URD 2022

-

Presentation of the Group

-

1.1History

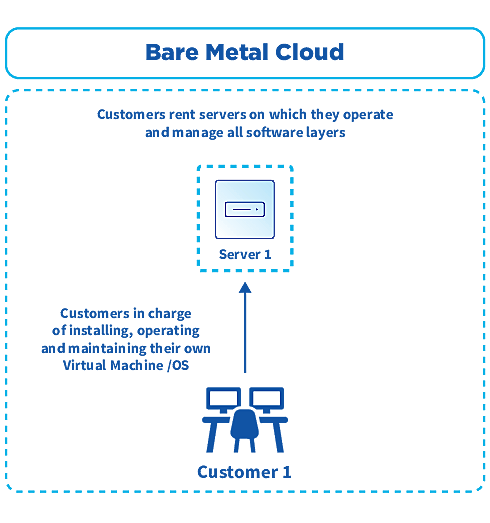

OVHcloud’s position as the leading European cloud provider traces its roots to its founding in 1999 as an internet hosting company in France. Over the past twenty years, OVHcloud has expanded significantly, initially by developing its infrastructure and growing its presence within Europe, and then by diversifying its cloud offerings and expanding its operations globally.

Key developments:

1999

OVH founded by Octave Klaba as one of Europe’s first internet hosting companies.

2000

First .fr and .be top-level domain accreditations.

2002

OVH begins manufacturing its own servers.

2003

First use of proprietary water-cooling technology for servers.

2004

Initial geographical expansion into Poland and Spain.

2005

Opening of first data centre, in Roubaix, France.

2006

Opening in Germany. Deployment of proprietary fibre optic network.

2008

Expansion of offering to include telecommunications and internet access. Expansion into Italy, Portugal and the United Kingdom. Additional data centre opened in Roubaix, France.

2009

Continued expansion in Europe, including the Netherlands, Ireland, Finland, Lithuania and the Czech Republic. OVH launches 10 Gbps Baremetal servers.

2010

Expansion into cloud services. Opening of third data centre in Roubaix, France.

2011

OVH becomes Europe’s No. 1 web hoster. Fourth data centre opened in Roubaix, France. Launch of Public Cloud offering.

2012-2015

Expansion outside of Europe, including in the United States and Canada. Opening of three new data centres in France and one in Beauharnois, Canada.

2014

Launch of OpenStack Project for Public Cloud and Vrack (a private network on dedicated servers).

2016

Additional data centres in Roubaix, France and Beauharnois, Canada. OVH raises €250 million in capital when KKR and TowerBrook Capital Partners become shareholders.

2017

Acquisition of vCloudAir, VMware’s former cloud offering. From 2017-2020, continued geographical expansion by opening data centres in the United States, the United Kingdom, Germany, Poland, Singapore, Australia, France and Canada.

2018

“OVHcloud” is adopted as the Group’s new name, emphasising its positioning as a cloud service provider. Michel Paulin is appointed as Chief Executive Officer. Opening of office in India.

2019

OVHcloud introduces Kubernetes technology into its Public Cloud solutions as well as a range of high-performance processing units. It expands its partnerships internationally. OVHcloud receives its Hébergeur de Données de Santé (HDS) security certification.

2020

Acquisition of OpenIO and Exten. OVHcloud becomes a founding member of the GAIA-X initiative.

2021

OVHcloud continues to expand its partnerships, announcing collaborations with IBM and Atempo, Atos, Orange Business Services, Capgemini, mongoDB and Thales. OVHcloud receives its SecNumCloud security certification.

OVHcloud was listed on the compartment A of Euronext Paris regulated market on 15 October 2021 to finance its growth strategy, including the financing of its geographical expansion, the construction of data centres, the development of new products and external growth transactions where applicable.

2022

Acquisition of ForePaaS. OVHcloud reaches more than 80 available IaaS and PaaS solutions.

-

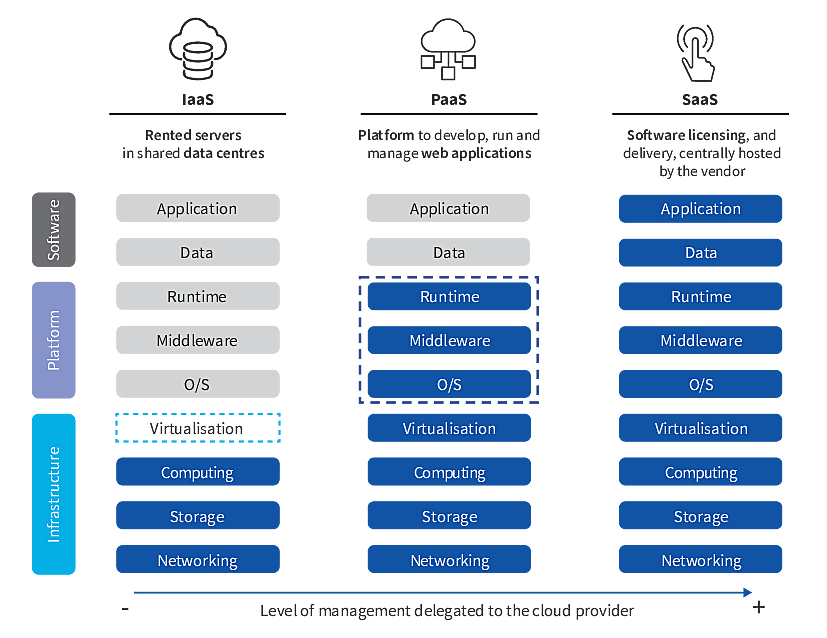

1.2The cloud computing market

1.2.1Cloud computing

Cloud computing means providing users with storage, computing and network resources, over the internet, on demand. Cloud resources are located in data centres that house servers and equipment used to process, store and transmit data. Users of cloud computing services can access stored data and instruct processing units to perform computing functions automatically, without the need for human interaction, minimising the computing and storage capacities needed on their devices (such as personal computers, tablets and mobile phones). Wherever they are located, so long as they have an internet connection, users are able to access IT services through the cloud.

Businesses can establish and operate their own data centres using internal IT staff, or they can outsource some or all functions to cloud service providers such as OVHcloud. For many businesses, the time and financial investment required makes proprietary cloud computing less attractive than outsourcing, which involves paying only for the resources they actually use. Additionally, it can be difficult for businesses that are not specialised in IT services to innovate at the requisite levels in order to ensure that their cloud infrastructure provides them with adequate services and protections, such as data security. Internal IT systems also might not be sufficiently scalable to meet peak-load demands (unless businesses maintain costly excess capacity).

Servers maintained in data centres can be used for multiple functions, each of which is accessed through a “virtual machine” created on the server. The virtual machines are operated and separated from one another through a software platform known as a “virtualisation stack.” Each virtual machine can have its own operating system that permits users to develop and run applications. Through a function known as a “hypervisor,” the server’s capacity is allocated to the virtual machines in accordance with the demands of users. More recently, software applications have been written to be bundled in “containers” that run directly on the operating system of the server itself, coordinated through platforms known as “orchestration” systems, which generally take less space and can provide better performance than hypervisor-based virtualisation stacks.

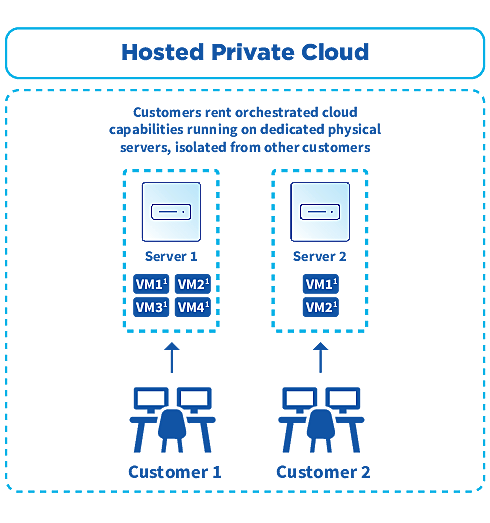

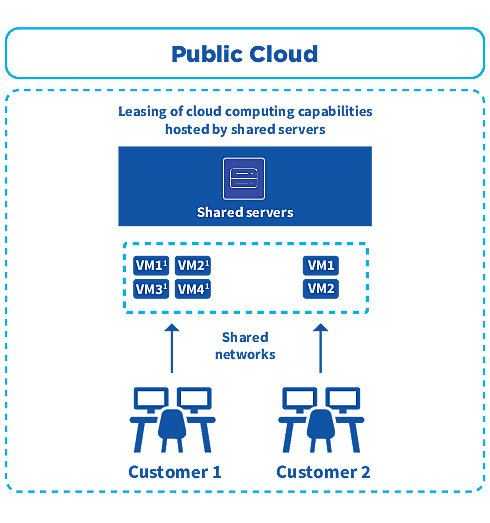

The ability to create multiple virtual machines in each server or to deploy container-based systems allows a cloud service provider to allocate its capacity among multiple user groups or customers in a secure manner. Service providers can dedicate a server to a single customer (a “Private Cloud” system), allocating the server’s capacity among user groups authorised by the customer. Alternatively, a server can be shared among multiple customers (a “Public Cloud” system). Private Cloud customers generally pay monthly charges for dedicated capacity, whether or not they use that capacity. Public Cloud customers generally pay for the capacity they actually use.

