URD 2025

-

1.1History

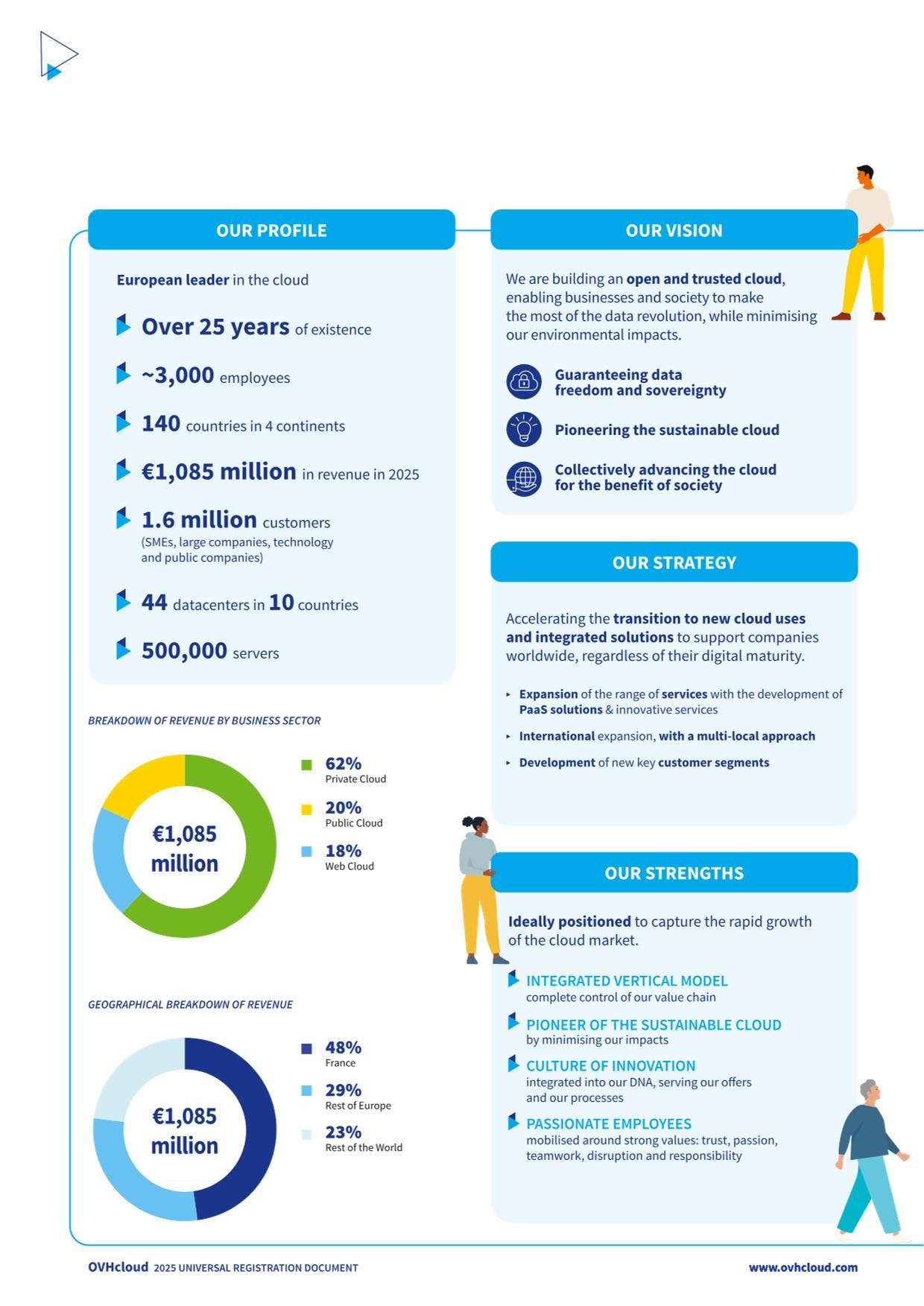

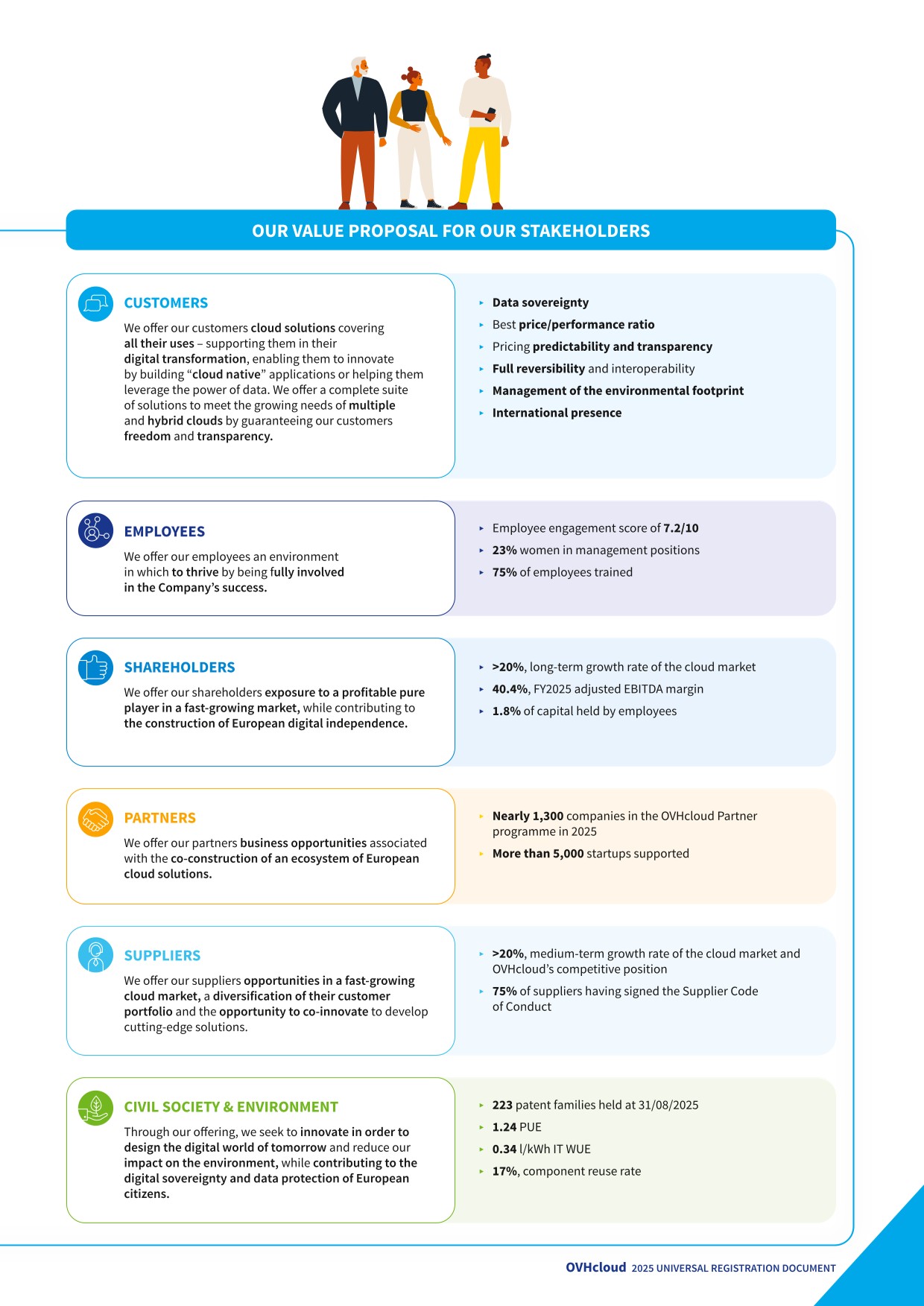

OVHcloud’s position as the leading European cloud provider traces its roots to its founding in 1999 as an internet hosting company in France. Over the past 26 years, OVHcloud has developed significantly, initially by expanding its infrastructure and growing its presence within Europe, and then by diversifying its cloud offerings and expanding its operations globally.

Key developments

1999

Founding by Octave Klaba as one of Europe’s first internet hosting companies.

2000

First top-level .fr and .be domain accreditations.

2002

Manufacturing of the Company’s own servers begins.

2003

First use of proprietary watercooling technology for servers.

2004

Initial geographical expansion into Poland and Spain.

2005

Opening of first datacenter, in Roubaix, France.

2006

Opening of a datacenter in Germany. Deployment of proprietary fibre optic network.

2008

Expansion of offering to include telecommunications and internet access. Expansion into Italy, Portugal and the United Kingdom. Additional datacenter opened in Roubaix, France.

2009

Continued expansion in Europe, including the Netherlands, Ireland, Finland, Lithuania and the Czech Republic. Launch of 10 Gbps Bare Metal servers.

2010

Expansion into cloud services. Opening of third datacenter in Roubaix, France.

2011

OVH becomes Europe’s No. 1 web hosting service. Fourth datacenter opened in Roubaix, France. Launch of Public Cloud offering.

2012-2015

Expansion outside of Europe, including in the United States and Canada. Opening of three new datacenters in France and one in Beauharnois, Canada.

2016

Opening of additional datacenters in Roubaix, France and Beauharnois, Canada. €250 million in capital raised when KKR and TowerBrook Capital Partners become shareholders.

2017

Acquisition of vCloudAir in the United States, VMware’s cloud offering.

2017-2020

Continued geographical expansion with the opening of datacenters in the United States, the United Kingdom, Germany, Poland, Singapore, Australia, France and Canada.

2018

Adoption of “OVHcloud” as the Group’s new name, emphasising its positioning as a cloud service provider. Michel Paulin is appointed Chief Executive Officer. Opening of office in India.

2019

Introduction of Kubernetes technology into Public Cloud solutions as well as a range of high-performance processing units. OVHcloud receives its Hébergeur de données de santé (HDS) health data hosting security certification.

2020

Acquisition of OpenIO and Exten. OVHcloud becomes a founding member of the GAIA-X initiative.

2021

OVHcloud receives its SecNumCloud security certification.

Initial public offering on 15 October 2021, in Paris.

