

- ▶Lastly, as part of its Universal Registration Document, OVHcloud transparently shares its performance and management of non-financial risks.

Public authorities

- ▶OVHcloud, proactively and when it is called upon, contributes to the debates of public authorities (administrations, regulatory authorities, parliamentarians, etc.) concerning its activities and the challenges within its segment (digital sovereignty, competitive dynamics of the market, the cloud's environmental footprint). The Group shares its vision and technical details of its activities with the aim of influencing public decision-making. The Group shares its positions/proposals directly with these players or in conjunction with representative associations and its ecosystem of partners.

- ▶OVHcloud also organises visits to its infrastructures (datacenters, server production plants), either proactively or on request, to familiarise the public authorities and the players in its ecosystem with the operational reality of its activities.

-

Materiality analysis and CSR risk assessment

OVHcloud developed a Group risk map in 2020, which has been reviewed and updated twice: first in 2022 and again in 2023 (see Chapter 2 of this Universal Registration Document for a description of the Group's risk factors). In addition, the Group created its first materiality matrix in 2022, focusing on CSR issues.

Materiality analysis

In 2022, OVHcloud put together its first materiality matrix by interviewing its external and internal stakeholders, in order to determine the Group's most material CSR issues, i.e., those that have or could have an impact on the Group’s ability to create or protect financial and non-financial value for itself and its stakeholders.

This exercise was carried out in four stages: identification of potential CSR issues, confrontation of these issues with external and internal stakeholders, consolidation of the results and the main lessons learned from the analysis of these results.

Identification of issues

OVHcloud has defined a list of 24 potential CSR issues, subdivided into three categories: environment, business conduct and social/societal.

ENVIRONMENT

BUSINESS CONDUCT

SOCIAL/SOCIETAL

1. Low-carbon trajectory.

2. Environmental display and carbon transparency

of offers and services.3. IT for Green.

4. Resilience to climate change and physical risks.

5. Innovation and R&D for Green IT.

6. Efficient energy management.

7. Responsible water management.

8. Eco-design, circular economy and hardware life cycle.

9. Securing strategic supplies.

10. Responsible supply chain.

11. Reliability and customer trust.

12. Transparent and predictable pricing.

13. Full reversibility and interoperability.

14. Business ethics, transparency and governance.

15. Positive influence policy.

16. Data sovereignty, data compliance,

data governance.17. Cybersecurity and data protection.

18. Diversity and inclusion.

19. Attracting and retaining talent.

20. Employee health, safety and well-being.

21. Fair compensation for all (employees, suppliers

and subcontractors).22. Quality of social dialogue.

23. Impact on local employment pools.

24. Contribution to the digital transition

and digital accessibility.Stakeholder interviews

OVHcloud addressed this list of potential issues with its internal and external stakeholders during interviews, conducted in particular with its customers, suppliers, investors, representatives of its ecosystem (associations, NGOs, partners, etc.) as well as the Group's directors and managers, including the Executive Committee, in order to collect their point of view and expectations regarding each of the issues. The interviews were conducted by OVHcloud's teams, with the exception of investors, who were consulted through a perception study carried out by an external service provider. OVHcloud also consulted its employees (excluding the Executive Committee and other managers) through an online survey.

An interview guide has been drawn up to guide the various interviews. This guide was used as the basis for the online survey tool.

The main question concerned the rating of the issues according to the level of expectation for each of them, according to the following grid:

- ▶0: no expectation. OVHcloud does not have to particularly commit to this issue;

- ▶1: limited. Issue for which OVHcloud can implement some actions, without integrating them into its strategy;

- ▶2: important. OVHcloud should adopt a policy, targets and an action plan concerning this issue;

- ▶3: priority. This issue must be a major strategic priority for OVHcloud.

- ▶management (shown on the horizontal axis of the matrix):

- •the Chairman of the Board of Directors,

- •18 management representatives including the Chief Executive Officer and the entire Executive Committee as well as the main regional managers;

- ▶stakeholders (represented on the vertical axis of the matrix):

- •34 external stakeholder representatives: customers, suppliers, public authorities, investors, members of the OVHcloud ecosystem (associations, partners, NGOs, etc.);

- •178 employees surveyed.

Methodological biases

The voice of the public authorities was expressed by the person responsible for public affairs at OVHcloud.

For investors, the rating was carried out by transposing the 2022 “ESG Investors” perception study carried out by an external service provider to a similar rating grid and a slightly more limited list of issues.

Consolidation of results and formalisation of the matrix

The analysis of quantitative and qualitative data was carried out with the support of a CSR consulting firm, according to the following methodology:

- 1 .consolidation of results: for internal and external stakeholders, the average rating of the issues was established on the basis of an equal weighting of the results within each stakeholder category, then between the categories. For management, the ratings assigned by the Chairman and the Chief Executive Officer were given more weight than the responses of management representatives;

- 2 .formalisation of the matrix: the ratings thus obtained made it possible to place each issue on the horizontal axis (average allocated by management) and on the vertical axis (average allocated by internal and external stakeholders);

- 3 .analysis of the results: the key lessons are drawn from the compilation of the analysis (correlations, dispersions, ranking of issues, comparison according to stakeholders) of the results.