In order to optimise the cost of cloud services, many businesses are deploying “hybrid cloud” strategies, in which they combine on-premises or outsourced Private Cloud capacity for their most sensitive functions and data, with Public Cloud capacity for their less sensitive needs. Customers are also deploying “multi-cloud” strategies, purchasing cloud services from several providers. To meet the growing demand for hybrid cloud and multi-cloud services, a cloud provider must offer packages that allow the various solutions to function as an integrated whole.

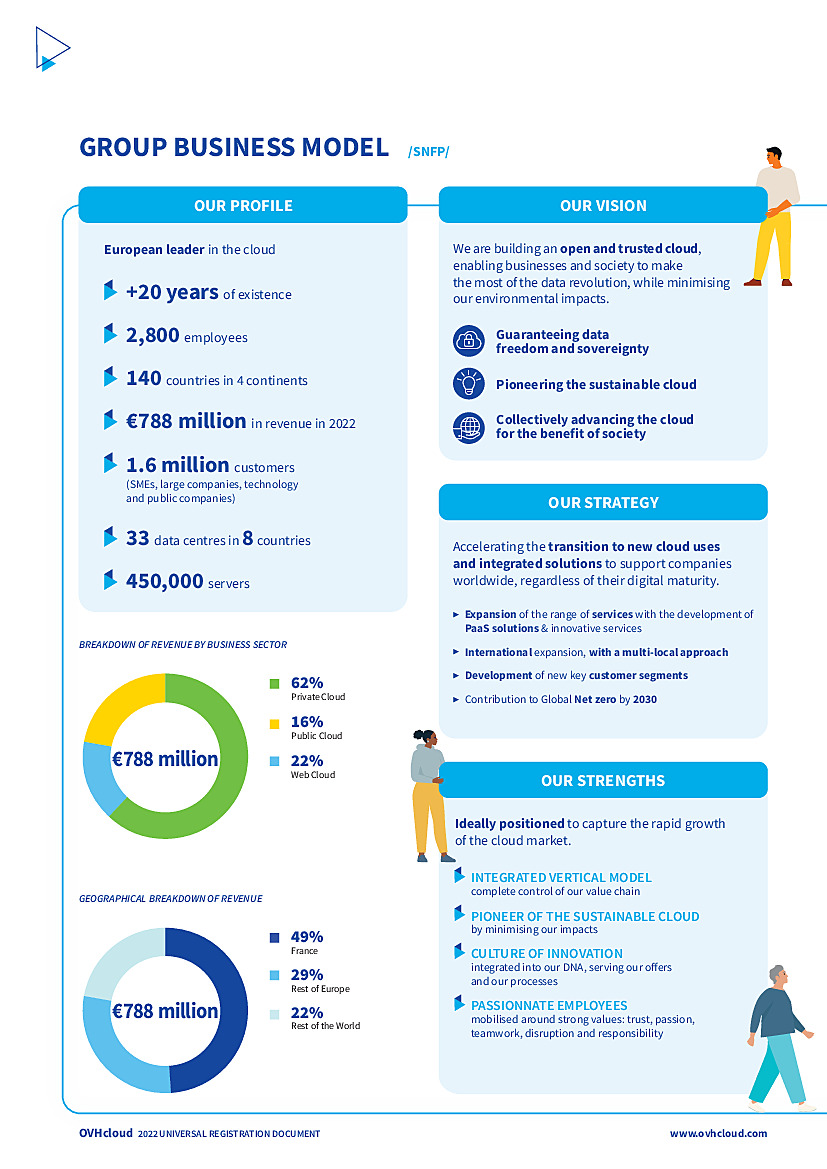

Cloud computing encompasses a range of services that include providing access to infrastructure (Infrastructure as a Service or “IaaS”), selecting and operating platforms such as operating systems, virtualisation stacks and security systems (Platform-as-a-Service or “PaaS”), and offering applications that are developed and can function on cloud platforms (Software-as-a-Service or “SaaS”). The following graphic illustrates these features:

The cloud solutions market also includes web services targeted mainly at individuals and small and medium businesses. The Web Cloud market largely consists of web and domain hosting, including leasing servers for websites, selling secondary services (such as software packages) and domain name registration, renewal and transfer services.

-

1.3Business

1.3.1A comprehensive range of solutions

1.3.1.1Private Cloud

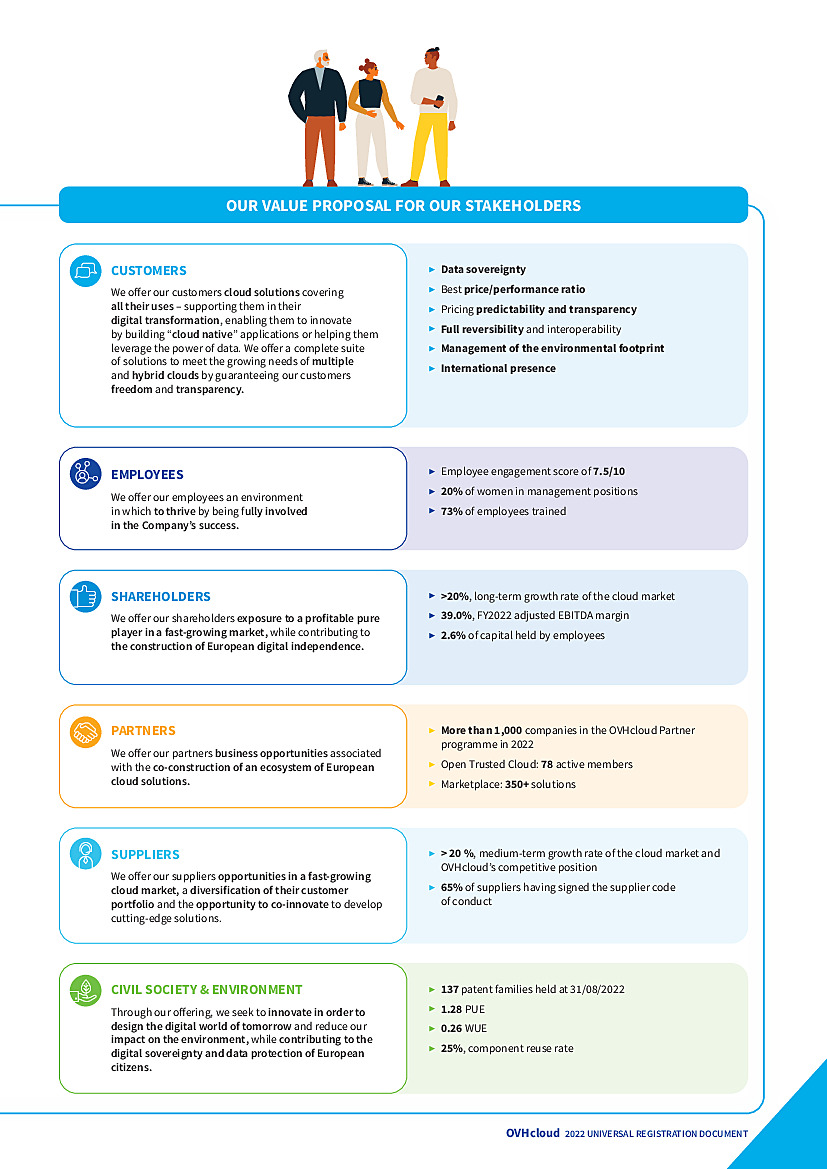

Baremetal Cloud

OVHcloud’s Baremetal Cloud service provides dedicated physical servers to customers, who have full control over the server, including the choice of operating system. The Baremetal Cloud allows them to have a similar experience to the one they would have with on-premise solutions managed by their internal teams, while taking advantage of the benefits offered by outsourcing.

OVHcloud’s main Baremetal Cloud offering sells high-end servers and mid-to-high-level services. OVHcloud also has a lower priced offering marketed under the “Eco” range, with the “So You Start” and “Kimsufi” products, using refurbished servers that provide quality services at a reduced cost, while improving environmental efficiency.

Baremetal Cloud services provide business customers with high-level computing power and strict service level agreements, in a secure environment appropriate for data-sensitive applications. The server can be customised to meet customer requirements and can be operated without a need to allocate the server’s capacity to virtual machines through a hypervisor, which allows the customer to use the server’s full capacity. Any unused capacity can be deployed within minutes, although the total capacity is limited by that of the dedicated server.

Baremetal Cloud customers pay monthly fees that depend on the performance levels they select. They may also choose options (such as server customisation or data backup) for additional fees.

The main uses of Baremetal Cloud services include the computation of complex data, low latency operations, streaming, online gaming, critical business applications such as ERP and CRM.

Hosted Private Cloud

OVHcloud offers Hosted Private Cloud services to its business customers, providing servers fully managed by OVHcloud, including the operating system and the virtualisation layer, in partnership with VMware or Nutanix offerings.

Within its Hosted Private Cloud service, OVHcloud has two main offerings: (i) Essential and (ii) Premier.

- ▶Essential allows customers to benefit from dedicated and virtualised servers, fully managed by OVHcloud, with a 99.9% service level. Essential's customers are mainly medium-sized companies.

- ▶Premier provides high-end dedicated virtualised servers, and includes virtual storage and backup management as well as 24/7 support, with a 99.9% service level The servers are certified to host information from customers in a variety of sensitive sectors, including healthcare in France (HDS certification), Germany, the United Kingdom and Poland, and finance, including credit card payments (PCI DSS certification). Premier's customers are primarily large companies and public sector customers looking to move to a cloud service provider.