2022

Acquisition of ForePaaS. OVHcloud reaches more than 80 available IaaS and PaaS solutions.

2023

Opening of new datacenters in France and India. S&P Global ratings awards OVHcloud a score of 71/100, reflecting the Group’s commitment to leading the data revolution for a responsible future.

2024

Launch of the third generation of Advance Bare Metal Servers (ADV-Gen3) using AMD EPYC processors.

2025

Launch of On-Prem Cloud Platform, a ready-to-use on-premises cloud platform.

SecNumCloud qualification for Bare Metal Pod, a Private Cloud solution combining strategic autonomy and enhanced security.

Launch of the Public Cloud 3-AZ solution in the Paris region, offering high resilience for data.

-

1.2The cloud computing market

1.2.1Cloud computing

Cloud computing means providing users with storage, computing and network resources on demand. Cloud resources are located in datacenters that house servers and equipment used to process, store and transmit data. Users of cloud computing services can access stored data and instruct processing units to perform computing functions automatically, without the need for human interaction, minimising the computing and storage capacities needed on their devices (such as personal computers, tablets and mobile phones). Wherever they are located, as long as they have an internet connection, users are able to access IT services through the cloud.

Businesses can establish and operate their own datacenters using internal IT staff, or they can outsource some or all functions to cloud service providers such as OVHcloud. For many businesses, the time and financial investment required makes proprietary cloud computing less attractive than outsourcing, which means paying only for the resources they actually use. Additionally, it can be difficult for businesses that are not specialised in IT services to innovate at the requisite levels in order to ensure that their cloud infrastructure provides them with adequate services and protections, such as data security. Internal IT systems also might not be sufficiently scalable to meet peak-load demands (unless businesses maintain costly excess capacity).

Servers maintained in datacenters can be used for multiple functions, each of which is accessed through a “virtual machine” created on the server. The virtual machines are operated and separated from one another through a software platform known as a “virtualisation stack.” Each virtual machine can have its own operating system that permits users to develop and run applications. Through a function known as a “hypervisor,” the server’s capacity is allocated to the virtual machines in accordance with the demands of users. Furthermore, software applications have been written to be bundled in “containers” that run directly on the operating system of the server itself, coordinated through platforms known as “orchestration” systems, which generally take up less space and can provide better performance than hypervisor-based virtualisation stacks.

The ability to create multiple virtual machines in each server or to deploy container-based systems allows a cloud service provider to allocate its capacity among multiple user groups or customers in a secure manner. Service providers can dedicate a server to a single customer (a “Private Cloud” system), allocating the server’s capacity among user groups authorised by the customer. Alternatively, a server can be shared among multiple customers (a “Public Cloud” system). Private Cloud customers generally pay monthly charges for dedicated capacity, whether or not they use that capacity. Public Cloud customers generally pay for the capacity they actually use.

In order to optimise the cost of cloud services, many businesses are deploying “hybrid cloud” strategies, in which they combine on-premises or outsourced Private Cloud capacity for their most sensitive functions and data, with Public Cloud capacity for their less sensitive needs. Customers are also deploying “multi-cloud” strategies, purchasing cloud services from several providers. To meet the growing demand for hybrid cloud and multi-cloud services, a cloud provider must offer packages that allow the various solutions to function as an integrated whole.

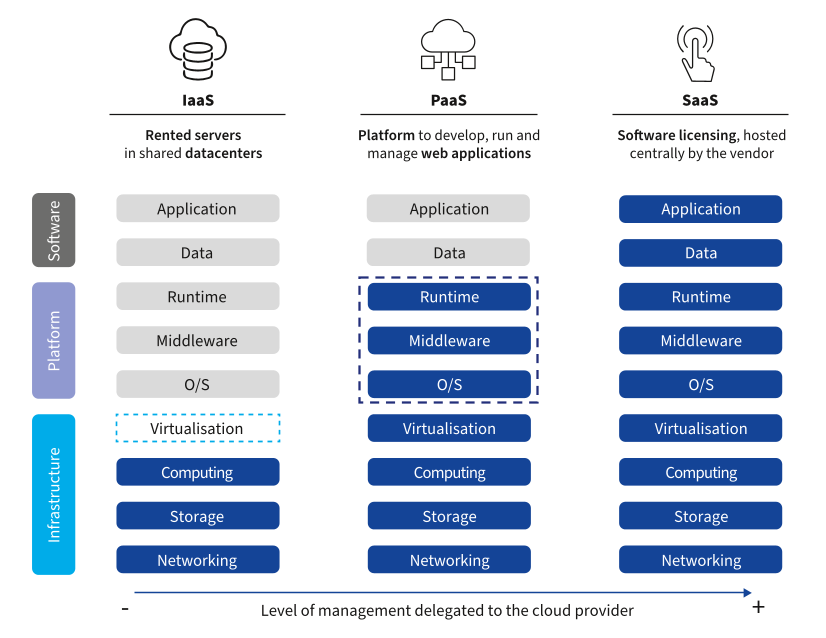

Cloud computing encompasses a range of services that include providing access to infrastructure (Infrastructure-as-a-Service or “IaaS”), selecting and operating platforms such as operating systems, virtualisation stacks and security systems (Platform-as-a-Service or “PaaS”), and offering applications that are developed and can function on cloud platforms (Software-as-a-Service or “SaaS”). These features are illustrated in the following graphic:

The cloud solutions market also includes Web services targeted mainly at individuals and small and medium-sized businesses. The Web Cloud market largely consists of web and domain hosting, including leasing servers for websites, selling secondary services (such as software packages) and domain name registration, renewal and transfer services.

-

1.3Business

1.3.1A comprehensive range of solutions

1.3.1.1Private Cloud

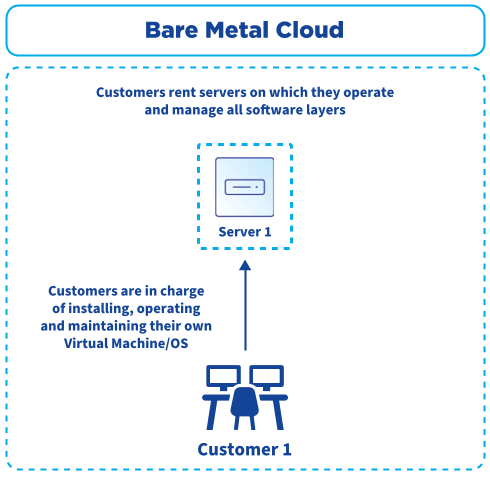

Bare Metal Cloud

OVHcloud’s Bare Metal Cloud service provides dedicated physical servers to customers, who have full control over the server, including the choice of operating system. The Bare Metal Cloud allows them to have a similar experience to the one they would have with on-premises solutions managed by their internal teams, while taking advantage of the benefits offered by outsourcing.

OVHcloud’s main Bare Metal Cloud offering consists of high-end servers and mid-to-high-level services. OVHcloud also has a lower-priced offering marketed as part of the “Eco” range, which uses refurbished servers that provide quality services at a reduced cost, while improving environmental efficiency.

Bare Metal Cloud services provide business customers with high-level computing power and strict service level agreements in a secure environment appropriate for sensitive data applications. The server can be customised to meet customer requirements and can be operated without allocating the server’s capacity to virtual machines through a hypervisor, allowing the customer to use the server’s full capacity. Any unused capacity can be deployed within minutes, although the total capacity is limited by that of the dedicated server.

Bare Metal Cloud customers pay monthly fees that depend on the performance levels they select. They may also choose options (such as server customisation or data backup) for additional fees.

The main uses of Bare Metal Cloud services include the computation of complex data, low latency operations, streaming, online gaming and critical business applications such as ERP and CRM.

In 2025, OVHcloud launched Bare Metal Pod, a sovereign infrastructure that is SecNumCloud 3.2 certified by ANSSI and dedicated to offering the power of the cloud combined with the physical isolation of Bare Metal servers, designed to host critical or sensitive environments.

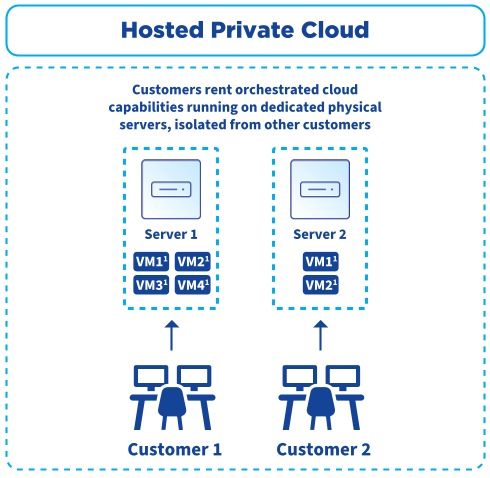

Hosted Private Cloud

OVHcloud offers Hosted Private Cloud services to its business customers, providing servers fully managed by OVHcloud, including the operating system and the virtualisation layer, in partnership with VMware or Nutanix offerings.

OVHcloud’s Hosted Private Cloud services provide customers with private access to servers that can be customised to satisfy their specific requirements. They meet the needs of customers seeking isolation and security, scalable resources and resilience.

The main uses for Hosted Private Cloud services include deployment in hybrid cloud strategies, media encoding, big data analytics and disaster recovery, as well as the storage and processing of sensitive data in key sectors such as healthcare, finance and the public sector.

Since 2021, OVHcloud has been offering SecNumCloud-certified Hosted Private Cloud services. SecNumCloud certification gives customers the assurance of choosing solutions that comply with the highest ANSSI security standards, as well as the guarantee of having solutions tailored to the sensitive data of public authorities and businesses.

On-Prem Cloud Platform

In 2025, OVHcloud launched On-Prem Cloud Platform, a ready-to-use on-premises cloud platform. The launch was marked by the signing of a commercial contract with DEEP. On 31 March 2025, DEEP, part of POST Group, the leader in telecoms and ICT, postal and postal financial services in Luxembourg, and OVHcloud signed a strategic partnership to develop a sovereign cloud in Luxembourg. The DEEP Sovereign Cloud will be based on OVHcloud's On-Prem Cloud Platform (OPCP): an integrated cloud platform (hardware and software), which will be hosted and operated autonomously by DEEP in its own Tier IV certified data centres in Luxembourg, in an offline mode.