Strong alignment between management and stakeholders

* For the detailed wording of the issues, see the table in the section on identifying issues on page 60.

Main lessons

- ▶Overall, internal and external stakeholders are aligned on the most material issues, particularly those related to the Group’s core business, a sign of a good understanding between OVHcloud and its ecosystem. These are issues relating to data sovereignty, low-carbon trajectory, efficient energy management, cybersecurity and data protection, environmental labelling and carbon transparency, and securing strategic supplies.

- ▶Three major issues stand out in particular, consistent with the Group’s vision and strategic directions:

- •data sovereignty;

- •low-carbon trajectory;

- •efficient energy management.

- ▶Important issues are also aligned on more generic but fundamental issues for the Company's operation such as a responsible supply chain, eco-design, business ethics, responsible water management, attraction and retention of talent, reliability and customer trust, health, safety at work and employee well-being, diversity and inclusion, innovation and R&D for Green IT.

- ▶Regarding deviations (which remain limited), we note that management places particular importance on the attraction of talent and customer trust, whereas stakeholders have strong expectations concerning continuity of service – in terms of cybersecurity and resilience to climate change – and environmental labelling.

- ▶OVHcloud is clearly recognised for issues relating to the differentiation of its offering, linked to its value proposition: price transparency, eco-design, a responsible approach to resource management and, above all, data sovereignty. Nevertheless, expectations are very high regarding these issues, which rank among the most material.

- ▶When asked about the issues on which OVHcloud needs to progress, stakeholders were generally less vocal than management. The most frequently mentioned issues were cybersecurity and data protection, environmental labelling, diversity and inclusion, talent attraction and retention and contribution to the digital transition and digital accessibility.

-

3.1Guaranteeing data sovereignty and freedom

Leading European cloud services provider, OVHcloud, is at the heart of the digital revolution, which opens the way to a multitude of opportunities in terms of applications and technology. In this context, the Group offers its customers cloud solutions covering all their uses – supporting them in their digital transformation, enabling them to innovate by building cloud native applications or helping them leverage the power of data. In fulfilling this mission, the Group offers its customers the freedom to build their most ambitious projects in a secure, compliant and sustainable cloud environment. For OVHcloud, everyone must be able to control their data and be guaranteed that they are secure. Free choice and openness in terms of services and innovation are the foundation of the relationship of trust established with its customers and partners. This also involves a range of services offering the best price-performance ratio and transparent and predictable rates.

3.1.1Defending data sovereignty, security and privacy

OVHcloud’s activities focus on the computing capacity, storage, processing and transfer of its customers’ data, including personal data, as well as business-critical data. Data sovereignty, security and confidentiality form the basis of the Group’s value proposition and the foundation of the relationship of trust that unites it with its customers. OVHcloud ensures the highest level of data protection. This level of excellence is supported by an effective data governance system. The Group is also campaigning for a European cloud, guaranteeing the technological independence of Europe and the sovereignty of its data.

3.1.1.1Highest level of data protection

An absolute priority: ensuring security in the cloud

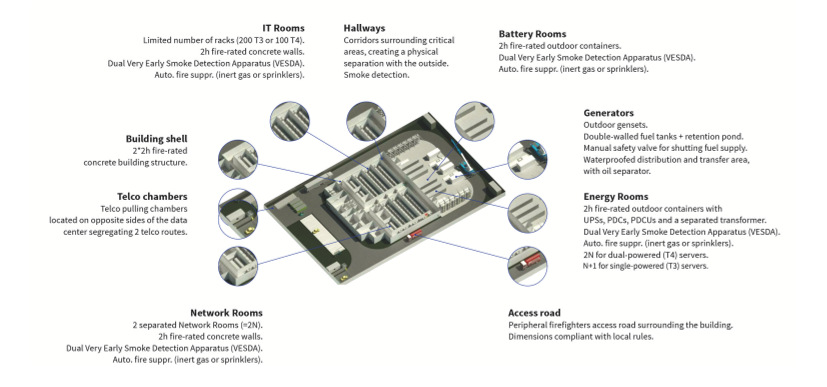

OVHcloud implements security measures at all its datacenters and processes to protect its customers worldwide.

Cybersecurity

OVHcloud considers cybersecurity to be a pillar of its development strategy. The Group's ability to protect its customers' data and processing workloads is a key factor in the trust they place in the Group. The Information Systems Security Policy (ISSP(1)) provides the cybersecurity reference framework for OVHcloud. It describes the context in which it was set up and its three basic principles:

- ▶deployment of a large-scale, industrial approach to security. Security is an integral part of the product development cycle. The security team is constantly involved in deciding what security measures to adopt to prevent and mitigate risks. This approach is based on standardised security measures, architectures that are secure from the outset, and formal, tried-and-tested, highly automated processes. The standardised security measures are supplemented by additional measures in consideration of the specific features of each project. Lastly, OVHcloud operates a permanent threat analysis system based on the continuous system monitoring, enabling it to systematically adapt its operational practices to immediate risks and to respond effectively to security incidents;