OVHcloud’s Hosted Private Cloud services provide customers with private access to servers that can be customised to meet the customer’s specific requirements. It meets the needs of customers seeking isolation and security, scalable resources and resilience.

The main usages for Hosted Private Cloud services include deployment in hybrid cloud strategies, media encoding, big data analytics and disaster recovery, as well as the storage and processing of sensitive data in key sectors such as healthcare, finance and the public sector.

1.3.1.2Public Cloud

OVHcloud offers Public Cloud solutions based on open source technologies such as OpenStack (a platform for deploying processing, storage and networking resources) and Kubernetes (a container orchestration platform that has become a market benchmark). The use of these standard platforms provides customers with easy data transfer capability and access to source code, facilitating reversibility and eliminating “vendor lock-in”. This feature of the OVHcloud offering is particularly attractive for customers looking to deploy multi-cloud strategies.

Public Cloud solutions provide users with virtually unlimited computing capacity, with the only constraint being the demands of other users and the total installed capacity of the cloud provider. It is possible to deploy new Public Cloud instances automatically and in seconds. Because Public Cloud service is based on shared servers, customisation options are defined by OVHcloud. Service levels are high given the flexibility of the hardware architecture.

Public Cloud customers pay usage fees for the capacity they actually use. The OVHcloud model offers much more predictability than models used by hyperscalers and many other competitors. In particular, unlike hyperscalers, OVHcloud does not charge additional fees for outgoing data transfers or API calls, except for block and archive storage, and for services located in Asia-Pacific.

The Group’s Public Cloud offering provides three core cloud computing services: computer performance, storage and network capabilities.

Customers of OVHcloud's Public Cloud solutions can choose fully scalable public cloud services on virtual machines that are hosted on shared servers and networks.

OVHcloud’s Public Cloud service is attractive for customers seeking highly scalable resources, with significant peak management demands across multiple access locations, and a high degree of resilience. This service is used for applications with high-demand bursts and services that use large volumes of data, such as video and music streaming.

OVHcloud's Public Cloud customers can also choose from a number of on-demand (SaaS) software running on OVHcloud's Public Cloud servers. In particular, OVHcloud offers its customers access to Microsoft Exchange messaging and calendar solutions, SharePoint data storage and management solutions, and the Office365 business software suite.

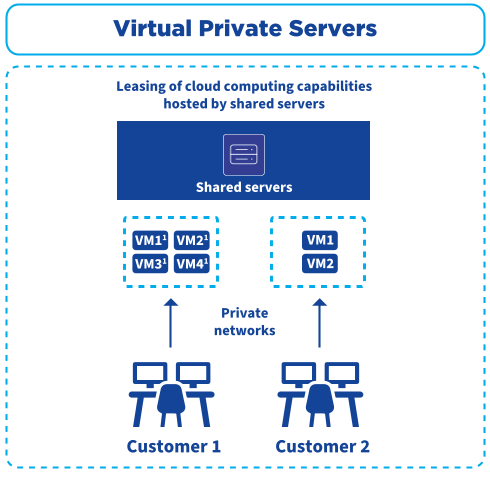

Virtual private servers

OVHcloud also offers a virtual private server option, providing IT capabilities located on shared servers, but with virtual machines isolated through the use of virtual private networks.

The virtual private server option is attractive to customers seeking tailored resources, particularly for short-duration operations with volatile workloads and server demand. Virtual private server solutions are used primarily for applications testing and other one-time projects, the management of short-duration peak loads and backup functions.

Platform-as-a-Service (PaaS)

As part of its growth strategy, OVHcloud is developing and implementing a comprehensive PaaS offering that it intends to overlay on its Private Cloud and Public Cloud IaaS products. In addition to developing products in-house, OVHcloud has announced several partnerships and acquisitions, in order to accelerate its development plan, which allows it to offer 81 IaaS and PaaS solutions to its customers at the end of the 2022 financial year, mainly in the following areas:

- ▶Storage. OVHcloud now offers its customers a comprehensive portfolio of storage solutions such as Object Storage S3 (High Performance and Standard), Block Storage, File Storage, Snapshot & Backup and Archive;

- ▶DataBase-as-a-Service. Data management software allows users to manage their databases to enable queries and updates. It includes programmes that execute queries on data and provide visual representation of the data in formats such as spreadsheets, enabling users to build applications faster and automate database management. OVHcloud announced a partnership in April 2021 with MongoDB, and in July 2021 with Aiven to make several types of databases available on the OVHcloud infrastructure;

- ▶AI, Machine Learning & Analytics. Artificial intelligence and analytics solutions include tools and services that support data analysis and presentation. OVHcloud is particularly advanced in high-performance computing solutions for artificial intelligence and machine learning, and intends to continue its development in this area. In April 2022, OVHcloud announced the acquisition of ForePaaS, a company specialising in the field of analytics;

- ▶Security & Encryption. OVHcloud is expanding its offering of identity access management and encryption solutions, including end-to-end encryption that secures customer data in all states. In July 2021, OVHcloud announced the acquisition of BuyDRM, a US specialist company in this area;

- ▶Application platforms. Application platforms are back-end server software solutions that provide developers with a runtime and development environment.

1.3.1.3Web Cloud & Other

OVHcloud has offered Webcloud services since its founding in 1999. With its leading position in the French market and strong positions elsewhere in Europe, the Web Cloud offering provides a stable, recurring income base and regular growth.

- ▶Web hosting and domain names. This includes the leasing of capacity on web servers, allowing customers to connect their websites to the internet, as well as domain name registration, renewal and transfers. Customers can choose basic packages offering one or only a few websites, or packages targeted at professionals and developers that wish to host multiple websites, together with email addresses and storage options. OVHcloud offers its customers additional services, such as Secure Socket Layer (SSL) certificates, which enable secure connections between a web server and a browser;

- ▶Telephony and connectivity. Customers can purchase VoIP (Voice over IP) systems enabling uses such as switchboards and interactive voice response systems. OVHcloud also offers customers internet access through ADSL and fibre networks, with basic and professional packages;

- ▶Support and services. OVHcloud offers its customers additional levels of support and service, which include a range of support, expertise and online services. Support offerings may be Business, which corresponds to the level suitable for production environments, or Enterprise, which offers a key account experience for critical production environments. Additional services are offered in the Professional Services offering, which provides access to technical support and advice during infrastructure migration or IT architecture changes.

OVHcloud’s main customers in the Web Cloud segment are small and medium-sized businesses, as well as certain individual customers and entrepreneurs. Web Cloud customers are generally seeking secure and reliable web and communications services, to establish their web presence, and to digitise business functions.

-

1.4Strategy and targets

1.4.1Develop key customer segments

OVHcloud pursues a growth strategy adapted to its three main customer segments: (i) technology and software companies, (ii) large corporates, SMEs and public entities, as well as (iii) White-Label, resellers and private individuals.

Technology and software companies (digital native)

This customer segment is historically favourable for OVHcloud. In order to extend its growth in this segment, OVHcloud has put in place an enhanced digital marketing strategy, including an improved customer experience on the Group’s websites with a customer-centric interface, focused on usage and products, a prospect relationship management programme, online support such as chatbots and training courses such as webinars or technical documentation.

- ▶the Start-up programme helps start-ups grow and develop by providing them with technology credits, resources, training and advice. This programme is particularly useful for start-ups still in the idea-forming stage. The 12-month programme allows the use of up to €10,000 in technology credits and several hours of technical support. Since 2015, more than 1,800 start-ups and scale-ups from all over the world have joined the programme and the ecosystem;

- ▶the Market Place brings together innovative and trusted technology and software companies as part of a SaaS (Software-as-a-Service) marketplace hosted by OVHcloud.

Large corporates, SMEs and public entities

OVHcloud is implementing a three-part strategy to realise growth with large corporates, SMEs, and public entities. As part of this strategy, OVHcloud is addressing the needs of these customers for transformation and support as they consider migrating to the cloud.

- ▶OVHcloud is leveraging its position as a European “trusted cloud” provider, answering security and data sovereignty needs of European companies and public sector entities handling highly sensitive or strategic data. OVHcloud does not use or sell its customers' data, which is stored in the data centres chosen by its customers. It offers the highest level of security with numerous recognised certifications, including the SecNumCloud qualification delivered by the French National Cybersecurity Agency (ANSSI), attesting to the highest level of IT security in Europe for the hosting of sensitive and strategic data in the cloud. OVHcloud has also launched the Trusted Zone Sovereign Solution, which is designed to meet the highest security standards of public sector and critical services operators. It is also one of the founding members of the Gaia-X initiative to help promote a European sovereign cloud. OVHcloud is constantly improving its offers by investing in security and encryption solutions.

- ▶OVHcloud is strengthening its marketing channels to enhance its position with large corporate customers and public entities. As part of this strategy, OVHcloud has strengthened its relationships with its network of almost 1,000 IT partners, reinforcing its position with large system integrators such as Accenture, Capgemini, Sopra Steria and Deloitte and specialised system integrators such as Neurones IT, providing OVHcloud with a strong platform to capture a broader share of the IT spending of their corporate customer base. At the same time, OVHcloud has substantially increased its direct sales force that serves the needs of its large corporate customers, as well as providing enhanced customer support and services to accompany corporate customers in their cloud migration projects.

- ▶OVHcloud has developed specific offerings for small and medium businesses. For this segment, OVHcloud is leveraging its strong relationships with IT advisors and web agencies, while offering maximum flexibility through an automated self-service channel that can be used by customers directly or through their IT advisors. OVHcloud is also enhancing its multi-location, multi-language support offering for small businesses.