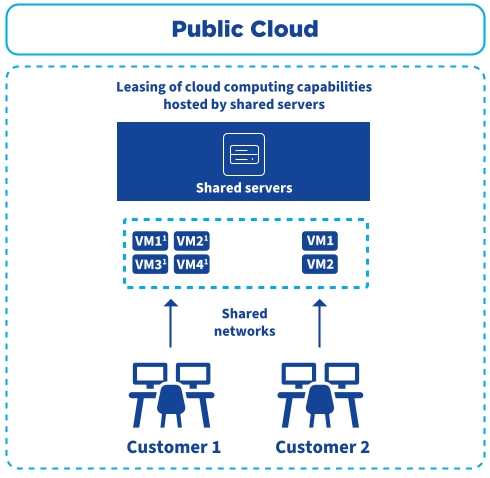

1.3.1.2Public Cloud

OVHcloud offers Public Cloud solutions based on open source technologies such as OpenStack (a platform for deploying processing, storage and networking resources) and Kubernetes (a container orchestration platform that has become a market benchmark). The use of these standard platforms provides customers with easy data transfer capability and deliberately transparent access to source code, facilitating reversibility and eliminating “vendor lock-in”. This feature of the OVHcloud offering is particularly attractive for customers looking to deploy multi-cloud strategies.

Public Cloud solutions provide users with virtually unlimited computing capacity, with the only constraint being the demands of other users and the total installed capacity of the cloud provider. It is possible to deploy new Public Cloud instances automatically and in seconds. As the Public Cloud service is based on shared servers, customisation options are defined by OVHcloud. The flexibility of the hardware architecture offers high service levels.

Public Cloud customers pay usage fees for the capacity they actually use. The OVHcloud model offers much more predictability than models used by hyperscalers and many other competitors. In particular, unlike hyperscalers, OVHcloud does not charge additional fees for outgoing data transfers or API calls, except for block and archive storage, and for services located in Asia-Pacific.

The Group’s Public Cloud offering provides three core cloud computing services: computer performance, storage and network capabilities.

Customers of OVHcloud’s Public Cloud solutions can choose fully scalable Public Cloud services on virtual machines that are hosted on shared servers and networks.

OVHcloud’s Public Cloud service is attractive for customers seeking highly scalable resources, with significant peak management demands across multiple access locations, and a high degree of resilience. This service is used for applications with high-demand bursts and services that use large volumes of data, such as video and music streaming.

OVHcloud’s Public Cloud customers can also choose from a number of on-demand (SaaS) software running on OVHcloud’s Public Cloud servers. In particular, OVHcloud offers its customers access to Microsoft Exchange messaging and calendar solutions, SharePoint data storage and management solutions, and the Office365 business software suite.

As of this year, OVHcloud offers Public Cloud products in the 3-AZ Paris region. This region offers businesses and organisations a presence in three geographically close datacenters (AZ or Availability Zones) so that they can benefit from high resilience and low latency between the three datacenters.

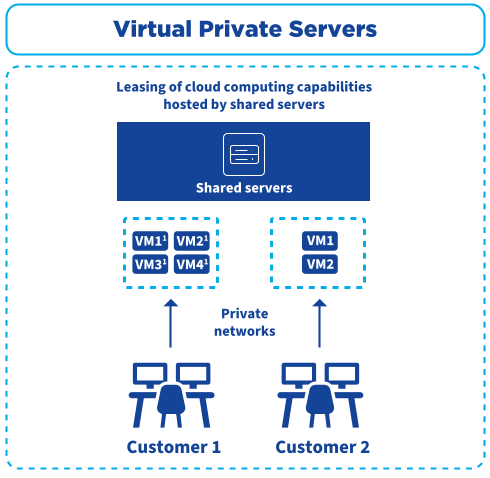

Virtual private servers

OVHcloud also offers a virtual private server option, providing IT capabilities located on shared servers, but with virtual machines isolated through the use of virtual private networks.

The virtual private server option is attractive to customers seeking tailored resources, particularly for short-term operations with volatile workloads and server demand. Virtual private server solutions are used primarily for applications testing and other one-time projects, the management of short-term peak loads and backup functions.

Platform-as-a-Service (PaaS)

As part of its growth strategy, OVHcloud is developing and implementing a comprehensive PaaS offering, overlaying its Private Cloud and Public Cloud IaaS products. In addition to developing products in-house, OVHcloud has announced several partnerships and acquisitions in order to accelerate its development plan, enabling it to offer more than 80 IaaS and PaaS solutions to its customers by the end of the 2024 financial year, mainly in the following areas:

- ▶Storage. OVHcloud now offers its customers a comprehensive portfolio of storage solutions such as Object Storage S3 (High Performance and Standard), Block Storage, File Storage, Snapshot & Backup and Archive;

- ▶Database-as-a-Service. Data management software allows users to manage their databases to enable queries and updates. It includes programmes that execute queries on data and provide visual representation of the data in formats such as spreadsheets, enabling users to build applications faster and automate database management. OVHcloud announced a partnership with MongoDB in April 2021 and a partnership with Aiven in July 2021 to make several types of database available on the OVHcloud infrastructure;

- ▶AI, Machine Learning & Analytics. Artificial intelligence and analytics solutions include tools and services that support data analysis and presentation. OVHcloud is particularly advanced in high-performance computing solutions for artificial intelligence and machine learning, and intends to continue its development in this area. In April 2022, OVHcloud announced the acquisition of ForePaaS, a company specialising in analytics. Over the last two years, OVHcloud has strengthened its artificial intelligence product offering, including AI Notebook, AI Deploy, AI Training, AI App Builder and AI Endpoint, a platform that uses an application programming interface (API) to provide easy access to numerous pre-trained artificial intelligence models (LLM, voice, image, etc.) for rapid integration into applications;

- ▶Security & Encryption. OVHcloud is expanding its offering of identity access management and encryption solutions, including end-to-end encryption that secures customer data in all states. In July 2021, OVHcloud announced the acquisition of BuyDRM, a US company specialising in this area;

- ▶Application platforms. Application platforms are back-end server software solutions that provide developers with a runtime and development environment.

1.3.1.3Web Cloud and Other

OVHcloud has offered Web Cloud services since its founding in 1999. With its leading position in the French market and strong positions elsewhere in Europe, the Web Cloud offering provides a stable, recurring revenue base and regular growth.

- ▶Web hosting and domain names. This includes the leasing of capacity on servers, allowing customers to connect their websites to the internet, as well as domain name registration, renewal and transfers. Customers can choose basic packages offering just one or a few websites, or packages targeted at professionals and developers that wish to host multiple websites, together with email addresses and storage options. OVHcloud offers its customers additional services, such as Secure Socket Layer (SSL) certificates, which enable secure connections between a web server and a browser;

- ▶Telephony and connectivity. Customers can purchase VoIP (Voice over IP) systems for use as switchboards and interactive voice response systems. OVHcloud also offers customers internet access through ADSL and fibre networks, with basic and professional packages;

- ▶Support and services. OVHcloud offers its customers additional levels of support and services, including a range of support, expertise and online services. There are two levels of support offering: i) Business, which corresponds to the level suitable for production environments, or ii) Enterprise, which offers a key account experience for critical production environments. Additional services are proposed in the Professional Services offering, which provides access to technical support and advice during infrastructure migration or IT architecture changes.

OVHcloud’s main customers in the Web Cloud segment are small and medium-sized businesses, as well as certain individual customers and entrepreneurs. Web Cloud customers generally seek secure and reliable web and communications services to establish their web presence, and to digitise business functions.

-

1.4Strategy and targets

1.4.1A strategy built around four pillars

Since 2021 and its IPO, OVHcloud has been deploying its strategic roadmap. The Group has succeeded in:

- ▶developing key customer segments with average ARPAC(3) growth of 60% between 2021 and 2025;

- ▶addressing a broader market by currently offering customers over 40 Public Cloud products;

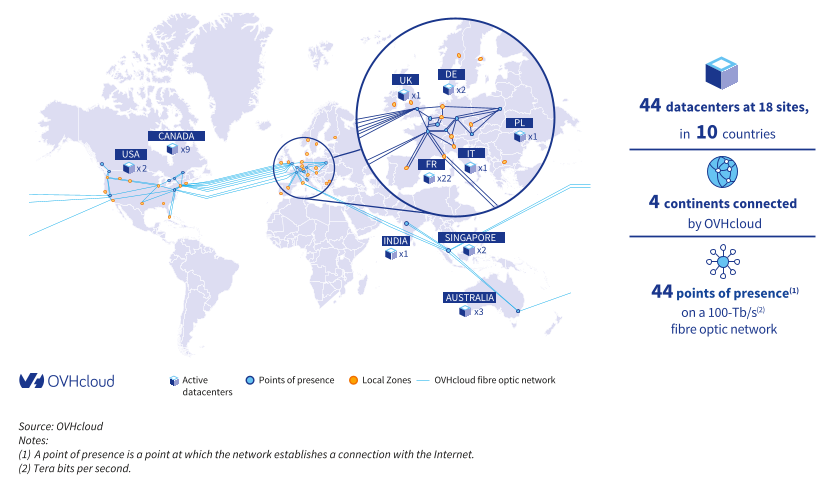

- ▶extending its geographical footprint with the opening of 11 new datacenters since 2021, to reach 44 datacenters by the end of FY2025;

- ▶investing in internal development with cumulative growth capex of around €1,100 million between 2021 and 2025, and external growth opportunities, with three acquisitions since 2021 (BuyDRM in security, ForePaaS in data management, and gridscale, to open Local Zones with minimum capital intensity).

Following these significant investments, OVHcloud introduced a new plan centred around four strategic pillars: (i) Be the data sovereignty reference, (ii) Innovate for next tech revolutions, (iii) Deliver sustainable and profitable growth, and (iv) Maximise cash generation.

Be the data sovereignty reference

OVHcloud already benefits from a structural advantage in that it is not subject to extraterritorial laws, and has developed a successful strategy of certifications with national and international regulators.