White-Label, resellers and individuals

OVHcloud has a long history of commercial success through web agencies that resell OVHcloud solutions, sometimes under their own brand names. For individuals in particular, significant work has been undertaken for several years to offer an optimised digital sales channel, new and improved product offerings, and improved support. This continuous improvement aims to promote the acquisition of new customers along with cross-selling opportunities to existing customers. OVHcloud is also developing a “DataCentre-as-a-Service (DCaaS)” offering for corporates to deliver high performance and data sovereignty for their “on premises” resources.

-

1.5OVHcloud’s competitive advantages

1.5.1The only European player of this size

OVHcloud is one of the two main providers of Private Cloud services in Europe. According to Forrester (June 2020), OVHcloud is a leader in Hosted Private Cloud services in Europe based on its current offering, market presence, and strategy. Additionally, as a Europe-based cloud provider, OVHcloud is able to meet the requirements of European customers for data sovereignty and security.

OVHcloud has a growing presence in the Public Cloud market, which is dominated globally by the so-called “hyperscalers” (Amazon Web Services, Google Cloud Platform and Microsoft Azure). It is the only European provider of Public Cloud infrastructure services that was named a contender in the IDC MarketScape (IDC (September 2020)), based on its infrastructure offering.

-

1.6Legislative and regulatory environment

1.6.1Legislation and regulations in the European Union

As a French cloud service provider, OVHcloud is subject to European regulations across a wide number of areas, including information technology (“IT”) services, cybersecurity, online content moderation and data protection. OVHcloud may also be subject to sectoral regulatory regimes applicable to certain customers and generally applicable regulations such as contract laws and consumer protection policies.

1.6.1.1Cybersecurity

OVHcloud is subject to European regulations aimed at strengthening cybersecurity across the European Union (the “EU”). Transposed into French law on 26 February 2018, Directive (EU) 2016/1148 of 9 July 2016, established requirements for cloud service providers with respect to security of network and information systems. According to French law(2) transposing Directive (EU) 2016/1148, cloud service providers are classified as digital service providers. As a digital service provider, OVHcloud must guarantee a level of information security adapted to the relevant risks and adopt appropriate organisational and technical measures. In the event of a security incident having a significant impact on the provision of services, a declaration must be made with the French National Cybersecurity Agency (“ANSSI”). The French Prime Minister may also open investigations upon receipt of information of a non-compliance by the digital service provider with security obligations. Fines for non-compliance with security obligations range from €50,000 to €100,000.

The ANSSI has adopted security standards for cloud service providers(3). In particular, cloud companies must set up a security policy for information relating to the service and carry out a risk assessment covering the entire service. If applicable security standards are met, the ANSSI delivers a qualification called “SecNumCloud” certifying an enhanced level of security for storage of sensitive information. In October 2022, ANSSI extended a security visa to OVHcloud for the “SecNumCloud” qualification for its Hosted Private Cloud, valid until December 2023. For the protection of critical information systems, the ANSSI recommends that operators of essential services (e.g. gas supply companies, airline carriers, health institutions, banks) use security products and services with an ANSSI security visa.

The role of the European Union Agency for Cybersecurity (the “ENISA”) was strengthened by Regulation (EU) 2019/881 of 17 April 2019 (the “Cybersecurity Act”). The ENISA is tasked with establishing and maintaining a European wide cybersecurity certification scheme applicable to cloud service providers, including a comprehensive set of rules, technical requirements, standards and procedures. In July 2020, ENISA published a proposal that would enable cloud service providers to obtain certifications across the EU attesting to the level of security of their services.

The European Commission unveiled in September 2022 its proposed Cyber Resilience Act (“CRA”). This proposal fixes a series of general and organizational requirements in terms of cyber security for products containing elements digital (for example: software, hardware products, data processing). It aims to adopt a common base within the European Union to limit cyber-attacks. The "CRA" applies differently to actors in the supply chain: manufacturers, importers or distributors. the text must still be examined by the European Parliament and then by the Council of the European Union; during this procedure, which may take up to two years, the current text will most likely be led to evolve. It is therefore still premature to comment on the potential impacts of this text on OVHcloud.

1.6.1.2Data protection

General principles

OVHcloud’s business involves the storage and transfer of substantial quantities of personal data, which must be done in manner that is consistent with the provisions of the GDPR as supplemented by applicable national data protection laws. The GDPR came into force in May 2018 and established requirements applicable to the processing of personal data by businesses established in the EU, or which offer products and services to individuals in the EU, or which monitor the behaviour of persons as far as such behaviour takes place within the EU. The GDPR places organisations under strict obligations in terms of security and reporting, strengthens the rights of individuals and increases the enforcement powers of supervisory authorities. Any action involving any information on an identified or identifiable individual will fall in the scope of the GDPR.

The GDPR distinguishes between (i) controllers, which, alone or jointly, determine the purposes and means of processing and (ii) processors, which process personal data on behalf, and under instructions, of a controller. In certain situations, multiple parties involved in the processing of personal data may qualify as joint controllers where they jointly determine the purposes and/or means of processing. While controllers are primarily responsible for the processing, processors may be directly liable to individuals and regulators for their own breaches of the GDPR or where they acted outside or contrary to lawful instructions of the controller.

OVHcloud is subject to the GDPR and national data protection laws when it processes personal data in the context of the activities of its EU establishments or otherwise conducted in the EU. OVHcloud generally qualifies as a processor when it provides services to customers, as it processes the data provided, and used, by its customers. In this case, OVHcloud’s customers then qualify as controllers, and OVHcloud acts pursuant to their instructions.

OVHcloud also qualifies as a controller when it processes its customers’ data for its own purposes, in particular for the purposes of (i) managing the customer relationship, including commercial activities, customer information and support, claims, payment and loyalty programme membership, (ii) managing the delivery of its services, including maintenance, development and system security, (iii) preventing fraud, payment default and use of its cloud services in ways that do not comply with applicable laws and regulations or the terms and conditions, (iv) complying with applicable laws and regulations, such as the obligation to archive and retain certain customer data, and (v) enforcing its rights.

A breach of the GDPR by a controller may lead to administrative fines of up to the higher of €20 million or 4% of the global annual revenue of the controller from the preceding year, while the breach of most obligations incumbent on processors is subject to a lower (but still significant) level of administrative fines of up to the higher of €10 million or 2% of the annual revenue from the preceding year. However, the breach of obligations relating to transfers of personal data outside the EU may be sanctioned by the highest level of fines regardless of whether it is committed by a controller or processor.

Key processor obligations

OVHcloud is acting as a processor whenever personal data are stored on its infrastructure on behalf of, and at the instruction of, its customers. Processors are responsible for (i) complying with their customers’ instructions, although the processor shall immediately inform the controller if, in its opinion, an instruction infringes the GDPR, (ii) implementing technical and organisational measures that ensure a level of security appropriate to the risks inherent to the data processing, and (iii) assisting the controller with the notification of breaches and in responding to individuals’ requests.

Controllers and processors must enter into an agreement setting out mandatory provisions prescribed by Article 28 of the GDPR. That agreement must set out details of the processing to be conducted by the processor on behalf of the controller, such as the duration of the processing, its purpose, categories of data to be processed, obligations of the controller and those of the processor, including: ensuring that processing is conducted by individuals subject to a confidentiality obligation, implementing appropriate security measures and making available to the controller any and all information needed to show compliance and/or to facilitate audits and inspections authorised by the controller.

In May 2018, OVHcloud updated its general terms and conditions of service with the inclusion of a data processing agreement, which it amended in 2020. Consistent with the provisions of Article 28 of the GDPR, this data processing agreement sets forth the conditions under which OVHcloud is entitled as a processor to carry out the processing of personal data on behalf of, and on instructions from, its customers. The latest version of the general terms and conditions provides that OVHcloud customers are responsible for compensating data subjects (such as the customers’ own customers) for any breach of processing obligations, and may subsequently recover from OVHcloud any portion of the compensation for which OVHcloud is properly liable.

Key controller obligations

OVHcloud also acts as a controller whenever it determines the purposes for which, and means by which, personal data is processed. It also acts as a controller when collecting personal data on its employees. Data controlling includes activities such as management of customer relationships, support and maintenance activities, sales prospecting, accountancy or managing accounts receivable. For specific activities (including mailing, marketing analysis or surveys), OVHcloud may also rely on third-party providers acting under its instructions.

Controllers are responsible in particular for (i) implementing technical and organisational measures to protect the data, (ii) ensuring the processing of data in a lawful and transparent manner to the customers, (iii) using only processors that can provide sufficient guarantees to implement appropriate technical and organisational measures in such a manner that processing will meet the requirements of EU Laws(4) and, in particular, the GDPR, and (iv) notifying the supervisory authority of any breaches likely to result in a risk to the rights and freedoms of natural persons and the relevant data subjects.

Pursuant to Article 13 of the GDPR, OVHcloud’s processing activities are subject to mandatory disclosure obligations. Therefore, OVHcloud informs its customers and regularly updates the information disclosed to them on a regular basis to ensure transparency of its processing activities. In addition, OVHcloud discloses these obligations to data subjects, users and customers through its data processing agreements and several other policies, such as its cookie policy and privacy policy.

Compliance tools

In order to ensure compliance with applicable data protection regulations, OVHcloud has implemented a personal information management system based on the ISO 27701 standard.

In addition, as a founding member of the Cloud Infrastructure Service Providers in Europe (the “CISPE”), OVHcloud participated in the drafting of a transnational code of conduct of good practices for cloud infrastructure service providers (the “CISPE Code of Conduct”) in order to ensure both compliance with GDPR and protection of customers’ personal data.

On 19 May 2021, the European Data Protection Board (the “EDPB”), an independent body of the European Union established by the GDPR and composed of representatives of the national supervisory authorities of the EU Member States and the European Data Protection Supervisor, adopted an opinion 17/2021 under Article 64 of the GDPR on the draft decision presented to the EDPB by the French supervisory authority (the “CNIL”) concerning the CISPE Code of Conduct. In the draft opinion, the European Data Protection Supervisor confirmed that it believes the CISPE Code of Conduct complies with the GDPR and fulfils the requirements set forth in Articles 40 and 41 of the GDPR. In its decision 2021-065 dated 3 June 2021, the CNIL approved the CISPE Code of Conduct.

OVHcloud is also relying on the CISPE Code of Conduct, with its certified offerings Baremetal Cloud and Hosted Private Cloud powered by VMWare, to ensure and demonstrate compliance of its IaaS activities.

Cross-border transfers

As a cloud service provider operating 33 data centres worldwide in 12 locations (in France and the European Union, the United Kingdom, North America, Singapore and Australia), OVHcloud is subject to restrictions imposed on cross-border transfers, including those imposed by the GDPR.

Personal data can be transferred freely within the EU and the European Economic Area (the “EEA”), provided that such transfers meet the criteria applicable to all processing of personal data under the GDPR. For example, the controller must inform individuals of the transfer and the data must not be further processed for purposes incompatible with the initial purposes.

Transfers of personal data outside of the EEA must take place only to the extent that an adequate level of protection can be ensured, through an adequacy decision issued by the European Commission or through appropriate safeguards or based on certain derogations set forth in Article 49 of the GDPR. Appropriate safeguards include: (i) parties entering into a set of standards contractual clauses (“SCCs”) issued by the European Commission, (ii) binding corporate rules adopted by entities belonging to the same group of companies, (iii) a code of conduct approved by applicable data protection authorities, or (iv) approved certification mechanisms.

The fact that servers are located within the EEA is not sufficient to assume that no personal data is being transferred outside of the EEA. Pursuant to the EDPB’s recommendations 01/2020 of 18 June 2021 (“Recommendations 01/2020”), if personal data is technically accessible from a country outside the EEA, such personal data is deemed transferred to that third country under the GDPR. In that case, an adequate level of protection must be ensured in the same manner as if servers were located outside of the EEA. OVHcloud therefore limits such processing and handles such transfers accordingly.

In order to carry out processing operations, and unless otherwise stipulated in the general terms of service, only European and Canadian entities of OVHcloud can process the data stored by European customers in the data centres located in the EU. On 20 December 2001, the European Commission issued an adequacy decision declaring that Canadian law offers an adequate level of protection for personal data transferred from the European Union to recipients subject to the Canadian Personal Information Protection and Electronic Documents Acts (“PIPEDA”), which is the case for OVHcloud’s Canadian entities. As a result, these processing activities performed remotely by Canadian entities do not require additional safeguards.

Further to its decision to leave the EU, the United Kingdom entered into a Trade and Cooperation Agreement with the EU on 24 December 2020, allowing personal data to continue to flow freely between them for a transitional period of up to 6 months, during which the European Commission would examine the possibility of granting the United Kingdom a decision recognising that it has an adequate level of data protection, which would allow data to permanently flow freely from the EU to the United Kingdom. On 28 June 2021, the European Commission adopted the adequacy decision on the GDPR recognising a level of data protection substantially equivalent to the level guaranteed by the European legislation and allowing the free flow of personal data from the EU to the UK for a period of four years.

Data transfers between the European Union and the United States

While the United States has not been recognised as offering an adequate level of personal data protection by the European Commission so as to enable the free transfer of personal data to the United States from the EU, the European Commission decided in July 2000 that US companies that agreed to comply with the principles of the so-called “EU-US Safe Harbour” scheme were allowed to freely import data from the EU. On 6 October 2015, the EU-US Safe Harbour system was invalidated by the Court of Justice of the European Union (the “CJEU”) in its Maximilian Schrems v. Data Protection Commissioner (“Schrems I”) ruling due to the access granted to US public authorities (including law enforcement authorities) to the content of electronic communications.

In July 2016, the European Commission and the United States adopted another scheme called the “EU-US Privacy Shield” as a successor to the EU-US Safe Harbour. On 16 July 2020, the CJEU issued its decision in the Data Protection Commissioner v. Facebook Ireland and Schrems (“Schrems II”) case, which invalidated the EU-US Privacy Shield for transfers of personal data from the EU to entities certified under this mechanism in the United States of America (the “United States”). As in Schrems I, US surveillance laws were deemed by the CJEU to provide US authorities with access to personal data in a manner not compliant with the guarantees of the GDPR and the EU Charter of Fundamental Rights.

In Schrems II, the CJEU upheld SCCs as a valid safeguard for cross-border data transfers, but imposed stricter requirements. Parties must ensure that (i) the surveillance and data monitoring laws of the country to which personal data is transferred enable them to perform the obligations set out in the SCCs or (ii) additional safeguards are added to such SCCs to that effect. On 4 June 2021, the European Commission issued new SCCs for international transfers. The new SCCs reflect the requirements under the GDPR and take into account the Schrems II ruling. While the new SCCs can serve as a valid safeguard for cross-border data transfers, responsible parties must still carry out an examination of the legislation and practice of the third country where data is transferred and additional supplementary measures may be necessary. On 18 June 2021, the EDPB adopted the final version of its Recommendations 01/2020 setting out possible additional safeguards that companies may use to supplement SCCs to transfer personal data to a country where the law or practice are not sufficient to guarantee an “essentially equivalent” level of data protection to that of the EU, which is the case for the United States. Recommendations 01/2020 indicate that no such supplementary measure could be envisioned for transferring personal data to cloud services that are not encrypted or pseudonymised. This may cause significant obstacles for cloud service providers that transfer data in a non-encrypted or non-pseudonymised form to certain countries, including to the United States.

OVHcloud's non-US entities do not transfer their customers’ data to the United States. The data centres located in the United States do not host any of the services provided by OVHcloud's non-US entities. Additionally, OVHcloud’s US entities do not participate in the services provided by OVHcloud’s non-US entities. As a result, the invalidation of the “EU-US Privacy Shield” should have no impact on such services.

Finally, OVHcloud follows developments relating to to the negotiations on Privacy Shield 2 between the European Commission and the United States following the signature by the President Biden of an Executive Order on October 7, 2022 aimed at responding the shortcomings raised by the Court of Justice of the Union European in its judgment of July 16, 2020 called "Schrems II" which leads to the cancellation of the Privacy Shield as well as the projects of legislative developments in the United Kingdom and India.

1.6.1.3Free movement of non-personal data

Regulation (EU) 2018/1807 of 14 November 2018 (“Free Flow of Non-Personal Data Regulation”) aims to ensure the free flow of non-personal data between EU Member States (the “Member States”) and IT systems in the EU. Non-personal data is either (i) data not linked to identified or identifiable individuals, or (ii) anonymised personal data. This regulation enables the storage and processing of non-personal data anywhere in the EU, prohibits data localisation and ensures the availability of data for regulatory control.

The Free Flow of Non-Personal Data Regulation also provides that the European Commission must encourage the development of self-regulatory codes of conduct to facilitate portability between service providers. To that end, OVHcloud participated in the drafting of two voluntary codes of conduct on switching cloud service providers and data portability through the working group on switching cloud providers and data porting (“SWIPO”). Published in July 2020, the Codes of Conduct for Infrastructure-as-a-Service (IaaS) and Software-as-a-Service (SaaS) provide guidance for cloud service providers and customers on switching cloud provider and porting non-personal data. The adoption of such codes of conduct aim at reducing the risks of vendor lock-in (i.e., situations where customers are dependent on a particular provider due to significant switching costs) by cloud service providers. They also provide guidance for customers on the transfer of non-personal data.

1.6.1.4Online content moderation

As a hosting service provider, OVHcloud has to comply with a number of laws on content moderation, including those moderating terrorist content, child sexual abuse material, hate speech and the infringement of intellectual property rights.

European legislation on digital services (Digital Services Act, “DSA”)

Regulation (EU) 2022/2065 of the European Parliament and of the Council of 19 October 2022 on a single market for services and amending Directive 2000/31/EC (“Regulation on digital services”) entered into force on November 18, 2022. This new framework aims to harmonize the rules applicable in the different Member States of the Union European Union and replaces the one adopted in 2000 with regard to liability of intermediaries with regard to illegal content while maintaining the fundamental principles of freedom of expression and freedom to provide services. The regulation also establishes new obligations of diligence and transparency for hosting services such as that OVHcloud, both vis-à-vis the authorities and users, by particular on the processing of reports of illegal content. He also increases the level of penalties that can be imposed in the event of breach of the obligations established by the regulations, with fines of up to 6% of the turnover intermediary service provider’s annual global business report. A certain number of measures are applicable on a deferred basis over the next two years and involve the adoption of texts at the national level. OVHcloud will carefully monitor their publication in order to comply with its obligations.