In the coming years, the Group will continue to expand its range of certified products, in particular with plans to extend SecNumCloud certification in France to its Public Cloud by end-2025. In addition, this year OVHcloud launched Bare Metal Pod, a sovereign infrastructure that is SecNumCloud 3.2 certified by ANSSI and dedicated to offering the power of the cloud combined with the physical isolation of bare metal servers, designed to host critical or sensitive environments.

In addition, specific services are currently being developed to respond even more precisely to the needs of certain verticals, in particular the public sector and healthcare.

Innovate for next tech revolutions

Innovation is at the heart of OVHcloud’s DNA, and the Group will continue to invest to innovate and prepare for the upcoming technological revolutions, such as artificial intelligence – which is already underway – and quantum computing in the medium term.

With regard to artificial intelligence, OVHcloud is continuing to strengthen its offering, in particular by developing AI solutions that guarantee customer data confidentiality and data sovereignty. OVHcloud offers its customers a broad portfolio of NVIDIA Tensor Core GPUs (H100, A100, L4, L40S) accessible in the Public Cloud and top-of-the line AI models integrating the latest open-source LLMs, like Mistral 8x22B or Llama3, which are notably available on the shelf via the OVHcloud AI Endpoints serverless solution. AI is opening up new opportunities and is at the heart of a revolution, creating extremely high stakes, especially in terms of intellectual property and data confidentiality.

OVHcloud is also ahead of the curve on quantum computing, which will be one of the next technological revolutions of the 21st century. OVHcloud is the only European cloud provider to offer its customers five quantum notebooks and one quantum emulator. The Group supports 14 leading quantum startups and owns one Quandela photonic computer.

Furthermore, in September 2025, OVHcloud became the first global player to strengthen website access security using a quantum computer. In association with Quandela, the Group has introduced quantum entropy-enhanced SSL certificates, improving the random generation of encryption keys.

Deliver sustainable and profitable growth and maximise cash generation

Since 2021, OVHcloud has opened more than eleven new datacenters, invested significantly in the development of new products and set up a programme to improve the resilience of its infrastructure.

Over the next few years, OVHcloud plans to optimise the utilisation rate of its datacenters, which stood at 66% at 31 August 2025 (up six points compared to 2024), improve inventory management and stabilise investments in new products in absolute value terms.

-

1.5OVHcloud’s competitive advantages

1.5.1Data sovereignty champion with a global presence

OVHcloud is the European Cloud leader and the only non-US or non-Chinese player among the ten largest global cloud service providers(4). It is the only major player of its size that is not subject to extraterritorial laws.

-

1.6Legislative and regulatory environment

1.6.1Legislation and regulations in the European Union

As a French cloud service provider, OVHcloud is subject to European regulations across a wide number of areas, including information technology (“IT”) services, cybersecurity, online content moderation and data protection. OVHcloud may also be subject to sectoral regulatory regimes applicable to certain customers and generally applicable regulations such as contract laws and consumer protection policies.

1.6.1.1Cybersecurity

OVHcloud is subject to European regulations aimed at strengthening cybersecurity across the European Union (the “EU”). Transposed into French law on 26 February 2018, Directive (EU) 2016/1148 of 9 July 2016 established requirements for cloud service providers with respect to network and information systems security. The French law(5) transposing Directive (EU) 2016/1148 classifies cloud service providers as digital service providers. As a digital service provider, OVHcloud must guarantee a level of information security adapted to the relevant risks and adopt appropriate organisational and technical measures. Any security incident having a significant impact on the provision of services must be declared to the French National Cybersecurity Agency (“ANSSI”). The French Prime Minister may also open investigations upon receiving information of non-compliance by the digital service provider with security obligations. Fines for non-compliance with security obligations range from €50,000 to €100,000.

The ANSSI has adopted security standards for cloud service providers(6). In particular, cloud companies must set up a security policy for information relating to the service and carry out a risk assessment covering the entire service. If applicable security standards are met, the ANSSI grants the “SecNumCloud” label certifying an enhanced level of security for the storage of sensitive information. In October 2022, the ANSSI extended OVHcloud’s “SecNumCloud” security visa for its Hosted Private Cloud until December 2023. For the protection of critical information systems, the ANSSI recommends that operators of essential services (e.g., gas supply companies, airline carriers, health institutions, banks) use security products and services with an ANSSI security visa.

The role of the European Union Agency for Cybersecurity (the “ENISA”) was strengthened by Regulation (EU) 2019/881 of 17 April 2019 (the “Cybersecurity Act”). The ENISA is tasked with establishing and maintaining a European-wide cybersecurity certification scheme applicable to cloud service providers, including a comprehensive set of rules, technical requirements, standards and procedures. In July 2020, the ENISA published a proposal that would enable cloud service providers to obtain certifications across the EU attesting to the level of security of their services.

In September 2022, the European Commission unveiled its proposed Cyber Resilience Act (“CRA”). This proposal fixes a series of general and organisational cybersecurity requirements for products containing digital elements (for example: software, hardware products, data processing). It aims to adopt a common base within the European Union to limit cyberattacks. The CRA applies differently to supply chain players: manufacturers, importers and distributors. The text is awaiting examination by the European Parliament and then by the Council of the European Union; during this procedure, which may take up to two years, the current text will most likely undergo certain changes. It is therefore still too early to comment on the impacts this text may have on OVHcloud.

1.6.1.2Data protection

As a provider of cloud and telecommunications services, OVHcloud processes, stores and transmits a substantial amount of personal data. As a result, OVHcloud must comply with a number of European regulations and national laws relating to personal data protection.

European Union – the General Data Protection Regulation (GDPR)

A cornerstone of personal data protection in the European Union since it came into force in May 2018, the GDPR has three main objectives: (i) to establish rules relating to the protection of individuals with regard to the processing of their personal data as well as rules relating to the free movement of such data, (ii) to strengthen the application of the regulation by providing a unified legal framework for organisations processing personal data, and finally (iii) to strengthen the responsibility of parties processing personal data (data controllers and processors) by requiring that processing and the tools/applications used be documented.

The GDPR places organisations under strict obligations in terms of information and transparency with regard to the personal data processing they carry out on their own behalf or on behalf of others.

It also confers a number of rights on data subjects with regard to the processing of their personal data, such as the right of access, the right to rectification and the right to erasure (“right to be forgotten”), giving them greater control over the use of their personal data.

The GDPR also requires organisations to implement appropriate technical and organisational security measures for the processing of personal data as soon as a new product or service is designed, in order to ensure that personal data security and confidentiality requirements are met (“Privacy by design”).

Lastly, the GDPR requires organisations responsible for processing personal data to notify the supervisory authority of any breach that is likely to result in a risk to the rights and freedoms of natural persons and data subjects.

Canada, Province of Quebec – An Act to modernise legislative provisions as regards the protection of personal information

Passed on 22 September 2021, the act to modernise legislative provisions as regards the protection of personal information, known as “Act 25”, makes major changes to the act respecting the protection of personal information in the private sector (“ARPPIPS”), giving citizens greater control over their personal data and making organisations more accountable for the way they manage this information. This act establishes new obligations and transparency rules for Quebec companies, such as the appointment of a Data Protection Officer, in order to establish governance policies and practices regarding personal information, conduct privacy impact assessments (PIAs), and respect the new rights granted to individuals with regard to their personal data, in particular the right to require that such information cease to be disseminated, or that it be re-indexed or de-indexed (the right to be forgotten) before being communicated outside Quebec, and ensure that technological products and services offered to the public have settings that provide the highest level of confidentiality by default.

The new responsibilities and requirements applicable to organisations processing personal data came into force progressively in September 2022, 2023 and 2024.

Compliance tools

In order to ensure compliance with applicable data protection regulations, OVHcloud has implemented a personal data management system based on the ISO 27701 standard.

OVHcloud also relies on the Cloud Infrastructure Service Providers in Europe (CISPE) Code of Conduct, with its certified Bare Metal Cloud and Hosted Private Cloud powered by VMWare offerings, to ensure and demonstrate the compliance of its IaaS activities.

1.6.1.3Free movement of non-personal data

Regulation (EU) 2018/1807 of 14 November 2018 (“Regulation on the free flow of non-personal data”) aims to ensure the free flow of non-personal data between EU Member States (the “Member States”) and IT systems in the EU. Non-personal data is either (i) data not linked to identified or identifiable natural persons, or (ii) anonymised personal data. This regulation enables the storage and processing of non-personal data anywhere in the EU, prohibits data localisation and ensures the availability of data for regulatory control.

The Regulation on the free flow of non-personal data also provides that the European Commission must encourage the development of self-regulatory codes of conduct to facilitate portability between service providers. To that end, OVHcloud participated in the drafting of two voluntary codes of conduct on switching cloud service providers and data portability through the working group on switching cloud providers and porting data (“SWIPO”). Published in July 2020, the codes of conduct for Infrastructure-as-a-Service (IaaS) and Software-as-a-Service (SaaS) provide guidance for cloud service providers and customers on switching cloud provider and porting non-personal data. The adoption of such codes of conduct aims to reduce the risks of vendor lock-in (i.e., situations where customers are dependent on a particular provider due to significant switching costs) by cloud service providers. It also provides guidance for customers on the transfer of non-personal data.

1.6.1.4Online content moderation

As a hosting service provider, OVHcloud must comply with a number of laws on content moderation, including those moderating terrorist content, child sexual abuse material and the infringement of intellectual property rights.

European legislation on digital services (Digital Services Act, “DSA”)

Regulation (EU) 2022/2065 of the European Parliament and of the Council of 19 October 2022 on a Single Market for Digital Services and amending Directive 2000/31/EC (“Digital Services Act”) entered into force on 18 November 2022. This new framework aims to harmonise the rules applicable in the different Member States of the European Union and replaces the framework adopted in 2000 with regard to liability of intermediaries in relation to illegal content while maintaining the fundamental principles of freedom of expression and freedom to provide services.

The regulation also establishes new obligations of due diligence and transparency for hosting services such as OVHcloud, both vis-à-vis the authorities and users, particularly on the processing of reports of illegal content. It also increases the level of penalties that can be imposed in the event of a breach of the obligations established by the regulation, with fines of up to 6% of the intermediary service provider’s global annual revenue. A certain number of measures are applicable on a deferred basis over the next two years and involve the adoption of texts at the national level. OVHcloud will carefully monitor their publication in order to comply with its obligations.

1.6.1.5Fight against anti-competitive practices on digital markets

European legislation on digital markets (Digital Markets Act, “DMA”)

Regulation (EU) 2022/1925 of the European Parliament and of the Council of 14 September 2022 on contestable and fair markets in the digital sector and amending Directives (EU) 2019/1937 and (EU) 2020/1828 (“Digital Markets Act”) aims to make the digital sector fairer and more competitive by introducing preventive measures for large digital companies as gatekeepers on the European market. In particular, the regulation provides for several obligations and prohibitions against gatekeeping online platforms and strengthens the sanctioning powers of the European Commission, which will be assisted by an advisory committee and a high-level group. So, for example, gatekeepers must allow users to easily uninstall pre-installed software on their devices and easily unsubscribe from an essential platform service such as a cloud service. Gatekeepers will no longer be able to impose software such as internet browsers or default search engines or reuse users’ personal data for the purpose of targeted advertising without their explicit consent.

Applicable from 2 May 2023, the companies concerned must report to the European Commission and ensure that they are compliant by March 2024 at the latest. The legislation gives the Commission the exclusive power to monitor compliance with their obligations, and imposes new sanctions, including a fine of up to 10% of the company’s total global revenue from the previous financial year.

The adoption of this new legislation is a positive step towards regulating the practices of the dominant digital players on the European market. However, its effectiveness will depend on the means that the European Commission devotes to ensuring compliance with it. OVHcloud will pay particular attention to the forthcoming details regarding the teams tasked with monitoring gatekeepers' compliance.

1.6.1.6Other applicable regulations and initiatives

Telecommunications sector

OVHcloud entities are telecommunications operators in four (4) Member States: Belgium, France, Germany and Spain. OVHcloud is subject to specific obligations when providing telecommunications services. Because the EU and its Member States have been regulating the telecommunications sector for many years, there are a variety of different implementing measures, guidelines and authorities across the EU. OVHcloud entities are also telecommunications operators in the United Kingdom and Switzerland, which have their own telecommunications regulations. The United Kingdom also implemented the requirements of the European Electronic Communications Code into its national regulatory framework prior to Brexit.

The Directive (EU) 2018/1972 of 11 December 2018 established the European Electronic Communications Code. Although this directive has not yet been transposed in all Member States where OVHcloud acts as an operator, several other directives applicable in the telecommunications sectors, such as Directives 2002/19/EC, 2002/20/EC, 2002/21/EC and 2002/22/EC of the European Parliament and of the Council, have been substantially amended. Directive 2018/1972 was transposed into French law in May 2021(7). The key objective of this European Electronic Communications Code is to create a comprehensive set of updated rules to regulate electronic communications and protect EU citizens when they communicate through traditional or web-based services, encourage competition between telecommunications operators, and ensure that national regulatory authorities are protected against external intervention or political pressure.

Health sector

As a cloud service provider, OVHcloud is subject to obligations when the Group provides services to organisations in the health sector. For example, French law requires health data hosting providers (i.e., any person hosting personal health data collected in the course of prevention, diagnosis, care or social and medical monitoring activities on behalf of natural or legal persons having produced or collected such data or on behalf of the patients themselves) to comply with specific obligations. Such obligations include obtaining proper certification or receiving prior approval from public authorities as per the French Public Health Code, and entering into an agreement with customers in the health sector, setting out the mandatory provisions prescribed by Article L. 1111-8 of the French Public Health Code. OVHcloud is also subject to the requirements of other jurisdictions in which it operates, such as Italy, Poland, Germany and the United Kingdom.

In 2016, OVHcloud obtained the “health data host” accreditation and, since 2018, the Group has operated a management system that allows several of its cloud offerings to comply with the requirements of this accreditation. In 2019, OVHcloud obtained the French HDS (hébergeur de données de santé – health data host) certification for its Hosted Private Cloud offering. In 2020, this certification was first extended to OVHcloud’s dedicated servers and then to OVHcloud’s Public Cloud offering and Trusted Exchange in 2021.

Financial sector

Companies in the financial sector (including credit institutions and investment firms) may also be subject to industry-specific obligations that may reflect on OVHcloud in the context of the provision of its services. In particular, in 2019, the European Banking Authority (“EBA”) issued “Recommendations on outsourcing to cloud service providers” applicable to outsourcing arrangements. These recommendations create obligations with respect to information systems security and audit rights for the outsourcing banks, which they must impose on their cloud service providers when using their services. OVHcloud aims to offer contractual conditions applicable to financial service operators that ensure that customers are able to implement an outsourcing policy which is compliant with the EBA’s recommendations and with local European regulations.

Financial service operators may also require OVHcloud to comply with specific national regulations. For instance, OVHcloud may have to comply with French regulations such as those of France’s banking and insurance supervisor, Autorité de contrôle prudentiel et de résolution (“ACPR”) on critical outsourced services such as banking operations. Companies outsourcing critical services must ensure that service providers guarantee the protection of confidential information, implement backup mechanisms in the event of significant difficulties affecting service continuity and provide the ACPR, in carrying out its duties, with access to critical outsourced information. With respect to internal procedures for managing information system security, the American Institute of Certified Public Accountants (“AICPA”) granted OVHcloud SOC I-II type 2 certifications.

With respect to hosting banking data and reducing card fraud, OVHcloud’s main Hosted Private Cloud offering is compliant with the Payment Card Industry Data Security Standard (“PCI DSS”). OVHcloud’s datacenters in France, Canada, the United Kingdom, Germany and Poland comply with PCI-DSS.

On 27 November 2022, the European Commission adopted a Digital Operational Resilience Act for the Financial Sector (“DORA”). Following a proposal by the 2020 European Commission, this regulation imposes a number of requirements on cloud outsourcing arrangements in the financial sector. The proposed regulation covers a broad range of regulated financial entities, including credit institutions (such as banks), central securities depositaries, insurance companies and certain fund managers, among others. It imposes a number of information and communications technology risk management requirements on these financial entities, some of which apply directly to outsourced cloud activities.

In particular, financial sector entities covered by the proposed regulation are required to take a number of steps to address risks in their relationships with third parties, such as cloud service providers, including ensuring that their cloud services contracts provide a full description of the services proposed with qualitative and quantitative performance targets, and include provisions governing integrity, security, personal data protection, recovery in case of failure, rights of inspection and audit, and termination provisions with clear exit strategies. The regulation proposes the approval of standardised contractual terms by the European Commission.

In addition, the regulation imposes a new oversight framework on critical third-party service providers (including cloud service providers), subjecting them to individual oversight plans adopted by the European financial regulatory bodies responsible for supervising banks, securities markets or insurance companies, depending on the sector primarily using the services of the relevant provider. The determination of which services are critical depends on their potential systemic impact, the dependence of financial entities on them for critical functions and the availability of alternatives. The oversight plan can impose requirements in areas such as security and quality, contractual terms, and subcontracting, with financial penalties imposed in case of non-compliance, up to 1% of the service provider’s global revenue in the most recent year. The oversight bodies have broad inspection and auditing rights and investigative powers. The adopted regulation also prohibits financial entities from using a service provider from a country outside the EU for critical cloud functions.

Environmental and industrial risks

Many of OVHcloud’s datacenters are located in former industrial buildings, some of which are classified as presenting environmental or other risks under applicable French legislation. OVHcloud’s datacenters outside of France may also be classified as presenting environmental risks under local regulations. In order to comply with applicable regulations, OVHcloud is sometimes required to submit applications and obtain operating licenses. OVHcloud may be required to take certain remedial measures as part of the application process.

-

1.7Group organisation

1.7.1Simplified organisational chart

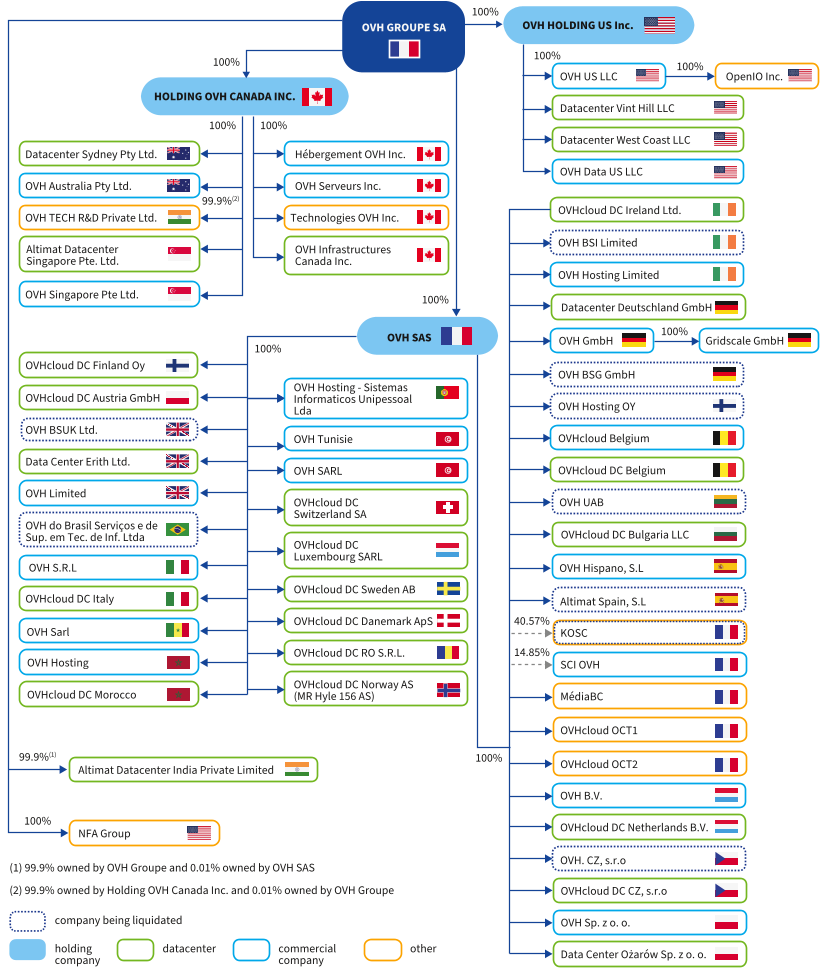

Simplified organisational chart as of the date of this Universal Registration Document

The simplified organisational chart below shows the Company’s legal structure and its consolidated subsidiaries as of the date of this Universal Registration Document. The percentages indicated below represent the percentages of share capital. There has been no significant change in capital ownership since 31 August 2024.