1.6.1.5Fight against anti-competitive practices on digital markets

European legislation on digital markets (Digital Markets Act, “DMA”)

Regulation (EU) 2022/1925 of the European Parliament and of the Council of 14 September 2022 on contestable and fair markets in the digital sector and amending Directives (EU) 2019/1937 and (EU) 2020/1828 (“Digital Markets Regulation”) aims to make the digital sector fairer and more competitive, by introducing preventive measures for large companies as access controllers on the market European. In particular, the regulation provides for several obligations and prohibitions against online platforms in a position of access controllers and strengthens the powers of sanction of the European Commission, which will be assisted by a committee advisory committee and a high-level group. So, for example, the access controllers must allow users to easily uninstall pre-installed software on their devices and easily unsubscribe from an essential platform service such as a cloud service. Access controllers will no longer be able to impose software such as internet browsers or default search engines, reuse personal data of a user for the purpose of targeted advertising without their consent explicit.

Applicable from 2 May 2023, the companies concerned must report to the European Commission and put themselves in compliance no later than March 2024. The legislation gives the Commission the exclusive power to monitor compliance with their obligations, and new sanctions, including a fine up to 10% of total worldwide turnover made by the company during the previous financial year.

The adoption of this new legislation is a positive step to regulate the practices of the dominant digital players on the European market, but its effectiveness will depend on the means that the European Commission will devote to the service of compliance with it. OVHcloud will pay particular attention to the details expected on the staff who will be dedicated to the control of obligations of access controllers

1.6.1.6Other applicable regulations and initiatives

Telecommunications sector

OVHcloud entities are telecommunications operators in four (4) Member States: Belgium, France, Germany and Spain. OVHcloud is subject to specific obligations when providing telecommunication services. Because the EU and its Member States have been regulating the telecommunications sector for many years, there are a variety of different implementing measures, guidelines and authorities across the EU. OVHcloud entities are also telecommunications operators in the United Kingdom and Switzerland, which have their own telecommunications regulations. The United Kingdom has also implemented the requirements of the European Electronic Communications Code into its national regulatory framework prior to Brexit.

The Directive (EU) 2018/1972 of 11 December 2018 established the European Electronic Communications Code. Although this directive has not yet been transposed in all Member States where OVHcloud acts as an operator, several other directives applicable in the telecommunications sectors, such as Directives 2002/19/EC, 2002/20/EC, 2002/21/EC and 2002/22/EC of the European Parliament and of the Council, have been substantially amended. Directive 2018/1972 was transposed into French law in May 2021(5). The key objective of this European Electronic Communications Code is to create a comprehensive set of updated rules to regulate electronic communications and protect EU citizens when they communicate through traditional or web-based services, encourage competition between telecommunication operators, and ensure that national regulatory authorities are protected against external intervention or political pressure.

Health sector

As a cloud service provider, OVHcloud is subject to obligations when providing services to organisations in the health sector. For example, French law requires health data hosting providers (i.e., any person hosting personal health data collected in the course of prevention, diagnosis, care or social and medical monitoring activities on behalf of natural or legal persons having produced or collected such data or on behalf of the patients themselves) to comply with specific obligations. Such obligations include receiving proper certification or receiving prior approval from public authorities as per the French Public Health Code, and entering into an agreement with customers in the health sector, setting out mandatory provisions prescribed by L. 1111-8 of the French Public Health Code. OVHcloud is also subject to the requirements of other jurisdictions in which it operates, such as Italy, Poland, Germany and the United Kingdom.

In 2016, OVHcloud benefited from the “health data host” accreditation and, since 2018, it has operated a management system that allows several of its cloud offerings to comply with the requirements of this accreditation. In 2019, OVHcloud obtained the French HDS (hébergeur de données de santé – health data host) certification for its Hosted Private Cloud offering. In 2020, this certification was extended to OVHcloud’s dedicated servers, and it was extended to OVHcloud’s Public Cloud offering and Trusted Exchange in 2021.

Financial sector

Companies in the financial sector (including credit institutions and investment firms) may also be subject to industry specific obligations that may reflect on OVHcloud in the context of the provision of its services. In particular, in 2019, the European Banking Authority (“EBA”) issued “Recommendations on outsourcing to cloud service providers” applicable to outsourcing arrangements. These recommendations create obligations with respect to security of information systems and audit rights for the benefit of the outsourcing banks, which they must impose on their cloud service providers when using their services. OVHcloud aims to offer contractual conditions applicable to financial service operators that ensure that customers are able to implement an outsourcing policy which is compliant with the EBA’s recommendations and with local European regulations.

Financial service operators may also require OVHcloud to comply with specific national regulations. For instance, OVHcloud may have to comply with French regulations such as of the French Prudential Supervision and Resolution Authority (“ACPR”) on essential outsourced services such as banking operations. Companies outsourcing essential services must ensure that service providers guarantee the protection of confidential information, implement back-up mechanisms in the event of significant difficulties affecting service continuity and provide the ACPR, in carrying out its missions, with access to essential outsourced information. With respect to internal procedures for managing information system security, the American Institute of Certified Public Accountants (“AICPA”) delivered SOC I-II type 2 certifications to OVHcloud.

With respect to bank data hosting and the reduction of card fraud, OVHcloud’s premier Hosted Private Cloud is compliant with the Payment Card Industry Data Security Standard (“PCI DSS”). OVHcloud’s data centres in France, Canada, the United Kingdom, Germany and Poland comply with PCI-DSS.

On 27 November 2022, the European Commission adopted a Regulation on Digital Operational Resilience for the Financial Sector (“DORA”). This regulation follows a proposal by the 2020 European Commission imposes a number of requirements on cloud outsourcing arrangements in the financial sector. The proposed regulation covers a broad range of regulated financial entities, including credit institutions (such as banks), central securities depositaries, insurance companies and certain fund managers, among other entities. It imposes a number of risk management requirements on these financial entities relating to information and communications technology, some of which apply directly to outsourced cloud activities.

In particular, financial sector entities covered by the proposed regulation are required to take a number of steps to address risks in their relationships with third parties, such as cloud service providers, including ensuring that their cloud services contracts provide a full description of the services provided with qualitative and quantitative performance targets, and include provisions governing integrity, security, protection of personal data, recovery in case of failure, rights of inspection and audit, and termination provisions with clear exit strategies. The proposed regulation contemplates the approval of standardised contractual terms by the European Commission.

In addition, the regulation imposes a new oversight framework on critical third-party service providers (including cloud service providers), subjecting them to individual oversight plans adopted by European financial regulatory bodies responsible for supervision of banks, securities markets or insurance companies, depending on which such sector primarily uses the services of the relevant provider. The determination of which services are critical depends on their potential systemic impact, the dependence of financial entities on them for critical functions and the availability of alternatives. The oversight plan can impose requirements in areas such as security and quality, contractual terms, and subcontracting, with financial penalties imposed in case of non-compliance, up to 1% of global revenue of the service provider in the most recent year. The oversight bodies have broad inspection and auditing rights and investigative powers. The adopted regulation also prohibits financial entities from using a service provider from a country outside the EU for critical cloud functions.

Environmental and industrial risks

Many of OVHcloud’s data centres are located in former industrial buildings, some of which are classified as presenting environmental or other risks under applicable French legislation. OVHcloud’s data centres outside of France may also be classified as presenting environmental risks under local regulations. In order to comply with the applicable regulations, OVHcloud is sometimes required to submit applications and receive authorisations to operate. In connection with the application process, OVHcloud may be required to take certain remedial measures.

-

1.7Group organisation

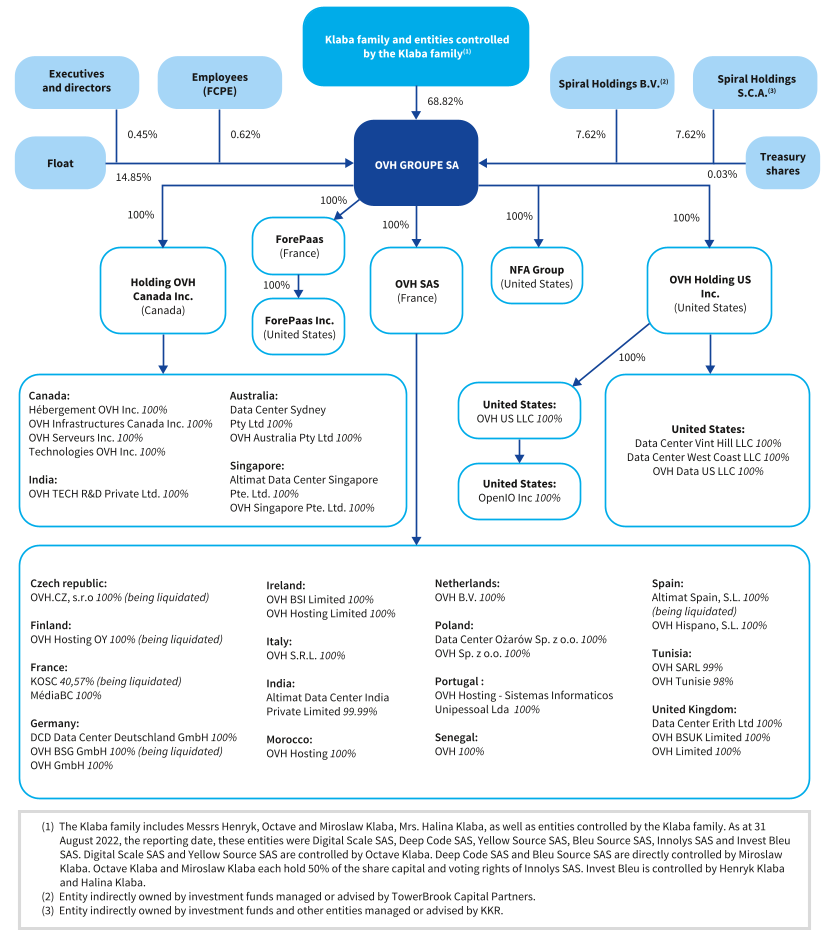

1.7.1Simplified organisational chart

Simplified organisational chart on the date of this Universal Registration Document

The simplified organisational chart below shows the legal organisation of the Company and its consolidated subsidiaries as of the date of this Universal Registration Document. The percentages indicated below represent the percentages of share capital. There was no significant change in the capital ownership since end of august 2022.

-

Risk factors and internal control

-

2.1Risk factors /AFR/

2.1.1Mapping and summary table of the main risks

Risk category

Description of the risk

Risks related to OVHcloud's strategy and market

Non-realisation of the anticipated benefits of its acquisition strategy (*)

Difficulties in the development of new products or services in an increasingly competitive market

Risks related to the international expansion of OVHcloud

OVHcloud’s growth depends on increased IT spending and cloud usage by businesses

Risks related to the implications of climate change

Risks related to OVHcloud’s business

Supply chain risks (*)

Risks related to a major interruption of OVHcloud services (*)

Risks related to an incident on OVHcloud’s physical infrastructures- (*)

Risks related to the commercial development of OVHcloud

Risks related to the launch of new projects

Human resources risks

Risks related to difficulties in recruiting and integrating new recruits

Risks related to the development and retention of key people

Risks related to occupational, physical or mental accidents

Financial and accounting risks

Tax risks

Liquidity risks

Risks related to currency exchange rates and interest rates

Risks related to fraud

Inflation-related risks

Legal and compliance risks

Risks related to non-compliance with certain laws and regulations

Risks related to regulatory changes

OVHcloud may not be able to protect its intellectual property rights.

Systems security risks

Risks related to the interruption of an internal IT system or tool

Risks related to cybersecurity

Risks related to data protection, loss or theft

Other risks

OVHcloud has entered into, and may continue to enter into, certain related-party transactions.

Risk management is closely monitored by Group management. The main mission of risk management is to identify, evaluate and prioritise (based on potential impact and probability of occurrence) risks, as well as to assist Group management in choosing the most appropriate risk management strategy and, in order to limit the remaining significant risks, to define and monitor the related action plans.

CSR risks are covered in Appendix II “Statement of Non-Financial Performance” (“Déclaration de Performance Extra-Financière” of this Universal Registration Document.

Risk mapping

The Group has developed a risk map in order to prevent the major risks relating to its activity, with the support of an external consultant specialising in these subjects. The risk mapping process, which was initiated in 2020, has made it possible to identify the main risks to which the Group is exposed and to assess their potential impact, taking into account their criticality, i.e. their potential severity and probability of occurrence.

The process of risk mapping involves the management of all Group activities and functions to a large extent, enabling the targets and challenges of all stakeholders to be taken into account. The exercise consists in particular of identifying the most significant risks for the Group, grouped into different families (strategy and markets, operational, human resources, financial, regulatory and legal, information systems). A description of the risks and their causes is provided, and for each of these risks, the probability of occurrence, their potential impact on the Group, and their current level of control are assessed. Following the assessment of the control of these risks, action plans are defined.

-

2.2Insurance and risk coverage

Insurance policies are generally taken out by the Company, on its own behalf and on behalf of its subsidiaries, through a broker mandated to negotiate with the main insurance companies to set up or renew the most appropriate guarantees for risk coverage requirements. Insurance companies are selected on the basis of criteria such as the amount of premiums, the scope of coverage offered, the ability to set up integrated programmes such as master policies, the duration of the commitment, their availability to insure the risks in question in the light of all their other commitments in the segment and market in question, and the ability to offer qualitative support in order to better understand risk management.

OVHcloud adapts its insurance coverage according to the evolution of risks related to its usual activities.

Coverage is normally renewed annually, except for certain one-time contracts taken out for one-time projects covering a specific period. The insurance contracts expiring on 6 and 15 October 2021 and 1 January 2022 have been renewed. The insurance contracts maturing at the end of August/beginning of September 2022 have been extended to cover identical guarantees or reassessed as necessary, until 31 December 2022 in order to harmonise the maturities of all insurance contracts. At the time of publication of this document, OVHcloud has obtained an agreement in principle on the renewal of the insurance policies that expire on 31 December 2022.

Below is a summary of the main insurance policies taken out by OVHcloud. OVHcloud prefers to take out “master” policies in order to pool coverage within the Group. For regulatory or factual reasons, such as the size of a subsidiary, OVHcloud also uses local or “standalone” policies taken out directly by its subsidiaries.

The Group also has insurance policies covering the liability of executives (“D&O” policy), risks relating to office facilities, its car fleet, and the travel of its employees using their own vehicle for business and occasional trips, professional assignments, construction work, installation of equipment or fittings in its data centres or offices or the transport of goods (mainly technological and IT equipment). The Group has numerous comprehensive home insurance policies covering rented homes made available to staff during occasional business trips to the head office, as well as the medical office of doctors also working on behalf of OVHcloud. Through its subsidiaries, the Group also has a number of insurance policies covering property damage, civil and employer’s liability and compensation for employees, offices and international data centres.

2.2.1Property damage

OVHcloud’s property and casualty insurance policy is based on the principle of “all risks except” covering all non-excluded material damages. The Company has taken out this policy which applies to certain subsidiaries in France, Germany, Belgium and the United Kingdom.

This contract was renewed on 1 September 2021 with AXA, as leading insurer with 35% of the risk shares and seven co-insurers sharing 65% of the remaining risk and according to the conditions of a prevention plan established and extended under the same guarantees until 31 December 2022.At the time of publication of this document, OVHcloud has obtained an agreement in principle on the renewal of the insurance policies that expire on 31 December 2022.

This insurance policy covers, in particular, direct material damage to insured property of accidental origin, including buildings, furniture, equipment and/or rental risks, miscellaneous costs and losses resulting from the covered material damage, financial consequences of civil liability following a fire, an explosion, water damage, attacks and acts of terrorism in France as well as the costs of resumption of activity following the material damage covered and the experts' fees following material damage.

The maximum compensation due for all losses covered (including direct damage, business recovery costs, all coverages, including costs and losses and liabilities) amounts to €140 million per claim. Coverage limits and sub-limits are applicable depending on the nature of the damage suffered or the category of property insured. The deductible for all damages amounts to €3 million. In the absence of the installation of automatic protection in accordance with AXA’s recommendations, this deductible is increased to €15 million for the Roubaix, Gravelines and Strasbourg sites, €6 million for the Croix site and an additional €10 million deductible for the Erith (United Kingdom) and Limburg (Germany) sites, taking the deductible to €13 million, as well as €3 million for the Paris 19th site taking the deductible to €6 million. These deductibles will be reduced to €3 million on completion of an investment programme agreed with the insurers and according to their recommendations, the amount of which is already included in the capital budget for the coming years (see Section 1.4.5 “Medium-term targets” of this Universal Registration Document). In addition, at the Roubaix, Gravelines, Strasbourg and Croix sites, the Company must maintain in place three specific complementary fire prevention measures (security guards, fire permits and means of intervention in charge on the premises), failing which the deductible would increase by 100% in the event of a claim. An additional contractual provision to terminate the insurance policy was given to the insurer at the renewal on 1 September 2021. The right of cancellation is conditional on the failure to implement a number of personnel and organisational recommendations or the placing of orders relating to the implementation of complete protection on the Roubaix, Strasbourg, Gravelines, Croix, Erith and Limburg sites, in accordance with the insurer’s recommendations and according to a procedure including the insurer for validating these projects, prior to 31 December 2021. All human and organisational recommendations were carried out successively on 31 December 2021 and 30 April 2022. On 30 April 2022, AXA confirmed that OVHcloud had fulfilled its contractual obligations in terms of risk prevention in accordance with its recommendations, and the early termination option was therefore cancelled.

The exclusions are in line with market standards and include, in particular, late payment penalties, fines, penalties and other criminal sanctions, loss of business and customers, operating losses and damage resulting from epidemics, pandemics or epizootics, as well as costs and losses, operating losses and damage resulting from administrative measures, sanitary measures, total or partial closure or withdrawal of administrative authorisation, impossibility, restriction or difficulty of access.

-

2.3Internal control and risk management

2.3.1Organisational framework for risk management

Operational risk management is the responsibility of the Ethics and Compliance and Data Protection Departments, which report to the Legal Department, as well as the Quality, Health, Environment and Information Systems Security Departments, which report to the Operations Department.

Ethics and Compliance

The Group pays strict attention to the compliance of its procedures and employee practices with applicable regulations. The Group has thus deployed ethics and anti-corruption codes with associated training. In addition, the Group raises awareness among its employees of whistleblowing issues, in particular as part of the measures put in place in accordance with the law of 9 December 2016 on transparency, the fight against corruption and influence peddling and the modernisation of economic life (the so-called “Sapin II” law). A platform accessible at all times has been set up on which employees can declare any observed act violating the Group’s ethical code: “ROGER” (Respect OVHcloud Guidelines and Ethical Rules).