-

Risk factors

and internal controlCentral to its governance mechanism, OVHcloud's risk management system helps the Group achieve its strategic objectives while protecting its assets and reputation. It also helps to mobilise employees around a common approach to risk. OVHcloud is committed to regularly assessing risks and implementing internal controls and action plans to mitigate them.

-

2.1Risk factors /AFR/

2.1.1Risk management system

Risk management system

The risk management system aims to identify, analyse and manage the main risks to which the Group is exposed. It contributes to the control and security of its activities, the effectiveness of its operations and the efficient use of resources.

This system comprises a series of processes aiming to identify, assess and prioritise risks, prevent and control them, promote a risk management culture, and monitor action plans to limit risks. It draws on the skills of the Group's employees, particularly in internal audit and compliance, and on external expertise where required.

CSR risks are covered in Chapter 3 – Sustainability Statement, which includes new CSRD-related requirements, of this Universal Registration Document.

Risk mapping

In 2020, the Group drew up a risk map, which was updated in 2022 and 2023. In 2025, risk mapping was revised with the new Chief Executive Officer, as part of the risk monitoring governance process. Certain risk levels and designations were adjusted.

Carried out across the Group and with the involvement of top management from all the Group's activities, the risk mapping process has made it possible to identify the main risks to which the Group is exposed and to assess their potential impact, taking into account their criticality and probability of occurrence. The Group's risk map also takes into account specific risk mapping exercises on topics such as cybersecurity and anti-corruption, and the monitoring of operational and emerging risks.

The most significant risks have been grouped into different families (strategy and markets, business, human resources, financial, regulatory and legal, information systems). For each risk, a description is provided of their causes and potential impact, as well as the actions taken to manage them.

Risk monitoring governance

Group management, the Board of Directors and the Audit Committee closely monitor risk management and define the most appropriate strategy.

One or more risk owners are appointed for each risk to complete the risk analysis, identify the actions and resources needed to mitigate the risk, and manage the corresponding action plans.

The relevance and progress of the action plans are monitored by members of the Group's Executive Committee, including the Chief Executive Officer, Chief Financial Officer and General Counsel, who review them on a quarterly basis. Risk mapping and action plans are presented annually to the Group's Audit Committee, and more frequently upon request.

-

2.2Insurance and risk coverage

2.2.1Insurance policy

The Group's insurance policy aims to protect its employees, assets, customers and shareholders against the financial consequences of major events.

Its purpose is to ensure business continuity and the operational resilience of the services provided to customers, to reduce the Group's financial exposure in the event of an incident and to strengthen the confidence of all its stakeholders.

- ▶an active prevention and protection policy at its industrial sites, in particular through its “Hyper Resilience” (HYR) prevention plan, designed to protect them against fire risks. The Group has most of its industrial sites audited annually by its brokers' and insurers' prevention engineers;

- ▶awareness-raising sessions on fire risk, with a technical and insurance-based approach, for a wide range of operational staff;

- ▶the development of risk prevention, such as exposure to natural and environmental disasters, therefore enhancing existing insurance coverage.

The insurance policy is part of the Group's overall strategy, taking into account the specific features of its business sector, its growth and its strong international presence.

To ensure that the insurance programme is relevant and appropriate, the Legal Department works constantly to identify risks that could be covered by insurance, in conjunction with all the Departments (Finance, Resilience and QSE, IT, Human Resources, etc.). These risks include:

- ▶all infrastructure-related damage (fire, explosion, natural events, etc.);

- ▶cyber risks (damage, theft, extortion, phone hacking, etc.);

- ▶professional civil liability and operational liability risks;

- ▶liability risks for executive corporate officers and non-executive officers;

- ▶risks related to the safety of employees;

- ▶risks related to business trips;

- ▶risks related to the transportation of goods.

-

2.3Internal control system

2.3.1General internal control framework

2.3.1.1Definition and objectives of the internal control system

Based on the AMF reference framework, OVHcloud has set up an internal control system comprising a set of resources, policies, behaviours, procedures and appropriate actions designed to ensure:

- ▶the application of instructions and guidelines set by management;

- ▶the operation of internal processes to ensure the effectiveness and control of activities;

- ▶the reliability of accounting and financial information;

- ▶compliance with laws and regulations;

- ▶the management of risks.

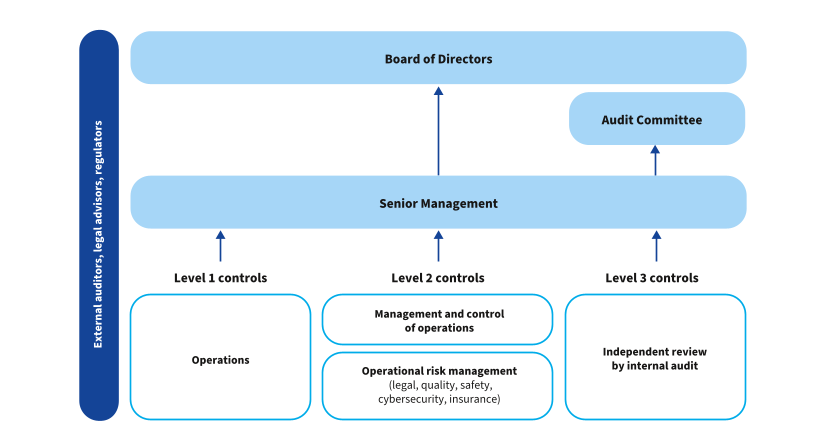

2.3.1.2Internal control governance

Board of Directors and Audit Committee

Delegated by the Board of Directors, the Audit Committee is responsible for monitoring the preparation of financial information and the effectiveness of internal control, risk management and internal audit systems.

See Section 4.1 – Governance overview for a detailed description of the tasks of the Board of Directors and the Audit Committee.

Senior Management

Senior Management is responsible for deploying the internal control system and overseeing risk mapping. To achieve this, Senior Management relies on the support of the Finance Department and the Audit, Internal Control and Risk Department.

Level 1 controls

The first line of control is made up of operations that formalise and implement operational processes to ensure the control of day-to-day operations and their internal control.

Level 2 controls

Internal control is an integral part of each operational department's mission. The management of the operational departments is responsible for checking that the Level 1 procedures and controls are being properly applied by carrying out Level 2 controls, for example via sampling and by implementing application controls and validation circuits. The management control function may also be responsible for carrying out Level 2 controls.

Lastly, the functional departments are responsible for defining the guidelines and controls to be applied by all the commercial and industrial entities and for managing the operational risks in their respective areas: for example, the Legal, Quality, Standards, Safety and Working Environment, Cybersecurity, Human Resources, Finance and Insurance Departments. These functional departments may also be called upon to verify that Level 1 rules have been applied correctly through Level 2 control campaigns.

With a view to strengthening its internal control and improving coordination, OVHcloud has set up an Audit, Internal Control and Risk Department, which reports to the Group's Finance Department. This department assists the operational and functional departments in setting up their Level 1 and 2 control systems. The Audit, Internal Control and Risk Department also carries out internal control campaigns based on the operational departments' self-assessment of whether controls have been applied correctly. The Audit Committee monitors the rollout of the internal control system.

Level 3 controls

The third line of control is the Audit, Internal Control and Risk Department. On the basis of an annual audit plan, approved by Senior Management and the Audit Committee, audits are carried out in a fully independent manner and are the subject of an audit report which identifies any risks and the action plans needed to mitigate them.

-

3.1ESRS 2 – General information

3.1.1Basis for preparation

3.1.1.1BP-1 – General basis for preparation of sustainability statements

This sustainability statement for the 2025 financial year has been drawn up in accordance with the European Union Corporate Sustainability Reporting Directive (CSRD – directive 022/2464), as transposed into French law by Order no. 2023-1142 of 6 December 2023, and in accordance with the EU Taxonomy Regulation on sustainable activities (Regulation (EU) 2020/852) which establishes a classification system to identify environmentally sustainable activities.

This year, OVHcloud is presenting its annual sustainability information for the consolidated Group in accordance with the European Sustainability Reporting Standards (ESRS), as required by the CSRD.

The same scope of consolidation is used as for OVHcloud's consolidated financial statements. Exclusions from this scope will be specified in the relevant section, where applicable.

Sustainability matters have also been analysed across the Group's upstream and downstream value chains, as have policy and action plans where applicable.

The sustainability statement covers all of OVHcloud's operations, covering the Group's upstream and downstream value chains. The policies, actions and targets are applied throughout the value chain in question, in order to address the impacts, risks and opportunities (IROs) that have been determined as material under the double materiality analysis.

This first report has been drawn up to the best of our understanding of ESRS requirements. This first financial year of applying the directive and materiality analysis is marked by uncertainties over the interpretation of the requirements, the absence of established processes and comparative data, in a few rare cases, as well as a number of difficulties in collecting data, particularly within the value chain.

OVHcloud has not used the option to omit specific information corresponding to intellectual property, know-how or the results of innovation.

3.1.1.2BP-2 – Disclosures in relation to specific circumstances

Time horizons

Unless otherwise specified, the terms "short-", "medium-" and "long-" term used in the analysis are used as defined by ESRS 1. As the reporting period for this analysis starts at end-2024, short-, medium- and long-term are defined as one year or less (2025), two to five years (2026 to 2029) and more than five years (2030 and beyond) respectively.

Use of estimates

In some cases, the Group has used estimates, particularly when obtaining information on the value chain in the case of greenhouse gas (GHG) emissions, or has made interpretations, particularly for the metrics requested for resource inflows, which cannot be measured comprehensively. These estimates are described in the methodological note in Section 3.2.5 – Methodological note for assessing the environmental footprint.

Included by reference

Datapoint

Reference document

Reference document section

ESRS 2 – GOV-1

2025 Universal Registration Document

4.1.2.2 Detailed presentation of the members of the Board of Directors

ESRS 2 – GOV-1

2025 Universal Registration Document

4.1.12 Duties, operation and work of the committees

ESRS 2 – GOV-2

2025 Universal Registration Document

4.1.9 Powers, duties, operation and work of the Board of Directors

ESRS 2 – GOV-3

2025 Universal Registration Document

4.5.2 Compensation and benefits paid to executive corporate officers and non-executive officers

ESRS 2 – GOV-5

2025 Universal Registration Document

2. Risk factors and internal control

ESRS 2 – SBM-1

2025 Universal Registration Document

1. Business overview

ESRS 2 – SBM-3

2024 Universal Registration Document

3. Materiality analysis and CSR risk assessment

ESRS E1 – GOV-3

2025 Universal Registration Document

4.5 Compensation and benefits

European Taxonomy

2025 Universal Registration Document

1.3.1.1 Private Cloud

European Taxonomy

2025 Universal Registration Document

1.3.1.2 Public Cloud

European Taxonomy

2025 Universal Registration Document

1.3.1.3 Web Cloud & Other

European Taxonomy

2025 Universal Registration Document

2.1.2.4 Financial risks

European Taxonomy

2025 Universal Registration Document

5. Note 4.3 Revenue

ESRS S1 – SBM-3

2025 Universal Registration Document

4.5 Compensation and benefits

ESRS S4 – SBM-3

2025 Universal Registration Document

1.3.2 Customer segmentation

-

3.2Environment

3.2.1ESRS E1 – Climate change

At the forefront of the sustainable cloud, since its creation, OVHcloud has integrated sustainability at the heart of its business model by developing industrial innovations to limit its environmental impact. During the 2025 financial year, OVHcloud pursued its climate performance trajectory. On the strength of its commitment to the SBTi, OVHcloud is making climate change mitigation an important part of its Group strategy.

3.2.1.1GOV-3 – Integration of ESG-related performance in executive compensation

OVHcloud has included environmental criteria directly linked to the achievement of its ESG objectives into executive variable compensation (see Sections 3.1.2.3 – GOV-3 – Integration of sustainability-related performance in incentive schemes and 4.5 – Compensation and benefits in Chapter 4 of the URD).

3.2.1.2SBM-3 – Material IROs and their integration into strategy and business models

The table below lists the IROs related to climate change that OVHcloud estimated as material during the double materiality assessment:

Topic

Sub-topic

Type of IRO

Position in the value chain

Time horizon

IRO description

IRO number

Climate

changeClimate

change mitigationNI

OO

ST

Direct GHG emissions generated by datacenters (use of fossil-fueled backup generators, refrigerant leaks, etc.) contributing to climate change

1

NI

OO

ST

Indirect GHG emissions generated by energy purchases to power servers, mainly produced from non-renewable sources, contributing to climate change

2

NI

usVC

ST

Indirect GHG emissions generated in the upstream value chain (production and transport of electronic components, construction of buildings, etc.), contributing to climate change

3

O

OO

ST

Implementation of energy efficiency measures (watercooling) leading to a reduction in scope 2 emissions and related expenditure

4

Climate

change adaptationNI

VC

MT

Lack of or insufficient adaptation to physical risks (natural disasters or extreme climatic events) resulting in a direct threat to the economic, social, physical and psychosocial integrity of end-users (downstream value chain)

5

R

OO

MT

Extreme physical or climatic event causing disruption (or even interruption) to the Group's growth due to a supply disruptions in the upstream value chain

6

R

usVC

MT

Extreme physical or climatic event (excluding access to water) causing disruption (or even interruption) to datacenter operations, resulting in reputational damage, loss of revenue and increased costs (penalties, infrastructure repairs)

7

R

OO

MT

Reinforcement of local regulations on climate change adaptation, generating costs (e.g., investment in infrastructure adaptation)

8

Energy

NI

OO

ST

Energy consumption in the Group's own operations applying pressure on fossil fuel resources

9

NI

usVC

ST

Energy consumption in its value chain, applying pressure on fossil fuel resources

10

Abbreviations:

NI = negative impact; PI = positive impact; R = risk; O = opportunity; VC = value chain; usVC = upstream value chain; dsVC = downstream value chain; OO = own operations;

ST = short term, less than one year; MT = medium term, one to five years.- ▶two physical risks:

- •extreme physical or climatic event causing disruption (or even interruption) to the Group's growth due to a supply shortage in the upstream value chain,

- •extreme physical or climatic event (excluding access to water) causing disruption (or even interruption) to datacenter operations, resulting in reputational damage, loss of revenue and increased costs (penalties, infrastructure repairs);

- ▶one transition risk:

- •reinforcement of local regulations on climate change adaptation, generating costs (e.g., investment in infrastructure adaptation).

In its assessment, OVHcloud takes into account the environmental realities associated with its business model, including external requirements to reduce greenhouse gas emissions and how climate change-related risks affect its business and its value chain. The risks associated with climate change include natural disasters and extreme climatic events, as well as the tightening of regulations governing companies as they adapt to climate change. In this context, a climate risk assessment was carried out based on the analysis of climate risk scenarios described below.

Analysis of climate risk scenarios for OVHcloud

In 2024, OVHcloud carried out a climate risk analysis across all its industrial sites (datacenters and assembly centres), as well as the Roubaix and Croix offices (they share buildings with industrial sites).

The latter, carried out by an external body, uses a climate risk analysis to assess the physical risks for four climate change scenarios mentioned by the IPCC (Intergovernmental Panel on Climate Change), as well as the regional loss experience over four different time horizons (2030, 2040, 2050, 2100), according to which risks may vary (for example, the frequency of heatwaves increasing from 2030, and marine submersion in 2100). The four scenarios, known as SSPs (Shared Socio-economic Pathways), are as follows, ranging from the least risky to the most risky:

- ▶Scenario SSP1-2.6: the scenario describes a future focused on sustainable development, with a global transition to clean energy, reinforced governance and low-carbon lifestyles. CO₂ emissions are falling, limiting warming to around 1.8°C by 2100 compared with the pre-industrial era. This scenario significantly reduces the intensity and frequency of extreme weather events compared with warmer trajectories, while remaining in line with the Paris Agreement.

- ▶Scenario SSP2-4.5: this scenario extends current socio-economic trends, with moderate growth, slow technological progress and persistent inequalities. CO₂ emissions are expected to remain stable until 2050 and then decline, leading to an average global warming of around +2.7 C by 2100 compared with the pre-industrial era. The challenges are medium to high in terms of mitigation and adaptation.

- ▶Scenario SSP3-7.0: a scenario marked by a resurgence of nationalism, low investment in education and technology, and slow and unequal economic growth. In this scenario, GHG emissions are set to double between now and 2100, leading to global warming of around +3.6 C to +4.6 C. The challenges for mitigation and adaptation are very high.

- ▶Scenario SSP5-8.5: intensification of energy-intensive lifestyles, fuelled by massive use of fossil fuels, while benefiting from strong growth and technological progress. In this scenario, CO₂ emissions are already set to double around 2050, and could triple by the end of the century, with global warming reaching around +4.4 C by 2100 (between +3.3 C and +5.7 C depending on the model). Despite high adaptive capacity, the absence of climate policies makes this scenario very risky.

Potential expected effects of the physical risks associated with climate change

Depending on the scenarios, their time horizon and their severity, the potential exposure to physical risks would be the following:

- ▶regarding extreme natural disasters: an increase in events such as floods, droughts, forest fires, cyclones and tsunamis, which can damage infrastructure and disrupt operations;

- ▶regarding resource shortages: risks of occasional or permanent shortages impacting operations and, consequently, a potential tightening of regulations (stricter standards on energy management, water use and eco-design).

- ▶increased investment: the regulatory environment becomes more complex in terms of environmental standards and compliance, requiring additional resources to ensure compliance;

- ▶increased operating costs: for example, heat waves can increase the operating costs of cooling systems. This phenomenon also impacts the sites as regards maintaining good working conditions for the Group's employees;

- ▶disruption of services: inability to provide services in accordance with contractual conditions, resulting in financial compensation or additional costs;

- ▶shortages of raw materials: climate change may cause shortages, making raw materials more expensive.

3.2.1.3IRO-1 – Description of the processes to identify and assess material IROs

OVHcloud identified climate-related material IROs as part of its double materiality assessment, as described above.

As part of its assessment and evaluation of physical risks, the Group relied on historical data, mainly on optimistic and sometimes more pessimistic scenarios, which predict an increase in the frequency and intensity of extreme weather events such as floods, droughts, forest fires, cyclones, etc., that could damage physical infrastructures and disrupt the Group's operations or have a negative impact on its value chain. Scenario SSP1-2.6 was also taken into account in the context of a financial risk generated by the strengthening of environmental regulations causing additional costs.

For the purposes of climate change mitigation, the SSP1 and SSP2 scenarios were considered. Materiality was established by taking into account the level of GHG emissions as they currently stand, without any means of remediation and with a business-as-usual approach. As a topical issue, the environmental impact of datacenters and their emissions is inevitably a key topic for the Group.

With regard to energy, due to the impact of datacenters on energy appropriation – particularly with the growth of generative AI (artificial intelligence) – the Group identified two negative impacts both for its own operations and for its value chain.

3.2.1.4E1-1 – Transition plan

3.2.1.4.1Mitigation plan

OVHcloud is putting GHG emissions reduction at the heart of its ambitions, by focusing on three main priorities:

- ▶reduction of compressible emissions by 2030;

- ▶involvement of the ecosystem: partners, customers, suppliers and employees in a process to reduce their carbon footprint;

- ▶contribution to increasing carbon sinks for all residual emissions.

OVHcloud developed a short-term strategy leading to the objectives described above. These objectives have been developed by incorporating the resources required to achieve them into the Group’s business plan.