Data Protection

Under the supervision of its Data Protection Officer (DPO), the Group implements a rigorous personal data protection policy. A policy for the use of personal data has been established which describes precisely the processing that OVHcloud may be required to carry out on data concerning customers, suppliers and partners, as well as the conditions of their implementation.

In the context of the processing operations covered by the personal data use policy, OVHcloud complies, in its capacity as data controller, with the regulations in force, in particular with the GDPR, as well as with any regulations of the Member States of the European Union that may apply to said processing operations, in particular French law No.78-17 of 6 January 1978 relating to data processing, files and freedoms, as amended.

- ▶only collect personal data that are necessary for the above-mentioned purposes;

- ▶implement processes to ensure the accuracy and updating of data used in the context of the said processing, as well as their deletion when they are no longer useful for the purposes pursued;

- ▶not to process personal data in its possession for purposes other than those mentioned in this policy, unless it obtains the consent of the data subjects, or informs them in advance about processing on legal grounds other than consent;

- ▶document the processing operations carried out in a register and carry out all the necessary impact analyses prior to their implementation;

- ▶implement an incident and data breach management process, and in the event of a breach, notify the protection authority under the conditions of Article 33 of the GDPR, and inform the data subjects, in accordance with Article 34 of the GDPR when the breach is likely to result in a high risk to rights and freedoms; as well as

- ▶implement technical and organisational measures to protect personal data against security risks, as defined in OVHcloud’s information systems security policy.

Information Systems Security

Information security is the subject of a programme and commitments developed within the OVHcloud Information Systems Security Policy (“ISSP”). This policy puts forward the following principles of application:

- ▶deployment a large-scale, industrial approach to security;

- ▶positioning OVHcloud as a trusted player in the ecosystem;

- ▶operating a secure cloud for all;

- ▶implementation of security management systems (ISMS) and privacy management systems (PIMS);

- ▶risk-based approach to safety;

- ▶demonstration of security through certification, internal control and external audit;

- ▶unified response to security incidents and personal data breaches;

- ▶integration of security and privacy issues into product development; and

- ▶safety assessment and implementation of continuous improvement.

The Information Systems Security Policy (“ISSP”), under the responsibility of the Chief Information Systems Officer (“CISO”), is reviewed by the Executive Committee, which verifies that its content is consistent with the Group’s strategic targets. It is revised once a year. The ISSP applies to all Group companies, employees, suppliers, service providers, subcontractors and users of the information system, regardless of their status.

Under the responsibility of the Chief Information Systems Officer (“CISO”), the OVHcloud security team is itself composed of three teams:

- ▶Tool security, in charge of developing and operating the tools supporting the security policy;

- ▶Operations security, responsible for ensuring the implementation of good security practices within operations and the implementation of formal security management processes, supporting the integration of security tools and the alignment of security arrangements within the Company; and

- ▶Security.cert, in charge of monitoring threat sources, identifying cyber attack tools and methods to anticipate them, and managing security incidents.

OVHcloud ensures that employees are aware of the challenges of IT security and, more specifically, of cybersecurity. To this end, the Group regularly conducts cyber attack simulation campaigns (phishing) designed on the basis of sophisticated scenarios. The latest campaigns have shown very good results with a 91% success rate.

Quality, Health, Environment

Through its Health and Safety policy, OVHcloud oversees the implementation of measures to offer safe and healthy workspaces for all its employees and stakeholders, its sites and its products. The Group’s industrial risk management policy is based on two axes: (i) prevention through audits carried out by external bodies at each of the sites, which result in reports with both human and material recommendations, and (ii) protection through the development of risk reduction plans, incorporating short- and medium-term investments as well as organisational or management actions.

Finally, the Company’s Audit Committee plays a role in risk management and internal control. It ensures the relevance, reliability and implementation of the Company’s internal control, identification, hedging and risk management procedures relating to its activities and financial and non-financial accounting information. The Group’s risk mapping and the action plans implemented are reported twice a year by the Group’s Chief Financial Officer.

-

Non-financial performance statement /SNFP/ /AFR/

-

CSR approach

During the 2022 financial year, OVHcloud undertook work to structure its CSR approach. With nearly 2,800 employees and a global industrial and commercial footprint, the Group is fully aware of its responsibility in a world where data has a major impact on private, social and professional lives and with regard to economic, geopolitical, ethical and environmental aspects. They impact the relationships between people and their use reflects a vision of the world and the type of society in which everyone wants to live. Driven by its ambition: “leading the data revolution for a responsible future”, OVHcloud’s mission is to build an open and trusted cloud, enabling businesses and society to make the most of the data revolution while minimising its environmental impacts.

This vision and the associated mission are reflected in a CSR policy, which is closely integrated into the Group’s strategy. This policy is based on three pillars of commitment, each of which in turn breaks down into three areas of action:

OVHcloud is at the heart of the digital revolution, which opens the way to a multitude of opportunities in applications and technology. In this context, the Group offers its customers cloud solutions covering all their uses – supporting them in their digital transformation, enabling them to innovate by building “cloud native” applications or helping them leverage the power of data. In fulfilling this mission, the Group offers its customers the freedom to build their most ambitious projects, in a secure, compliant and sustainable cloud environment, according to three areas of action:

- •Defending data sovereignty, security and privacy;

- •Guaranteeing freedom of choice and reversibility;

- •Offering predictable and transparent pricing.

At the forefront of sustainable cloud, OVHcloud has integrated sustainability at the heart of its business model since its creation, aiming to minimise its environmental impact at every stage. OVHcloud’s environmental action is structured around three axes:

- •Placing innovation at the heart of its industrial model;

- •Contributing to global Net Zero by 2030;

- •Raising awareness among stakeholders of all the impacts of the cloud, in order to initiate a collective approach to reducing the environmental footprint.

At OVHcloud, everything starts with people. The men and women make up the Company's wealth: it is the talents that ensure its success. "Working together” is one of the Group's fundamental values. This collective aspect is extended to its ecosystem, and in the desire to enable the entire European cloud segment to progress. This third pillar of commitment is broken down into three courses of action:

- •Attracting and developing talents in a collective adventure within a diverse and inclusive company;

- •Collaborating and developing coalitions with stakeholders in the European cloud ecosystem;

- •Promoting local anchoring and societal commitment by working on digital inclusion.

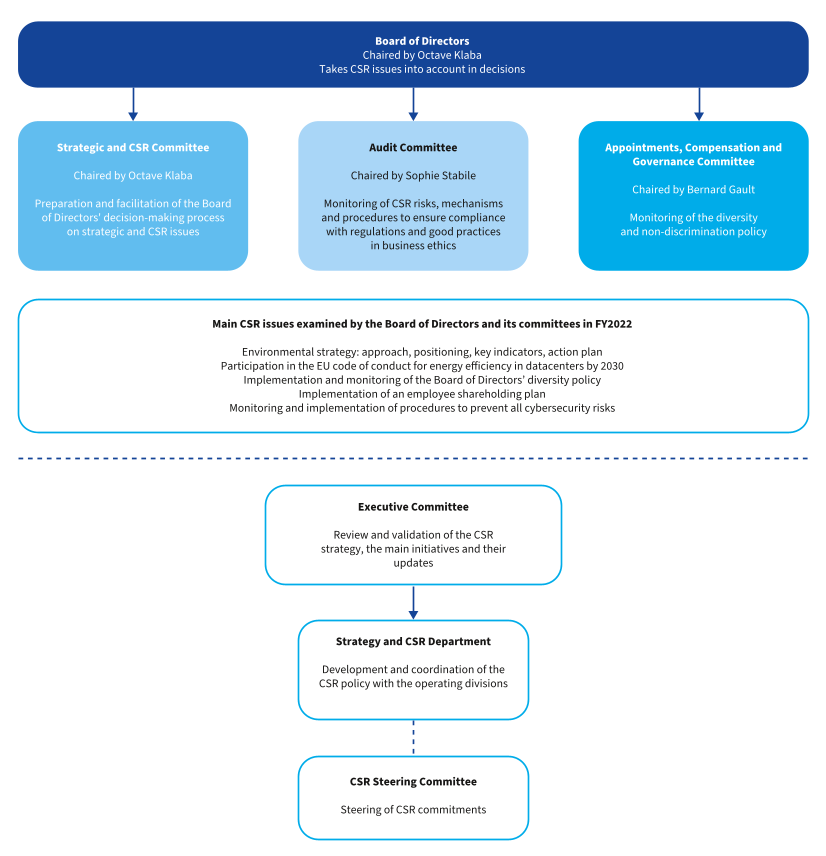

CSR Governance

To manage its corporate social responsibility (CSR) ambitions, OVHcloud has set up a dedicated governance, closely associated with the management of the Group’s overall strategy.

The Board of Directors strives to promote the Company’s long-term value creation by considering the social and environmental challenges of its activities. In connection with the strategy defined, it regularly examines the opportunities and risks such as the financial, legal, operational, social and environmental risks as well as the measures taken as a result. The medium-term Corporate Social Responsibility priorities and targets were approved by the Board of Directors in 2022. They are monitored by building on the work of its committees.

Established after the Group’s IPO in 2021, the Strategy and CSR Committee has the task of preparing the work and facilitating the decision-making process of the Board of Directors on strategic and CSR issues. In terms of CSR, it is notably responsible for:

- ▶ensuring that matters relating to social and environmental responsibility (such as diversity and non-discrimination policies and compliance and ethics policies) are taken into account in the Group’s strategy and in its implementation;