Basis of analysis

OVHcloud has been committed since 2023 to a process following the SBTi, an international benchmark that helps organisations to align their decarbonisation strategy with the pathway defined by the Paris Agreement.

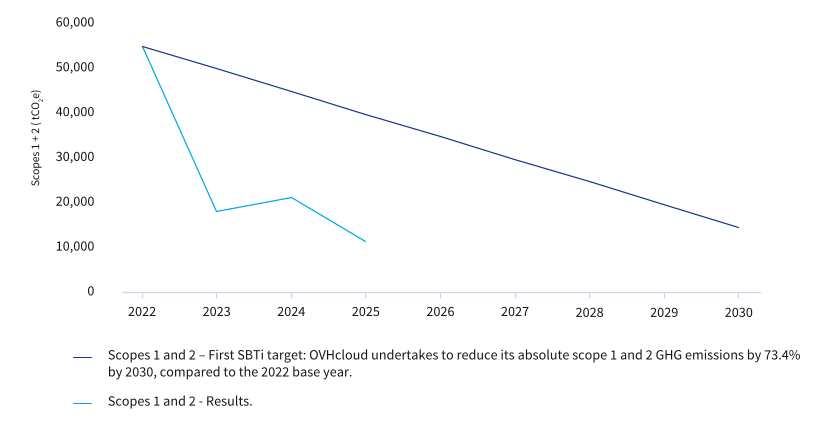

The SBTi deemed OVHcloud's two near-term objectives, established according to a specific sectoral pathway (softwares & services), as being compatible with the 1.5°C global objective.

The reduction in compressible emissions is reflected in the near-term commitments made and validated by the SBTi at the end of 2024.

Scope

Type

Ambition

Target year

Base year

Near-term 1

1 and 2

Absolute

-73.40%

2030

2022

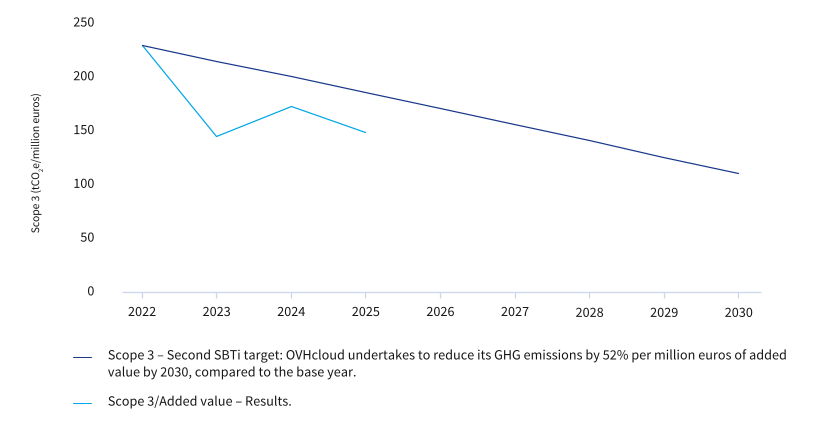

Near-term 2

3

Economic intensity (GEVA(1))

-52.00%

2030

2022

- (1)GEVA: Greenhouse gas Emissions per unit of Value Added, expressed in tCO2e per million euros of value added. Value added is defined as the sum of Recurring EBITDA and staff costs, in millions of euros.

Exclusion or non-exclusion of the EU Paris-aligned Benchmarks

OVHcloud is not engaged in activities meeting the exclusion criteria of Articles 12.1 (1) and 12.2 (2) of Commission Delegated Regulation (EU) 2020/1818 of 17 July 2020.

Locked-in emissions

OVHcloud has no locked-in emissions, as the Company's assets are mainly powered by electricity grids.

Explanation of decarbonisation levers and action plan

- ▶decarbonising the energy mix and improving energy efficiency (scopes 1 and 2);

- ▶purchasing more efficient equipment and implementation of circularity (scope 3).

An exhaustive list of decarbonisation levers and their implementation is presented in Section 3.2.1.6 – E1-3/E4 Actions and targets in relation to climate change policies.

Approval of the plan by the administrative, management and supervisory bodies

The near-term commitments and Group CSR policy were approved by the Group's Executive Committee and Senior Management, signatories of the SBTi commitment letter.

3.2.1.4.2Adaptation plan

In terms of adaptation, OVHcloud has prioritised adaptation to physical risks that could lead to business interruption.

These initiatives are part of a proactive approach to adapting to the impacts of climate change, thereby ensuring the sustainability of OVHcloud's infrastructure and services.

The Group implemented the “hyper resilience” program, aimed at strengthening physical security and continuity of services in the face of extreme events. This programme includes the construction of datacenters that meet enhanced security standards.

In addition, through the analysis of climate scenarios, specific action plans for each site were drawn up and presented to the risk monitoring governance body. Measures were taken to mitigate the prevailing risks in order to limit the risk of business interruption or service interruptions (hail, storms, cold weather, flooding, etc.) at the various locations where the Group's infrastructures are located. The Group also carries out risk analyses before acquiring new sites.

The Group is still studying medium- and long-term priorities for reducing its exposure to the risks quantified in the various scenarios.

3.2.1.5E1-2 – Policies related to climate change mitigation and adaptation

Policy

Topic

In charge of policy implementation

Topics covered

CSR policy

Climate change mitigation & GHG emissions

Strategy Department

Improve energy efficiency

Draw up contracts regarding the supply of renewable electricity

Reduce GHG emissions

Improve environmental transparency

Supplier Code of Conduct

Climate change mitigation & GHG emissions

Purchasing Department

Reduce GHG emissions

CSR policy

Energy

Strategy Department

Improve energy efficiency

Draw up contracts regarding the supply of renewable electricity

Adhere to the Energy Code of Conduct

Supplier Code of Conduct

Energy

Purchasing Department

Improve energy efficiency

Risk management policy

Climate change adaptation

Risk and Internal Control Department

Manage physical risks

CSR policy

Climate change adaptation

Strategy Department

Adapt to climate change through vertical integration and a circular, resilient approach to IT server production

OVHcloud launched its approach to climate change in 2022, fine-tuning its objectives and structuring its approach by mobilising various players in the Group and its value chain. With this in mind, various Group departments are supporting this transition by developing committed policies.

The CSR policy covers all Group entities with regard to environmental topics and defines environmental targets.

The Supplier Code of Conduct and the sustainable procurement policy reinforce this approach by incorporating climate change-related criteria. The Purchasing Department requires its suppliers to reduce their GHG emissions, by prioritising low-carbon solutions and raising their employees' awareness of climate matters, and to provide OVHcloud with the necessary data to calculate its own carbon emissions accurately and within a reasonable timeframe. It also requires its suppliers to commit to improving their energy efficiency.

3.2.1.6E1-3/E1-4 – Actions and targets related to climate change policies

Topic

coveredTarget

Methodology

for setting targetsScope

Timing

FY2025

annual resultsActions

Improve

energy

efficiencyPUE lower than 1.26

Continuous

improvement of PUEDirectly held datacenters excluding BHS1-7

Continuous

1.24

Deploy latest-generation cooling modules

Participate in the Code of Conduct in relation to energy efficiency in datacenters

Modernise the oldest datacenters

Disconnect unused equipment

Deploy more efficient equipment in the electricity chain

Optimise operating temperatures

Continue research and development on cooling systems

Maintain and extend ISO 50001 certification for our datacenters

Implement the energy performance plan

Explore and implement recovery systems

Draw up contracts regarding the supply of renewable electricity

100% REF (Renewable Energy Factor)

To achieve its decarbonisation objectives, the Group must source 100% of the energy it purchases from renewable sources

Directly held datacenters

2025

100%

Draw up PPAs (Power Purchase Agreements)

Acquire Energy Attribute Certificates

Substitute domestic heating oil with HVO 100 (100% renewable biofuel made from vegetable oils, residual oils or waste)

Reduce scope 1 and 2 GHG emissions

Target of reducing scope 1 and 2 GHG emissions by 73.4% by 2030

Near-term SBTi methodology

Group

2030

79.4% reduction (in line with the trajectory)

Improve energy efficiency

Draw up contracts regarding the supply of renewable electricity

Reduce fugitive emissions associated with HFCs (hydrofluorocarbons)

Reduce scope 3 GHG emissions

52% of scope 3 emissions per unit of value added by 2030

Near-term SBTi methodology

Group

2030

36% reduction (in line with the trajectory)

Implement circularity for IT equipment

Buy more efficient equipment

Adopt an optimised freight model

Better travel

Manage IT assets more effectively

Improve environmental transparency

Roll-out the environmental reporting tool for customers (Impact tracker)

Internal project management

Group

2026

Rolled out

Provide customers with the GHG emissions of their cloud service (continuity with the carbon calculator)

Improve energy efficiency

Constant attention is paid to energy efficiency, particularly watercooling which is the foundation and cornerstone of the cooling technologies rolled out for over 20 years and used on a large scale. This technology eliminates the need for air conditioning in server rooms, with significant benefits in terms of cost management and reduced environmental impacts.

Direct watercooling removes heat from the most energy intensive components, such as processors (CPU, CGU), and the air (which is then cooled inside the rack using water through a heat exchanger) and removes heat from other components. The heated water is then cooled using dry cooling towers. OVHcloud stands out with its closed circuit system that reduces the leakage of fluid, and by the use of dry coolers and the absence of air conditioning in the server rooms. In addition to being very efficient in terms of water and energy consumption, OVHcloud’s watercooling technology has relatively low maintenance costs.

The deployment of the latest-generation cooling systems (5th generation) continued in 2025, enabling the infrastructure to be operated at higher water temperature regimes, with higher efficiency (partial PUE of 1.06).

The roll out of new electrical units is being accompanied by the installation of more efficient equipment (high-yield UPS or inverters, busbars).

The plan to modernise the oldest datacenters, such as RBX1 (Roubaix 1), is currently underway. This upgrade will improve the Group's energy efficiency, as the older datacenters are less energy-efficient than newer ones.

Remaining within the framework of eliminating waste, the Company's own datacenters are implementing optimised settings in rooms that are still air-conditioned (network rooms, technical rooms or battery rooms). Servers not in use are switched off to avoid unnecessary energy consumption.